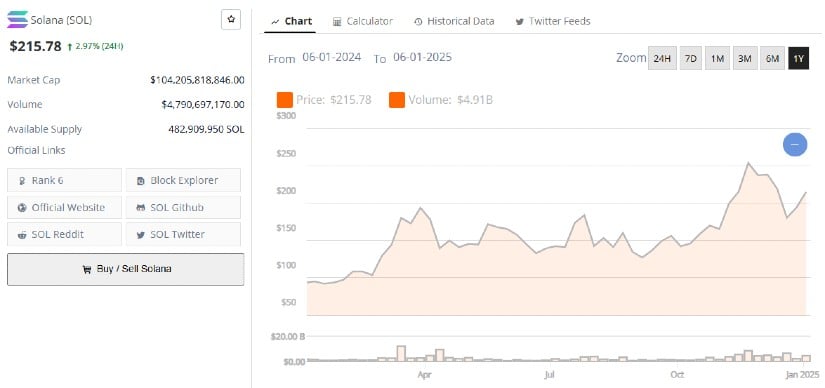

As a result Solana price predictions for 2025 are rising fast.

As an analyst, I’m observing a surge of optimism within the broader cryptocurrency market, coupled with significant technical achievements. This momentum seems to be propelling Solana (SOL) towards a potential revisit of its all-time high ($260) and even beyond. The question on everyone’s mind is whether this “Ethereum killer” could realistically reach the lofty price target of $1,000 by 2025.

Breaking Key Resistance Levels

The surge in Solana’s price can be attributed to both technical and market influences. A recent burst above a significant resistance line suggests that Solana might head towards its all-time high (ATH). If Solana manages to surpass its 50-day moving average, which is currently at $220, it could trigger additional positive price movements.

The rise in Solana’s price is happening concurrently with a general positive outlook in the cryptocurrency markets, fueled by expectations of crypto-friendly policies under the incoming U.S. administration headed by President Donald Trump. Analysts predict that this administration might mark the beginning of an era for increased cryptocurrency usage, as proposals like a national Bitcoin reserve could boost the entire market significantly.

2025 looks promising for Bitcoin, with significant growth expected. However, altcoins are anticipated to reap benefits as well. Solana is a notable contender, but XRP and Dogecoin are also receiving positive price forecasts in the upcoming year. As such, potential investors might want to explore a variety of cryptocurrencies before making their decision.

Quantum Resistance: A Game-Changing Development

The innovative leaps made by Solana have significantly impacted its current success. Lately, the blockchain has added an optional quantum-resistant feature known as the Solana Winternitz Vault. As per Dean Little, chief scientist at Zeus Network, this vault utilizes a hash-based signature system to create fresh keys for each transaction, thereby boosting security against potential threats from quantum computers.

In a recent post on GitHub, Little stated that this new development provides peace of mind for investors who worry about quantum computing affecting cryptographic security. But it’s essential to know that this added security measure is optional; users need to consciously choose to utilize it by storing their funds in Winternitz safes.

Can SOL Rival Ethereum?

Discussions have been ignited about Solana’s ability to rival Ethereum’s supremacy due to the expansion of its ecosystem. Currently, SOL is trading above $200, pushing its market capitalization to $104 billion. Despite this milestone, it still lags significantly behind Ethereum’s market cap of $417 billion.

The potential approval of Solana ETFs by the U.S. Securities and Exchange Commission could make SOL more visible to a wider range of investors, potentially increasing its price and market value. Furthermore, the substantial increase in trading volume on Solana’s decentralized exchange indicates high levels of activity within its ecosystem, currently at an impressive $626 billion.

Market Risks and Considerations

Despite a positive outlook for Solana, potential hazards might slow its upward trend. A more aggressive approach by the Federal Reserve, such as increasing interest rates, may negatively affect risky assets like cryptocurrencies. Moreover, if the anticipated crypto-friendly policies from the new U.S. administration don’t live up to expectations, market sentiment could become less favorable.

As a researcher immersed in the intriguing world of blockchain, I can’t help but notice the fiercely competitive landscape that we inhabit. Newcomers such as JetBolt (JBOLT), with groundbreaking offerings like zero-gas technology and a user-friendly staking platform, are capturing the spotlight and garnering substantial interest from investors. The impressive success of JetBolt’s presale, with over 230 million tokens sold, serves as a testament to the market’s dynamic nature and the ever-evolving advancements in blockchain technology.

Outlook for 2025: A Bullish Case for Solana

Despite some analysts expressing cautious optimism, they generally maintain a positive outlook on Solana’s price potential. The year that stood out was 2021, during which Solana skyrocketed an astounding 170 times its initial value. While such extraordinary growth may not be repeated, it’s still possible for Solana (SOL) to increase by 4-5 times, potentially pushing the price up to $1,000 if significant events like increased institutional interest, ETF approvals, and expansion of the ecosystem take place.

As Solana remains one of the most cutting-edge blockchain networks with an increasing user base, it certainly holds a strong position in the competition. Whether or not it will eventually surpass Ethereum’s market cap or reach $1,000 is uncertain and relies on a blend of market conditions, technological breakthroughs, and broader economic trends. However, the trend of SOL’s price suggests that it could continue to rise in value through 2025.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Elder Scrolls Oblivion: Best Battlemage Build

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- ALEO PREDICTION. ALEO cryptocurrency

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- 30 Best Couple/Wife Swap Movies You Need to See

- Revisiting The Final Moments Of Princess Diana’s Life On Her Death Anniversary: From Tragic Paparazzi Chase To Fatal Car Crash

- Who Is Emily Armstrong? Learn as Linkin Park Announces New Co-Vocalist Along With One Ok Rock’s Colin Brittain as New Drummer

2025-01-05 12:10