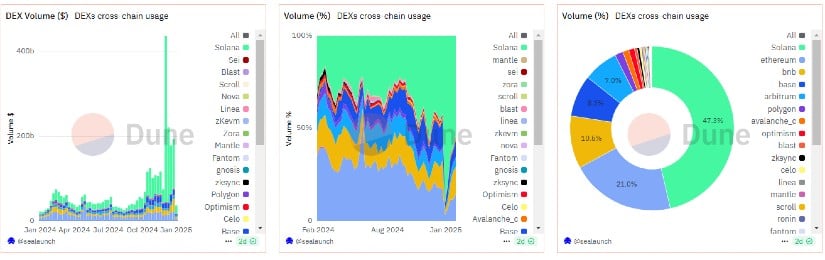

In a twist that would make even the most jaded crypto enthusiast raise an eyebrow, Solana has been spotted guzzling Ethereum’s milkshake, according to a January 2025 report by OKX. The upstart blockchain has gobbled up roughly 50% of the total DEX volume in recent weeks, leaving Ethereum to sip its latte in quiet contemplation.

Analysts, ever the poets, have dubbed this phenomenon “the great milkshake heist,” as Solana solidifies its place in the decentralized finance (DeFi) ecosystem. Ethereum, meanwhile, is left wondering where it left its straw.

Memecoins and Mayhem: The Fuel Behind the Fire

What’s driving Solana’s meteoric rise? Enter Pump.fun, the memecoin launchpad that’s been setting the crypto world ablaze. This platform has single-handedly turbocharged trading activity, even briefly eclipsing Ethereum’s DEX volume. OKX’s report reveals that Solana hit a jaw-dropping 89.7% market share in DEX activity during the last week of December 2024. For five straight weeks, it’s held above 50%, proving that Solana isn’t just a flash in the pan—it’s a full-blown fireworks display.

Solana’s secret sauce? Blazing-fast transaction speeds, fees so low they’re practically invisible, and tools that make developers swoon. Jupiter, Solana’s native DEX aggregator, has been the unsung hero, accounting for nearly 70% of Solana’s DEX volume. It’s like the Robin Hood of slippage optimization, stealing from the slow and giving to the speedy.

Ethereum’s Whale-Sized Dominance

But let’s not count Ethereum out just yet. While Solana is busy wooing the retail crowd, Ethereum remains the king of high-value transactions. It’s tokenizing real-world assets like a boss, commanding 82% of the $5 billion tokenized asset market. And let’s not forget Ethereum’s liquidity pool, which is so vast it could probably fill the Mariana Trench. Layer 2 solutions and institutional support keep Ethereum’s throne firmly intact.

“Solana may be the speed demon of retail trading, but Ethereum is still the heavyweight champion of high-value transactions,” OKX noted. Ethereum’s “whales” continue to dominate, proving that sometimes, size does matter.

Solana’s Sustainability: A Question Mark in Disguise

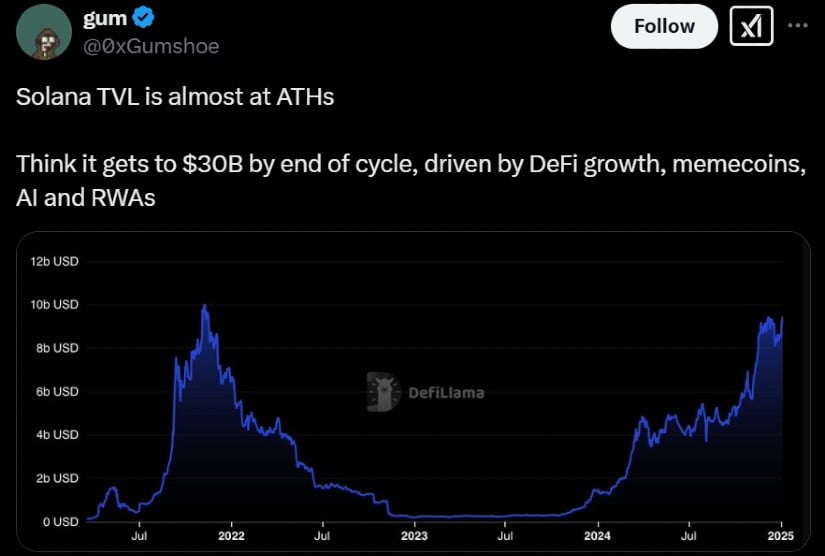

Solana’s rise is impressive, but is it sustainable? Its total value locked (TVL) pales in comparison to Ethereum’s, raising eyebrows about its long-term viability. While its low-cost, high-speed model has won over retail traders, liquidity remains a concern. Can Solana keep up the pace, or is it running on fumes?

As Solana attracts more users, the pressure is on to scale its infrastructure and boost liquidity. The next few months will be a litmus test for whether Solana’s success is a fleeting fling or a lasting love affair.

Solana’s Price: A Rollercoaster with a View

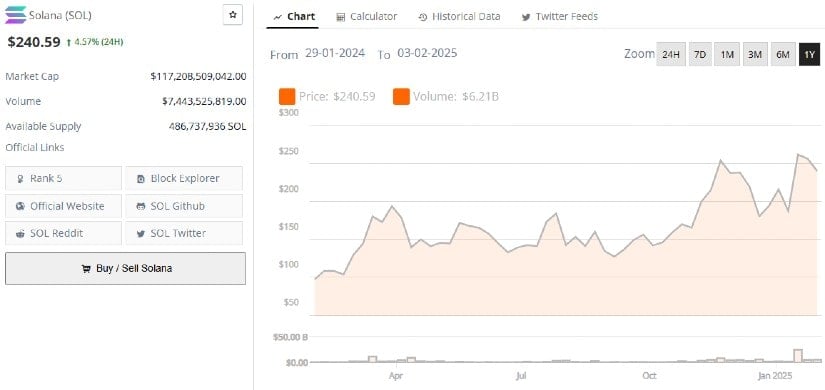

Solana’s market activity is mirrored in its price performance. After a three-day losing streak in January 2025, Solana’s price bounced back by 4.5%, stabilizing around $240. This recovery has sparked a surge in leveraged long positions, signaling that traders are betting big on Solana’s future.

Looking ahead, Solana is poised for potential upside. With increased leverage in the derivatives market and a growing retail presence, the network’s price could continue its upward trajectory—provided it can keep its DEX market share strong.

Conclusion: Solana’s DeFi Destiny

Solana’s rise in the DEX market is a testament to its speed, efficiency, and retail appeal. But whether it can sustain this momentum and challenge Ethereum’s dominance remains to be seen. The coming months will reveal whether Solana’s success is a fleeting anomaly or the dawn of a new DeFi era. One thing’s for sure: the crypto world is watching, popcorn in hand. 🍿

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-02-01 10:16