As an analyst with over a decade of experience in the crypto market, I must admit that I’ve seen my fair share of volatility and market fluctuations. The recent dip in Solana (SOL) is a stark reminder of the rollercoaster ride that is cryptocurrency investing.

Recently, the value of Solana has experienced notable fluctuations, reaching a low point over several weeks as the mood among investors remains uncertain and hesitant.

Regarding Solana (SOL), there’s been a shift from optimism earlier in the year to a dip in investor trust, as suggested by reduced user engagement and lower funding rates in recent times.

Solana Enthusiasts Are Concerned

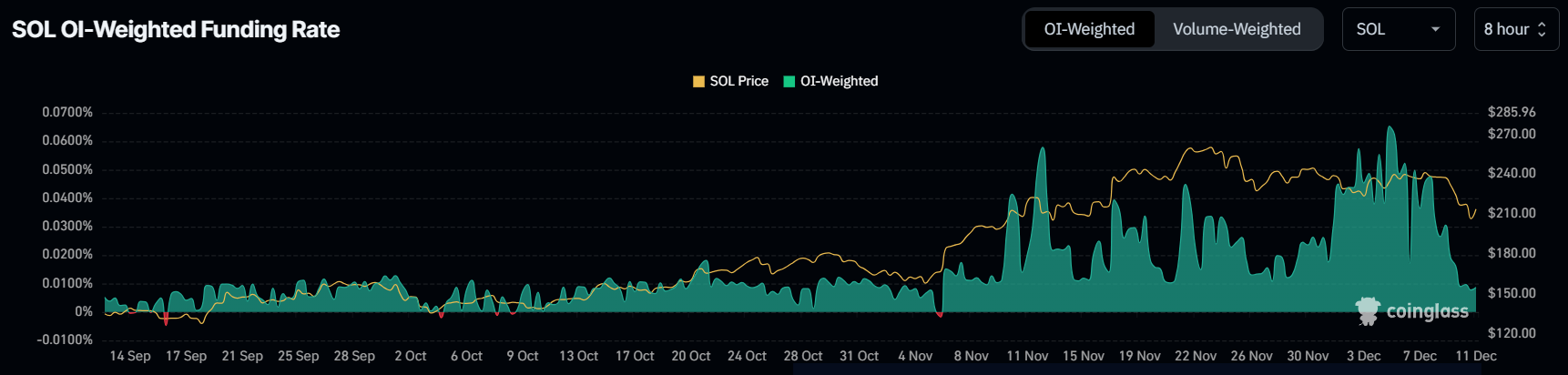

Over the past 48 hours, the funding rate for Solana has plummeted by 81%, which suggests a weakening bullish outlook among traders. Normally, a positive funding rate implies that more long positions are held in the market, indicating optimism from traders. But as this rate keeps falling, it shows increasing apprehension, as short contracts start to gain popularity as traders predict further price drops.

Even though the funding rate for SOL continues to be positive, it’s worth noting that it’s rapidly decreasing. This trend indicates that traders are becoming more cautious and are taking steps to protect themselves against potential price drops. This increased hedging activity implies a pessimistic short-term market view. This move toward shorting might suggest a decrease in traders’ faith in Solana’s ability to uphold its current price points, leading to uncertainties about its near future price trends.

