As a seasoned crypto investor with a keen interest in following the latest developments in the digital asset space, I believe VanEck’s move to file for a Solana ETF is an exciting development. Having witnessed the growth and potential of Solana’s unique features, such as its high-speed transactions and low fees, it’s no surprise that institutional investors are starting to take notice.

As a researcher studying the cryptocurrency market, I can’t help but notice the noteworthy addition of an institutional investment into Solana (SOL) through this recent filing. This action underscores the increasing institutional attention towards Solana and the broader crypto space.

VanEck’s Strategic Solana Move

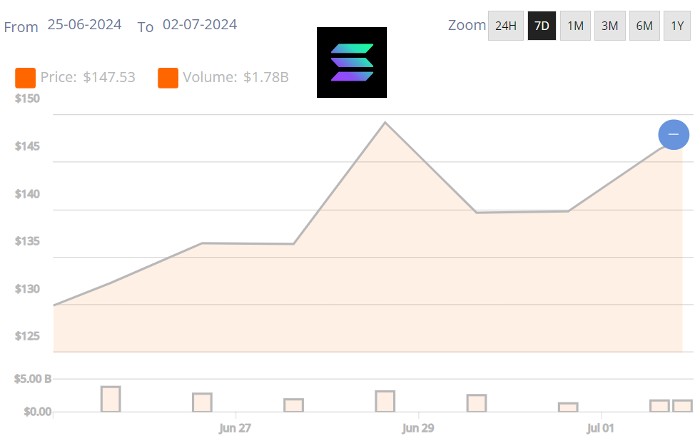

Matthew Sigel, the Head of Digital Assets Research at VanEck, declared on June 28th that an ETF filing for Solana had been submitted by the firm. Sigel explained the reasoning behind this decision, expressing his belief that Solana’s unique features, including high transaction speed, low fees, robust security, and a vibrant community, make it a compelling choice for an exchange-traded fund. VanEck views Solana’s digital currency, SOL, as a commodity akin to Bitcoin, which boasts several well-established spot ETFs in the US and internationally.

The VanEck Solana Trust ETF, to be listed on the Cboe BZX Exchange, is designed to mirror the performance of Solana (SOL), minus operational costs. Its share value will be calculated daily using the MarketVector Solana Index, derived from leading Solana market prices as identified by MarketVector.

Solana’s Unique Position

As a Solana analyst, I’ve noticed that this blockchain platform has gained significant traction due to its impressive capabilities in processing high-speed and affordable transactions. This attribute makes it an attractive option for implementing smart contracts and decentralized applications (dApps). Solana’s innovative approach to transaction validation, called Proof of History (PoH), sets it apart from other blockchain networks. With PoH, the network can handle a greater number of transactions per second, making it an ideal choice for launching meme coins like BONK and conducting efficient airdrops.

The Solana blockchain operates using its own token, SOL, that enables transactions and communications within the system. The platform’s efficiency in processing a high number of transactions has drawn a lively user base and generated substantial developer attention.

Details from the VanEck Solana SEC Filing

As a researcher studying investment products, I’d describe the VanEck Solana Trust in this way: This trust is designed as a passive investment vehicle that closely tracks the price of Solana (SOL) without engaging in any speculative activities, hedging, or leveraging. Instead, it aims to deliver a simple and direct exposure to SOL for investors by holding the underlying asset itself, thus avoiding the complexities of owning and trading SOL directly on digital asset platforms.

The filing indicates that the Trust does not fall under the category of an investment company as defined by the Investment Company Act of 1940, and it is not classified as a commodity pool according to the Commodity Exchange Act. As a result, the CFTC does not have jurisdiction over the Trust’s regulation.

Operational Framework and Custody

The VanEck Solana Trust will function without relying on derivatives, swap agreements, or futures contracts. By avoiding these financial instruments, the trust aims to eliminate counterparty risks and keep its primary focus on owning Solana (SOL) tokens outright. Additionally, the trust will abstain from participating in staking initiatives, forfeiting any potential rewards that could boost returns for individual SOL holders.

The Trust will depend on a regulated third-party custodian to securely store its SOL assets, adhering to regulatory requirements and ensuring safety. Through the MarketVector Solana Benchmark Rate, the Trust guarantees precise and authentic share pricing, drawing data from a select group of top-tier Solana trading platforms.

Market Impact and Investor Access

The arrival of a Solana ETF (Exchange-Traded Fund) from VanEck marks a major development, providing easier access for traditional investors to invest in Solana (SOL) via conventional brokerage platforms. This step is predicted to boost market liquidity and stability by introducing an institutional-quality investment tool.

Just as investing in Bitcoin has become simpler for people through exchange-traded funds (ETFs), the availability of a Solana ETF will allow investors to reap the benefits without dealing with the complexities of managing digital wallets or using cryptocurrency exchanges. The Trust’s creation mirrors the industry trend toward incorporating digital assets into traditional financial instruments, underscoring the growing mainstream adoption and recognition of blockchain technology within finance.

Conclusion

The announcement of VanEck’s filing for a Solana exchange-traded fund (ETF) signifies the increasing belief in Solana’s blockchain technology and its prospect as a viable investment option in the mainstream market. If approved by regulators, this ETF will create fresh opportunities for investors to tap into the potential of Solana.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Every Minecraft update ranked from worst to best

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

2024-07-01 10:08