As a seasoned crypto investor with a few gray hairs to show for it, I’ve seen my fair share of market ebbs and flows. The current surge in activity on the Solana blockchain, driven by the meme coin craze, has caught my attention.

The Solana blockchain is witnessing a surge in activity due to a growing frenzy around meme coins.

The surge of excitement has significantly increased network activity and driven transaction fees to their peak points in more than a year.

Solana Meme Coin Hype Drives Network Fees and Adoption

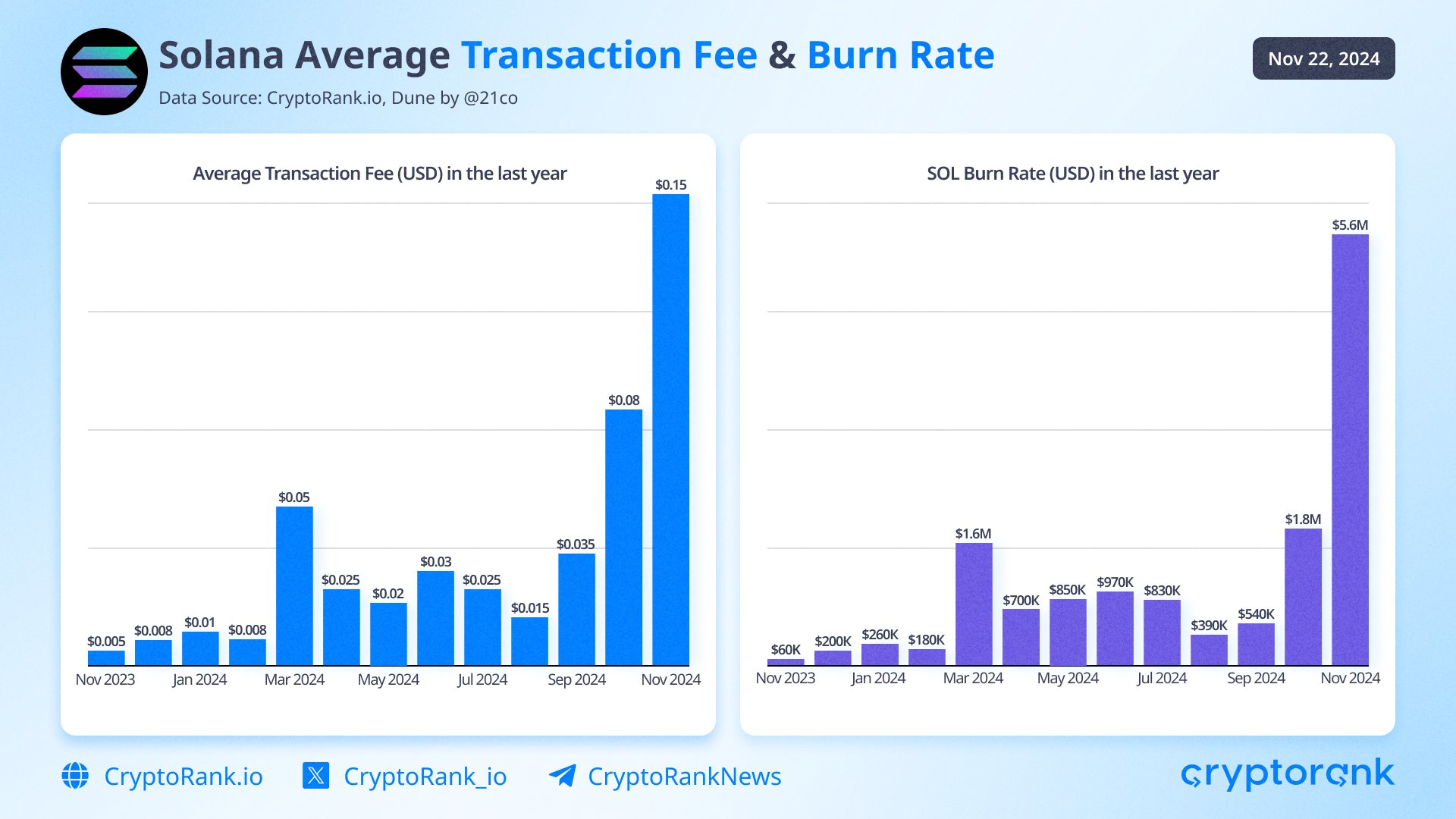

Over the past few weeks, meme coins have experienced a surge in activity, driven primarily by the overall crypto market uptrend, particularly large players like Bitcoin. This renewed vigor has notably boosted transaction volumes on Solana, consequently causing transaction fees to rise. As per Cryptorank, Solana’s transaction fees peaked at $0.15 this month, nearly doubling from October’s $0.08 and reaching the highest level in a year.