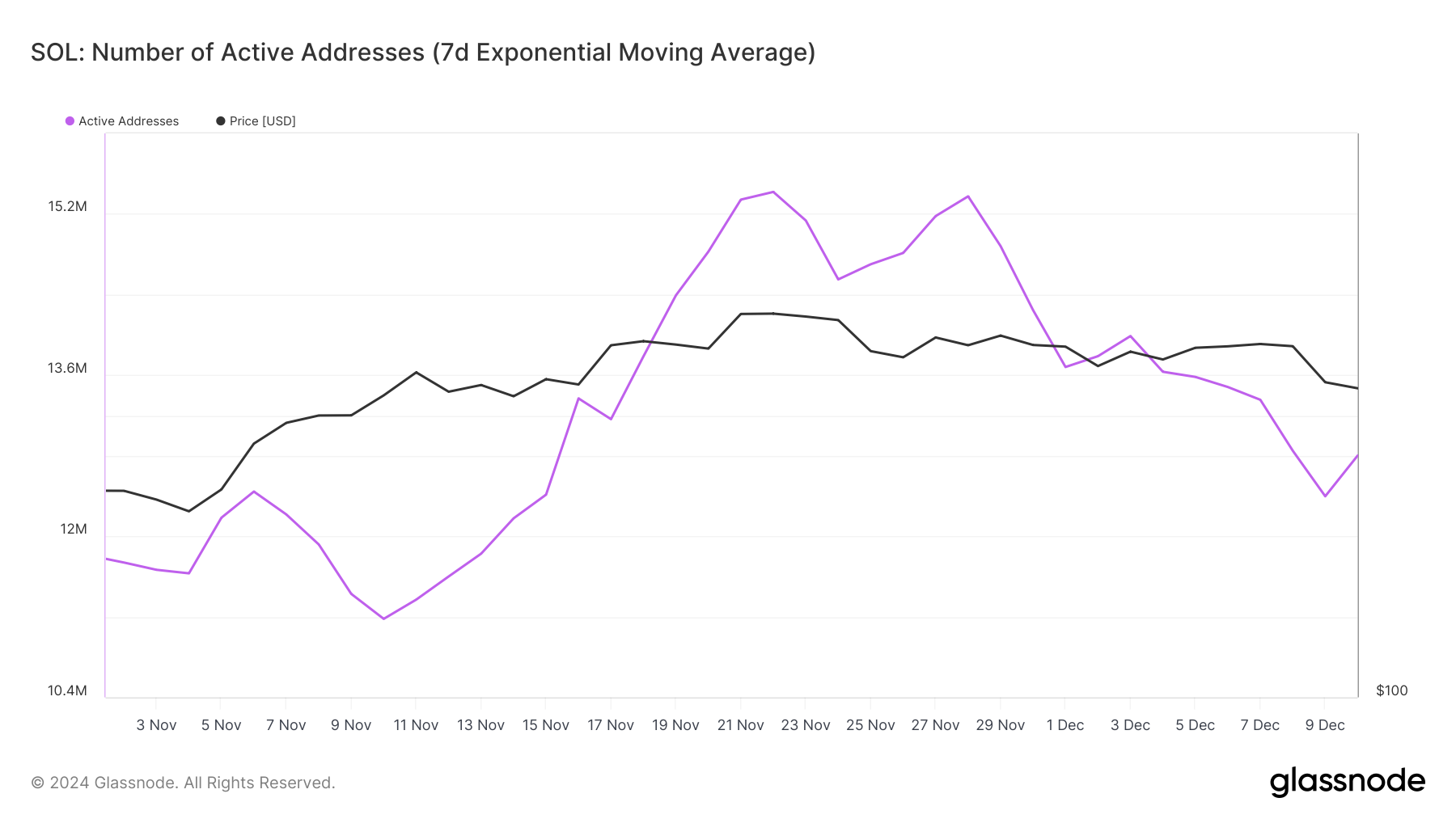

As a researcher examining the cryptocurrency market, I’ve noticed a concerning trend with Solana: the number of active addresses has reached its lowest point since December. This decrease in user engagement is causing ripples of concern, as it might suggest decreasing interest in the platform.

A decrease in user interaction might make Solana less competitive in the market. As fewer users interact with the network, it can alter the general market viewpoint, making the asset seem less attractive to prospective investors. If user activity doesn’t increase, Solana may continue to experience downward pressure on its price.

