If one had predicted that sober men in well-pressed suits would someday joust in Byzantine ritual before the U.S. Securities and Exchange Commission over the digital offspring of investment banks and adolescent coders, one might have been considered madder than the March Hare. Yet here we are: Invesco and Galaxy Digital have dispatched an S-1 form on the altar of bureaucracy, all in a bid to give birth to a Solana-friendly ETF—spot, no less. One awaits the ticker ‘QSOL’ with the enthusiasm usually reserved for the second cup of weak tea at a county luncheon. 🥱

This marks the ninth—yes, the ninth—such petition, as though filing S-1s were the latest trend amongst people with far too little to do on a Thursday. Institutional interest in these so-called “altcoins” is evidently mounting, presumably because some analyst stuck a dart in a chart and declared crypto “in.” Still, hope springs eternal, and forms multiply like rabbits at a country estate. 🐇

Should this experiment proceed, the Cboe BZX exchange (bless its acronymic heart) would host the revels under the sign of ‘QSOL’, while the Bank of New York Mellon is pressed into administrative drudgery and Coinbase guards the digital loot. Invesco dons the role of sponsor, no doubt with the stern rectitude of a boarding school headmaster, while Galaxy manages the crucial business of actually getting some Solana—presumably not by digging for it in the flower beds.

The uninitiated might wonder: why all the excitement? Solana, we are told, can process 65,000 transactions a second—an almost indecent haste, as if the very fate of the Western world depended on swapping monkey JPEGs with distressing speed. This mania, one suspects, coincides with a spike in Solana’s CME futures, proving once again that correlation and causation are perfect strangers at a cocktail party. 🍸

The Trouble with SOL: Price Ennui

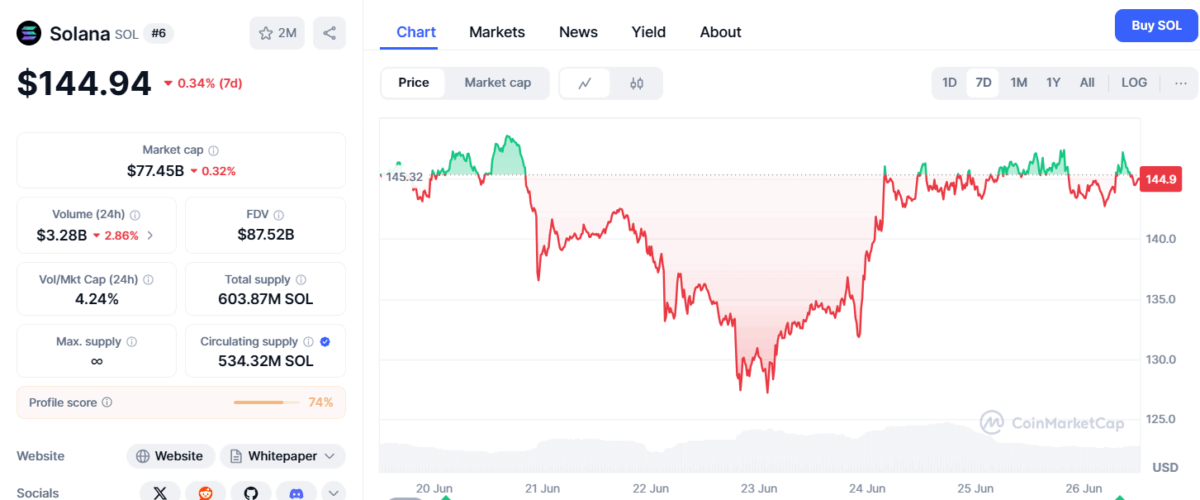

One might have expected the news of yet another ETF application to send Solana’s price moonward. Alas, not so! The wretched thing lingers in a weekly trading range, showing all the dynamism of a dowager at a bridge table. Historically, such filings have caused dramatic surges, but in our cruel epoch, the price has demonstrated the excitement of damp wallpaper.

At present, Solana stands at $144.94, clutching a 24-hour trading volume of $3.28 billion. It has tumbled a bracing 16% this past month, tracking a market that seems to have embraced despair as a lifestyle choice. Perhaps “to the moon” requires a bit more rocket fuel—and, dare one say, less bureaucracy.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Why Nio Stock Skyrocketed Today

- Games That Faced Bans in Countries Over Political Themes

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Best Ways to Farm Prestige in Kingdom Come: Deliverance 2

2025-06-26 10:56