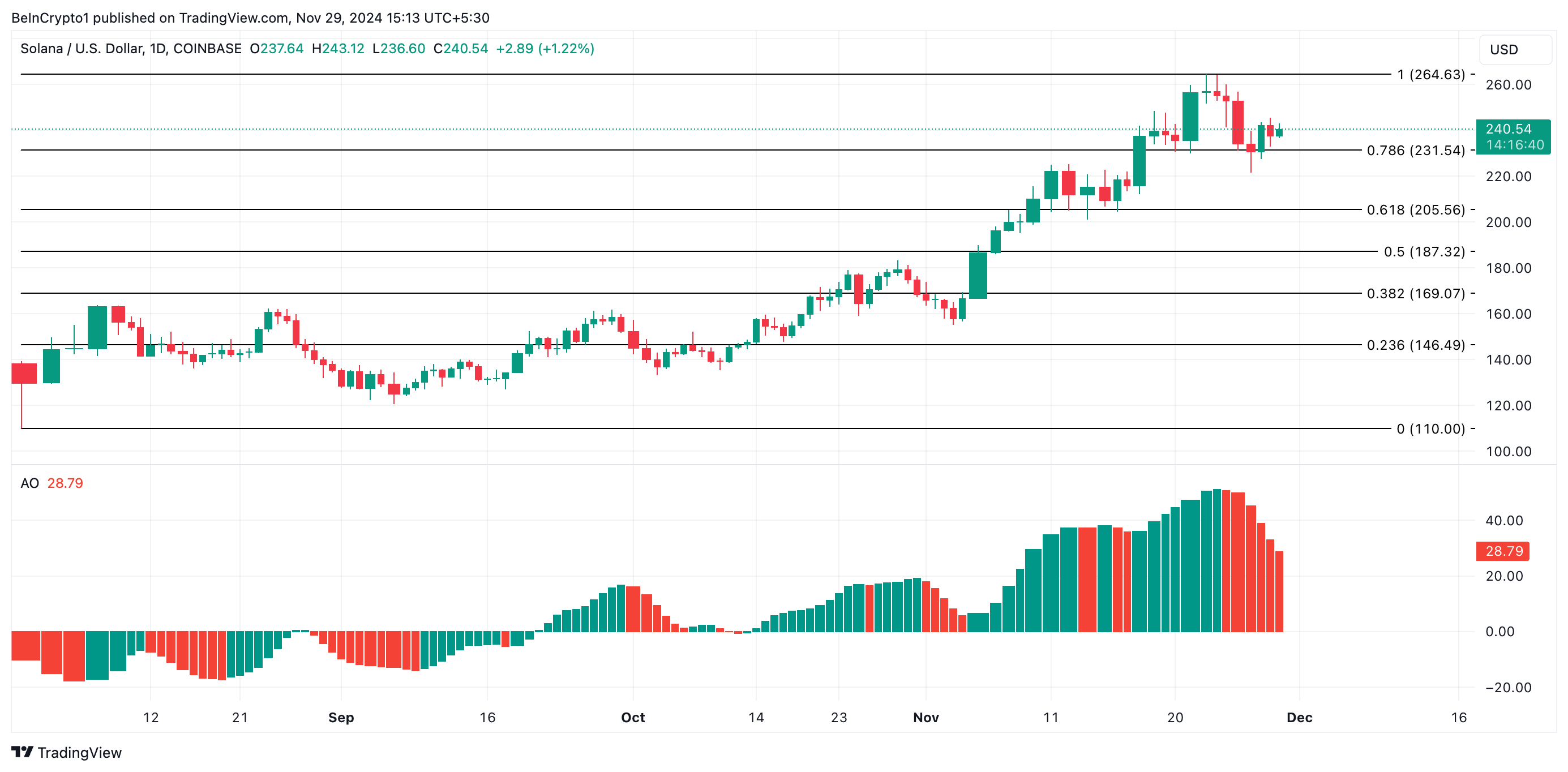

As a seasoned researcher with years of experience in the cryptocurrency market, I’ve seen my fair share of market swings – some gentle, others as tumultuous as a roller coaster ride. The recent downturn in Solana (SOL) has caught my attention, and not in a good way. Since hitting an all-time high of $264.63 just a week ago, SOL has been on a slippery slope, losing almost 10% of its value.

Over the last week, I’ve noticed a significant decline in Solana (SOL). After hitting an all-time peak of $264.63 on November 22, there’s been a noticeable increase in selling activity. This surge has led to a nearly 10% drop in SOL’s price within the past seven days.

Due to this drop, there’s been a rise in extended closings for Solana futures contracts. As the negative sentiment grows stronger, long-term traders of Solana might experience greater losses, here’s why:

Solana’s Market Activity Faces Decline

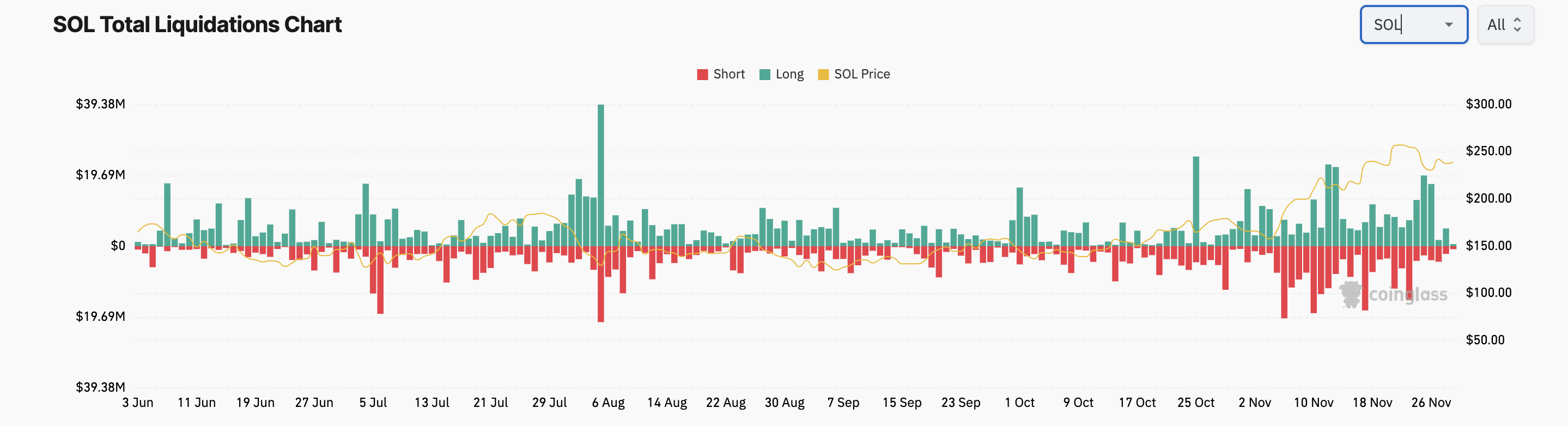

In the last seven days, a 8% decrease in SOL’s value has erased around $64 million worth of long positions in its derivatives market.

In simpler terms, lengthy liquidations happen when traders who initially bought an asset in anticipation of its price increase are compelled to sell it at a lower cost due to losses, as the price plummets. This happens when the asset’s price drops significantly, causing those with long-term investment bets to leave the market.

This indicates that SOL might be showing a pessimistic trend since, as investors who have long-held Solana positions aim to limit additional losses, they may boost the selling force, potentially causing more drops in the market.

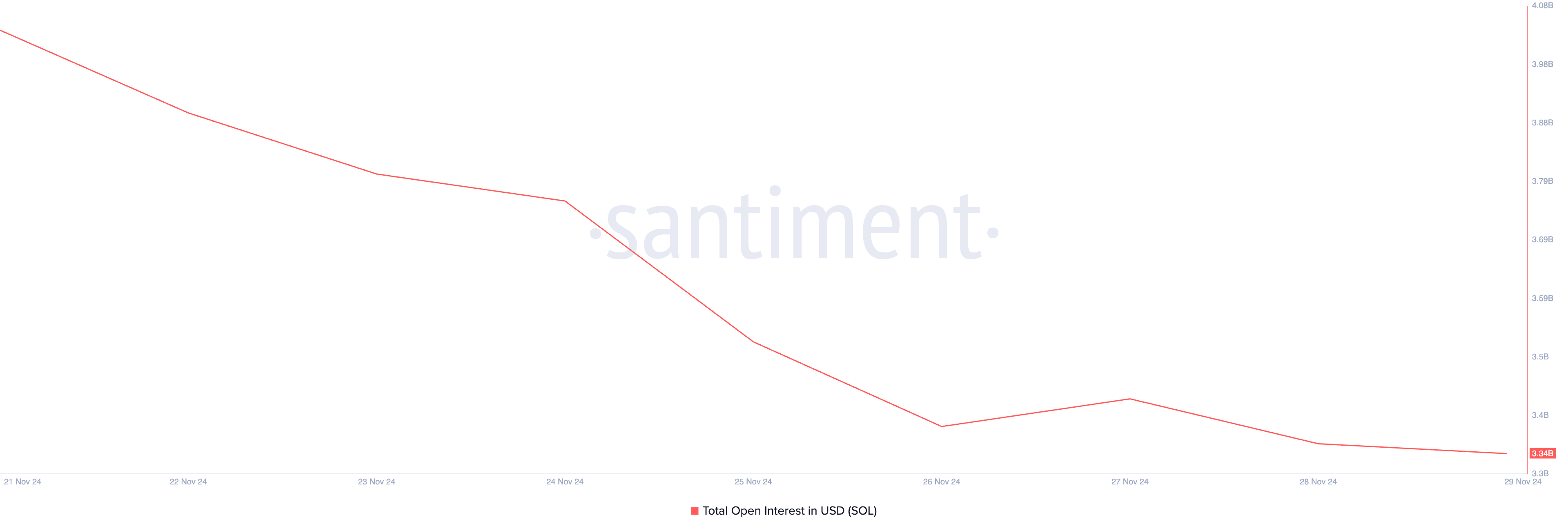

Significantly, the decrease in SOL’s value has resulted in reduced activity within its derivatives market. This reduction is evident in the coin’s open interest, which stands at a weekly minimum of $3.34 billion.

Open interest signifies the overall count of unsettled or unclosed contracts (either futures or options) that are currently active. A decrease in open interest during a price downturn suggests that traders are liquidating their positions, which can imply reduced market involvement and a possible lack of confidence in the asset’s continuing upward price trend.

SOL Price Prediction: Bears Dominate the Market

The Awesome Oscillator on Solana indicates a growing bearish sentiment around the coin, as evidenced by the appearance of red bars in the last week due to a drop in its price.

The Awesome Oscillator helps pinpoint trends in an asset’s price and possible turning points. When the oscillator displays red bars, it means that the short-term trend’s strength is waning compared to the long-term trend, which could signal a potential downtrend or a decrease in bullish energy.

Should trading volume for SOL increase significantly, its price might drop beneath the significant support line drawn at $231.54. A fall below this value could cause SOL’s price to decrease further to around $205.56.

Alternatively, should buying interest intensify, the price of SOL could ascend towards its peak value of $264.63.

Read More

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

2024-11-29 15:41