SOL Price Prediction: Breaching Resistance

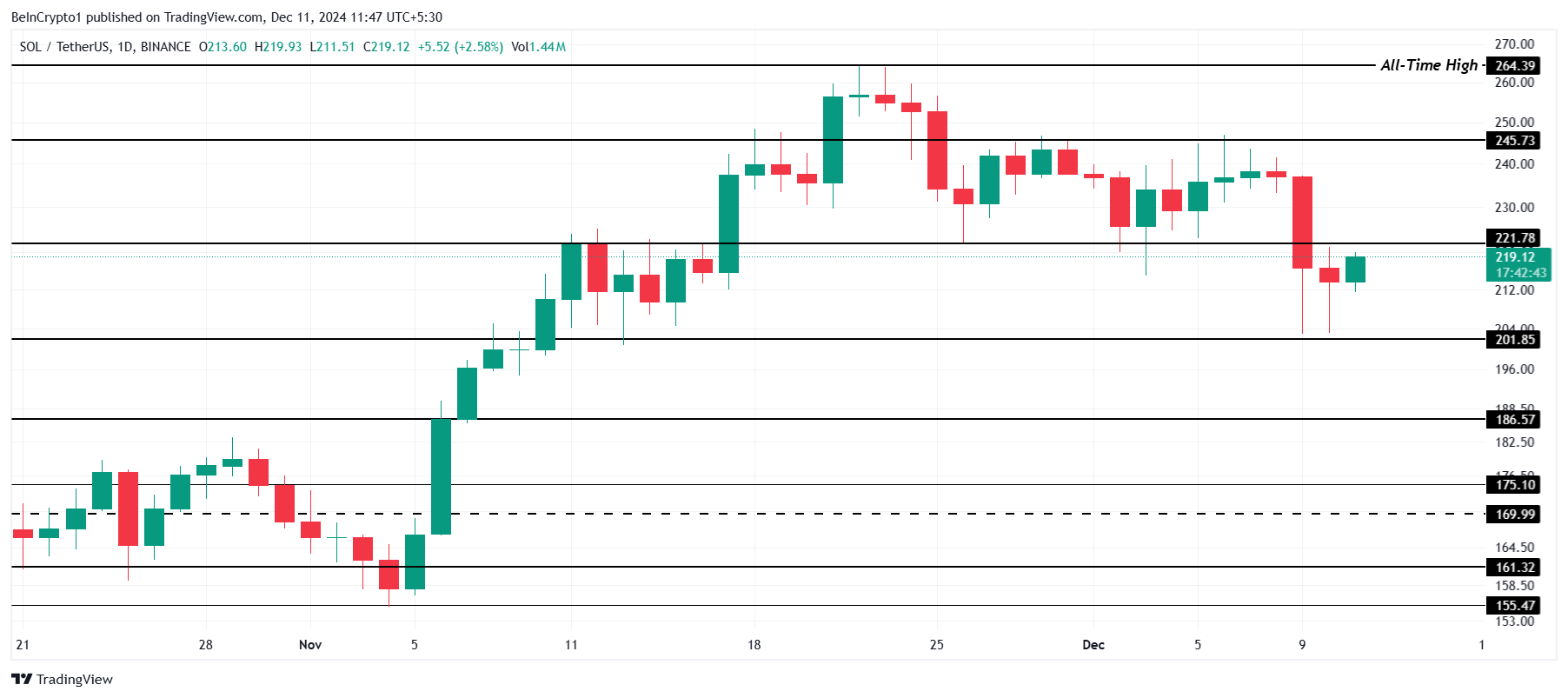

Currently, Solana’s value is being exchanged for approximately $219, and it’s trying to transform the resistance level of $221 into a support level instead.

If Solana doesn’t manage to keep its price above $221, it might take a step back, moving towards consolidation around $201 or higher. Losing this essential support level may indicate a broader market instability and lead investors to hesitate more, potentially restricting Solana (SOL) from making a near-term price surge.

If Solana manages to break through the resistance at $221, it could potentially push the price up towards $245. This would contradict the current pessimistic view, indicating a more optimistic market feeling and bringing the asset closer to its highest ever recorded price of $264. For Solana (SOL) to continue its upward trend and attempt to surpass previous highs, a consistent rise above $221 is vital.

Read More

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

2024-12-11 11:18