What to know:

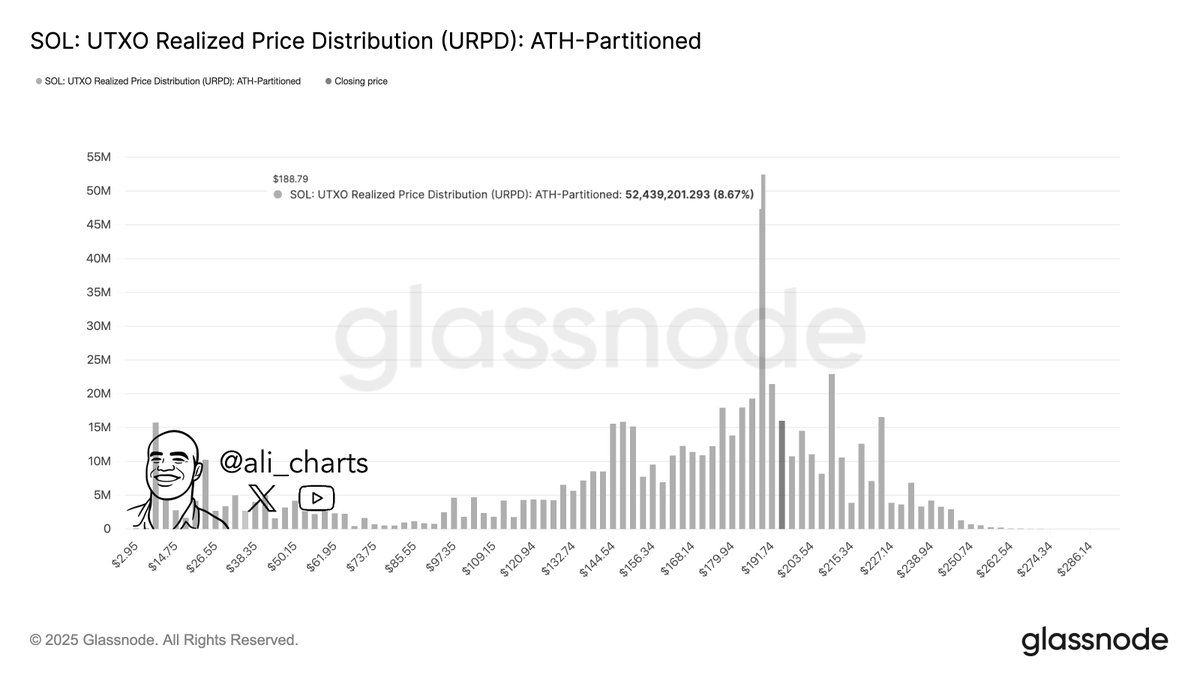

- Ali Martinez flagged $188 as Solana’s key support, citing data from Glassnode.

- CoinDesk Research’s model shows resistance near $195, supports around $189-$186, and an intraday pivot near $192.50.

- Fidelity Digital Assets lists SOL alongside BTC, ETH and LTC for eligible U.S. customers, widening retail access.

Solana traded around $191.95 at 15:45 UTC on Oct. 25, after a push toward $195 faded, with traders watching whether the market can hold the high-$180s and convert $192-$195 into a base. Ah, the drama! One moment it’s a Shakespearean tragedy, the next a rom-com of volatility. 🎭

Highlights of the week’s Solana news

Earlier today, crypto analyst Ali Martinez called $188 Solana’s most critical support and shared a Glassnode “realized price distribution” chart – a histogram of where large amounts of SOL last changed hands. A tale of supply and demand, told with more flair than a Parisian fashion show. 👗

Because a big supply cluster sits near $188, many holders are close to break-even there; such zones often act like floors (holding above them tends to reduce selling, while breaks can invite more supply). A delicate dance of greed and fear, performed by investors in tuxedos and tiaras. 💍

On Oct. 23, Fidelity has added SOL for U.S. brokerage customers, broadening access alongside bitcoin, ether, and… Access changes don’t decide the day’s tape, but they expand the potential buyer funnel. Fidelity, that paragon of financial conservatism, has decided to grace its platform with the presence of Solana. Who knew Wall Street could be so romantic? 💼❤️

On Oct. 20, Gemini announced a Solana edition of the Gemini Credit Card, which was launched in 2023. A crypto card so stylish, it makes your Venmo transactions look like a Victorian-era ledger. 🧾

The Solana-branded design provides up to 4% back in SOL on gas, EV charging, and rideshare up to a monthly cap, 3% on dining, 2% on groceries and 1% on other purchases, with select merchant offers that can reach 10 percent. Spend to earn! Because nothing says “financial wisdom” like buying avocado toast with crypto rewards. 🥑

The Gemini Credit Card has no annual fee, no fee to receive crypto rewards and no foreign transaction fees. Gemini is also introducing an option to auto-stake Solana rewards directly; staking APRs can change and are not guaranteed. A gift from the gods of finance-or at least a very well-dressed angel investor. 🎁

Session overview

CoinDesk Research’s technical analysis data model shows SOL edged higher over the prior 24-hour session, traveling about $5.24 (around 2.7%), with buyers defending $189.25 and sellers showing up near $195. The model’s map: primary support $189.25, secondary $186, and resistance clustered around $195.49, with a nearer intraday shelf near $192.50. Technical analysis: where numbers become poetry and charts resemble modern art. 🎨

Volume and intraday context

The largest burst hit 09:00 UTC, when volume rose to 786,000 – about 47% above the 24-hour average (534,000) – as price rejected the $195.16 area and slipped into the $192s. The market’s most dramatic moment occurred at 09:00 UTC, when volume surged like a Victorian novelist’s plot twist. 📖

On the 60-minute view, SOL fell from $193.73 to $192.53, with spikes at 14:10 UTC (around 39.9K) and 14:14 UTC (around 41.1K) helping push through $192.50 and set fresh hourly lows. In plain English: $195 behaved like a cap; $192.50 briefly gave way before stabilizing. A rollercoaster with all the charm of a 19th-century steam engine. 🚂

What to watch next

- Upside: If SOL closes above $195 (UTC) and holds it, the next area to target is $200-$208.

- Downside: If SOL falls below $192.50 and stays there, a retest of $189.25 is likely, with $186 next; losing the $189-$188 zone would put $183 in view.

If Solana ascends above $195, it may find itself in a romantic entanglement with $200. But should it falter below $192.50? Prepare for a Shakespearean tragedy. 🎭

CoinDesk 5 Index snapshot (UTC)

Over the same window, the CoinDesk 5 Index rose from 1,929.11 to 1,958.10 (about +1.5%), holding above 1,950 after a morning push. The CoinDesk 5 Index, that ever-reliable companion, rose with the grace of a ballerina on a budget. 🎭

Latest 24-hour and one-month chart read

As of 15:45-15:46 on Oct. 25, SOL was $191.95 (+0.53% over the period). On the 24-hour chart, $191-$192 acted as an intraday buy zone while $195 capped rebounds. A tug-of-war between hope and despair, played out in candlestick formations. 🕯️

On the one-month chart, SOL has rebounded from mid-October’s low near $175 but remains below early-October highs around $236, keeping focus on reclaiming $200-$208 and then retesting the early-month peak. A phoenix rising from the ashes-or a stock market phoenix, which is apparently a thing. 🦅

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Gay Actors Who Are Notoriously Private About Their Lives

- Games That Faced Bans in Countries Over Political Themes

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- 9 Video Games That Reshaped Our Moral Lens

- ETH PREDICTION. ETH cryptocurrency

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

2025-10-25 21:50