As a seasoned analyst with over two decades of experience in the financial markets, I find myself intrigued by Solana’s current predicament. On one hand, its demand surge has eclipsed Ethereum, as evidenced by the Hot Realized Cap metric. However, the price action seems to be telling a different story, with SOL struggling to breach $200.

Recently, Solana (SOL) has experienced a tough price trajectory, and while it seems to have halted its downward trend, the altcoin is having trouble regaining $200 as a reliable support level.

This difficulty persists despite Solana surpassing Ethereum in demand over the past few months, highlighting a disconnect between interest and price action.

Solana Is Doing Better Than Ethereum

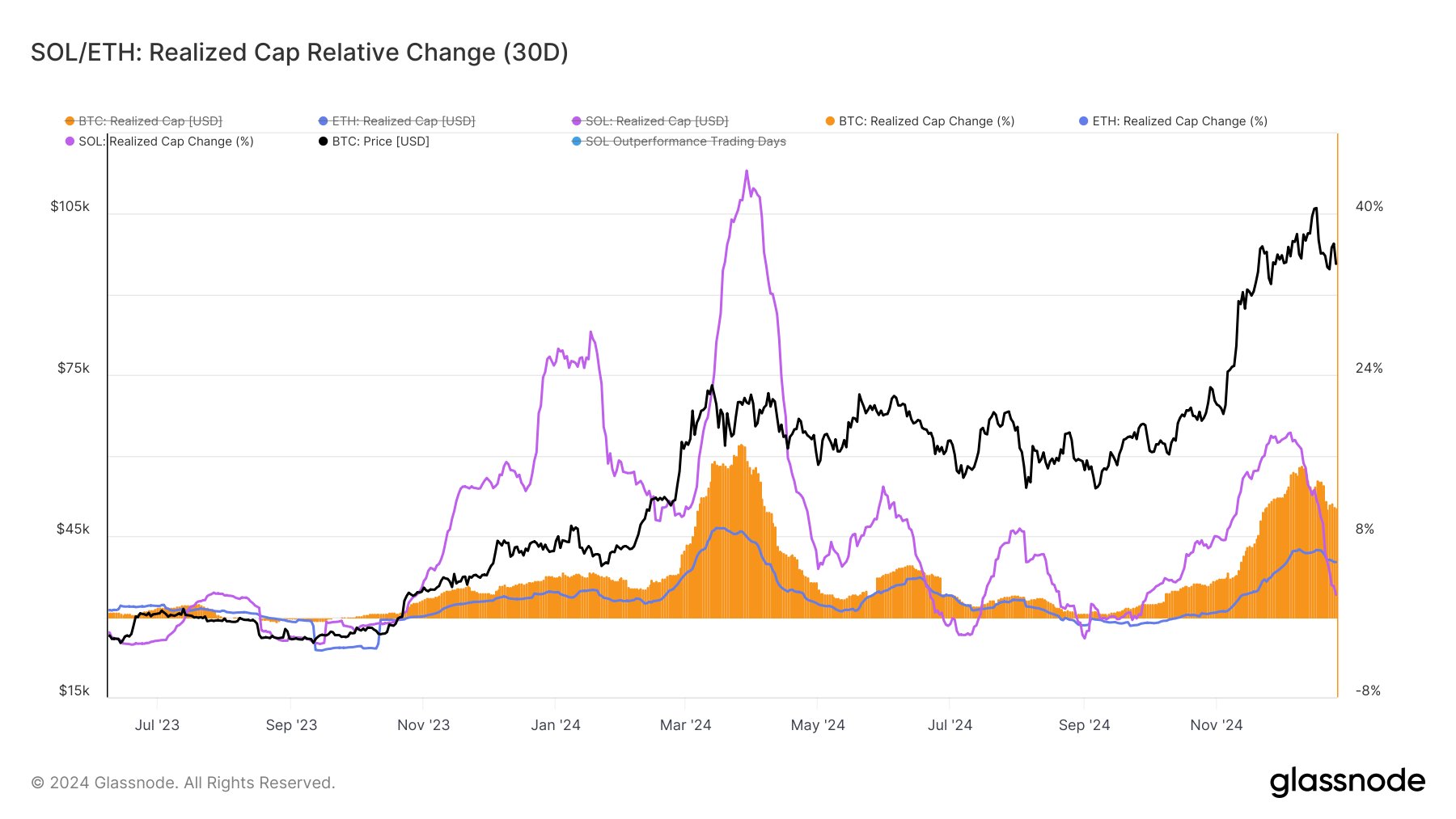

It appears that Solana’s popularity has been surpassing Ethereum lately, as shown by the Hot Realized Cap metric. According to a report by Glassnode, Solana’s Hot Realized Cap hit $9.5 billion this week, which is over twice the value of Ethereum’s Hot Realized Cap at $4.1 billion. This suggests that investors are keeping a close eye on Solana and there’s an uptick in activity within its network.

Looking at the amount of fresh investment flowing into both Solana and Ethereum assets, it’s worth noting that for the very first time, interest from new investors in Solana has exceeded that of Ethereum, underscoring its robust appeal. Interestingly, a significant surge in Hot Realized Capital for Solana just before 2024 signaled a turning point in the SOL/ETH ratio, with this increase in fresh capital fueling growth, according to Glassnode’s observations.

As a researcher, I’ve been analyzing the market momentum of various cryptocurrencies, and my findings suggest a somewhat contrasting picture for Solana (SOL). While the growth in its realized capitalization increased by 2.19%, this figure pales in comparison to Bitcoin‘s impressive 10.87% surge and Ethereum’s 5.43% rise. This stark difference underscores a more rapid dissipation of momentum for Solana compared to the top two cryptocurrencies.

A more gradual increase in actual capitalization indicates a pessimistic short-term forecast, suggesting that Solana’s network activity has failed to match its escalating demand. For Solana (SOL) to regain strong momentum, it would necessitate an upsurge in actual capitalization growth and broad market backing.

SOL Price Prediction: Resistance Ahead

At this moment, Solana’s price is having trouble regaining $200 as a support point, sitting at approximately $185. This trend follows a bearish short-term perspective, suggesting that SOL could encounter more resistance when attempting to surpass the significant psychological barrier.

Floating slightly above the crucial $175 mark, Solana currently finds itself in a vulnerable state. If this support fails, it could lead to a price drop, with potential support at around $155. This descent might intensify the negative market feelings and postpone any efforts toward recovery.

However, positive market cues could enable Solana to flip $200 into support, invalidating the bearish thesis. Achieving this milestone could trigger a rally toward $221 or higher, restoring confidence in the cryptocurrency’s upward trajectory. Sustained demand and broader market optimism would be key drivers for this scenario.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Elder Scrolls Oblivion: Best Battlemage Build

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- ALEO PREDICTION. ALEO cryptocurrency

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- 30 Best Couple/Wife Swap Movies You Need to See

- Revisiting The Final Moments Of Princess Diana’s Life On Her Death Anniversary: From Tragic Paparazzi Chase To Fatal Car Crash

- Who Is Emily Armstrong? Learn as Linkin Park Announces New Co-Vocalist Along With One Ok Rock’s Colin Brittain as New Drummer

2024-12-28 11:43