As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of market fluctuations. The recent drop in Solana (SOL) prices isn’t something new to the crypto world, but it’s certainly piqued my interest.

Since reaching its peak price of $264.63 on November 24, Solana (SOL) has experienced a surge in selling activity. Currently trading at $232.72, the cryptocurrency’s value has decreased by approximately 12% from its previous level.

As the optimism in the broader cryptosphere seems to be fading, I find myself drawn towards taking a more cautious stance. The recent downturn has sparked an increase in short positions, as many traders are now speculating that the Solana (SOL) price will continue to fall.

Solana Price Drops as Futures Traders Bet Against the Rally

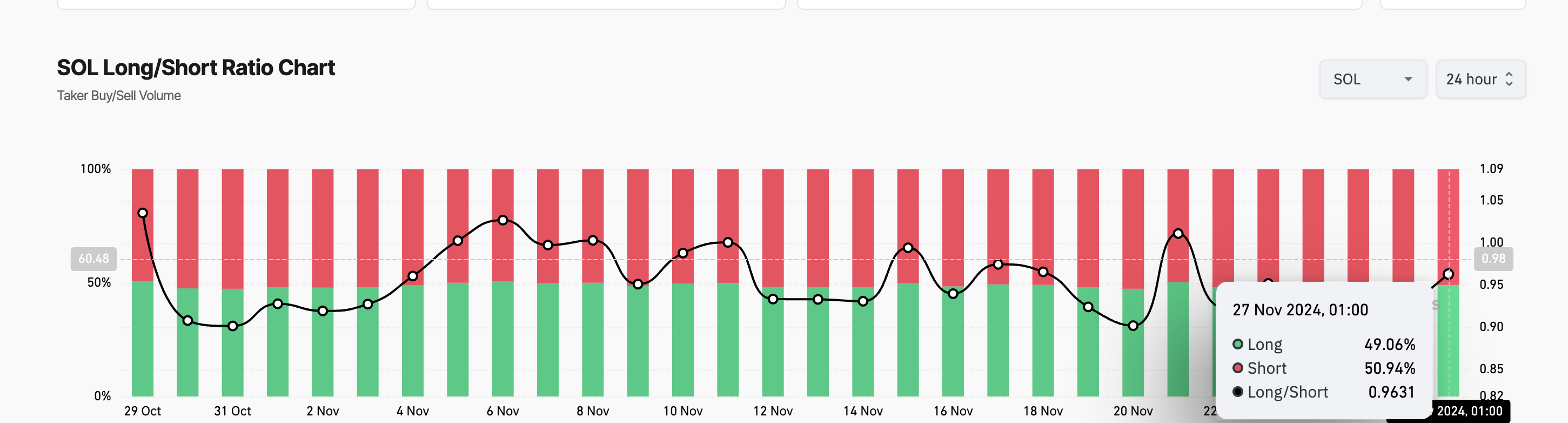

As per Coinglass’s latest data, in the last 24 hours, the worth of Solana bets that traders believe the price will drop (short positions) has soared to a staggering $6 billion. Remarkably, this surpasses the value of long positions, which stands at approximately $5.38 billion. This disparity suggests a robust negative outlook among traders towards Solana.

Currently, the long/short ratio for SOL is 0.96. This ratio reflects the balance between open long positions, which are wagers on price growth, and short positions, which are bets against price decreases, within a specific market.

When the number of traders with short positions exceeds the number with long positions (i.e., the ratio is less than 1), it implies that more traders are predicting a price drop rather than a rise.

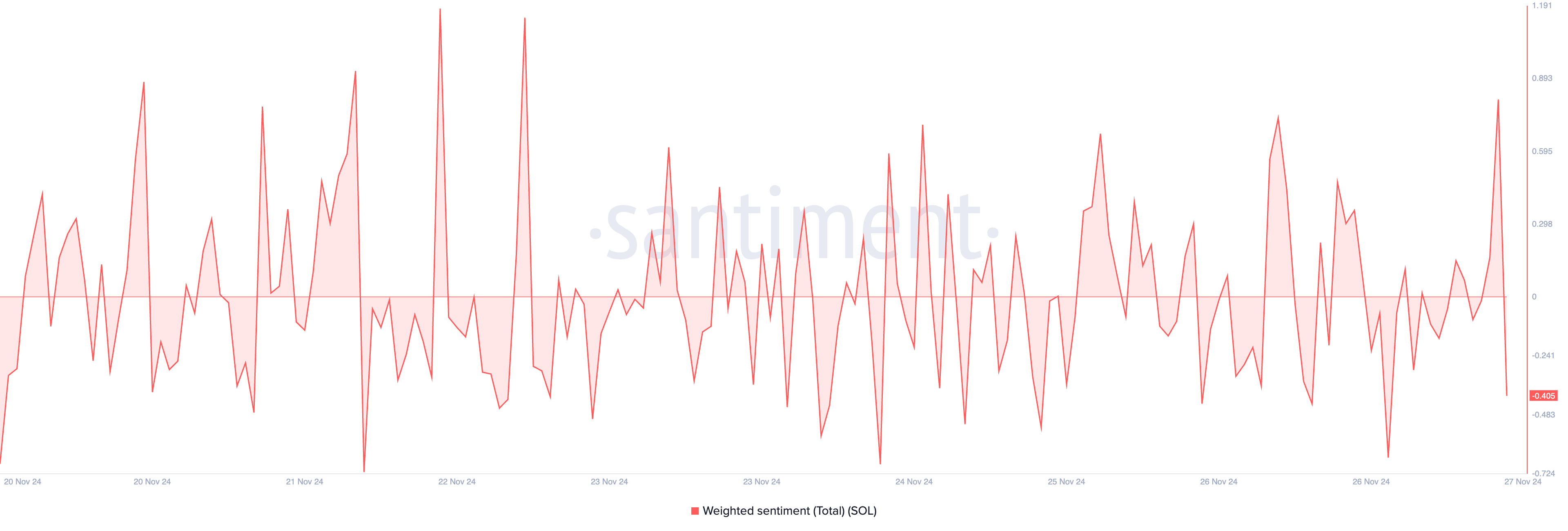

Additionally, SOL’s negative sentiment score, which is weighted, aligns with a pessimistic outlook on it. Currently, this score is -0.40.

The weighted sentiment score for an asset reflects the general feeling towards it within the market. When this score is negative, it suggests that the majority of conversations about the asset on social media are dominated by negative sentiments. This implies that investors anticipate a decrease in the asset’s price and have progressively lowered their trading activity to minimize potential losses.

SOL Price Prediction: The 20-Day EMA Is Key

Looking at the day-to-day graph, it appears Solana’s (SOL) price is about to dip below its 20-day Exponential Moving Average (EMA). This tool calculates the average value of the asset’s price over a 20-day period, giving greater emphasis to more recent prices.

Starting from October 11th, the SOL’s price has consistently found stability at a dynamic support level. At present, the 20-day Exponential Moving Average (EMA) offers support at approximately $226.52. If the price breaks decisively below this point, it would suggest a shift towards bearish trends. In such a case, the SOL’s price might fall to around $205.56.

Conversely, should the market’s overall outlook grow increasingly optimistic, it’s possible that Solana’s (SOL) value could surge and reach its previous peak of $264.63.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- ANDOR Recasts a Major STAR WARS Character for Season 2

- 30 Best Couple/Wife Swap Movies You Need to See

- All 6 ‘Final Destination’ Movies in Order

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Save or Doom Solace Keep? The Shocking Choice in Avowed!

- Where To Watch Kingdom Of The Planet Of The Apes Online? Streaming Details Explored

2024-11-27 15:48