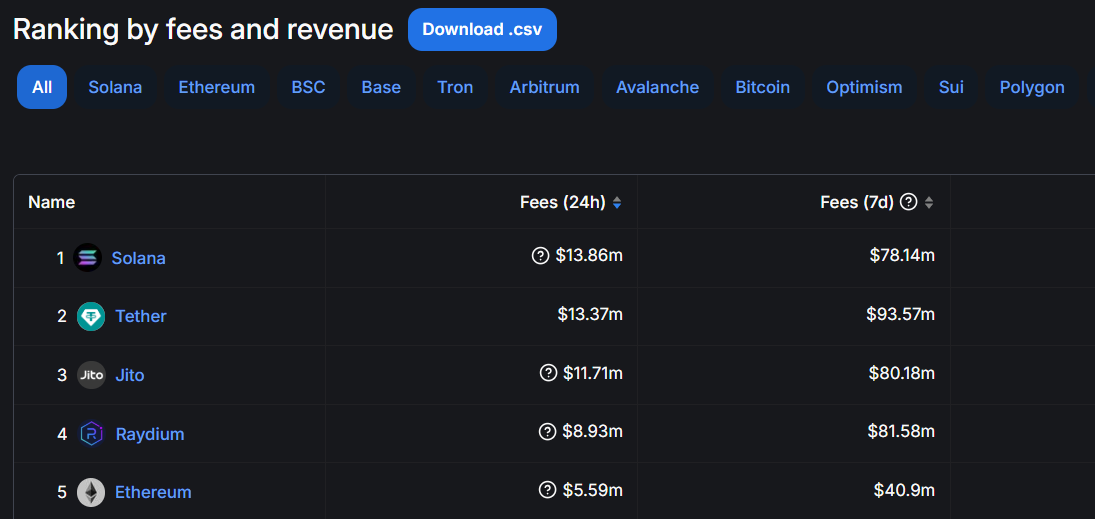

According to DeFiLlama’s data, Solana has raked in approximately $78.14 million in network fees over the last week, a figure that positions it among the highest earning networks. This amount is second only to Tether, which earned $93.57 million during the same period, but significantly surpasses Ethereum‘s earnings of $40.9 million.

Outside of the main Solana network, there has been a notable increase in activity and transaction fees associated with decentralized applications (dApps). Notable platforms such as Raydium, Jito, Pump.fun, and Photon have contributed significantly to this growth spurt. Specifically, Pump.fun and Photon have capitalized on the hype surrounding meme coins to gain substantial popularity.

As an analyst, I wish to echo the sentiments of Wei Dai, a researcher at 1kx Network, regarding Solana’s increasing activity. He underscores that such heightened activity might result in network congestion. It is crucial to acknowledge that persistent congestion typically leads to increased minimum fees. This escalation could potentially deter dApp developers and users, as was observed during Ethereum’s DeFi boom four years ago.

Despite acknowledging that Solana’s current congestion primarily consists of temporary peaks, which enables affordable transaction processing for patient users, Dai cautioned that this equilibrium could change if the network doesn’t adapt its infrastructure to manage increasing demand efficiently.

The congestion on Solana is intermittent at the moment. Currently, users are able to process their payment transactions, albeit with slight delays and affordable fees. However, this situation may evolve as demand escalates, potentially leading to higher fees or longer wait times unless Solana’s technology infrastructure significantly enhances to manage future demand, according to Dai.

Simultaneously, Solana’s price surge aligns with its reaching new record highs. Over the course of the last seven days, the value of SOL has climbed by almost 20%, hitting an unprecedented peak of $263, placing it among the top performers in the digital asset market since Donald Trump’s election victory on November 5.

Read More

- Gold Rate Forecast

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

2024-11-23 21:03