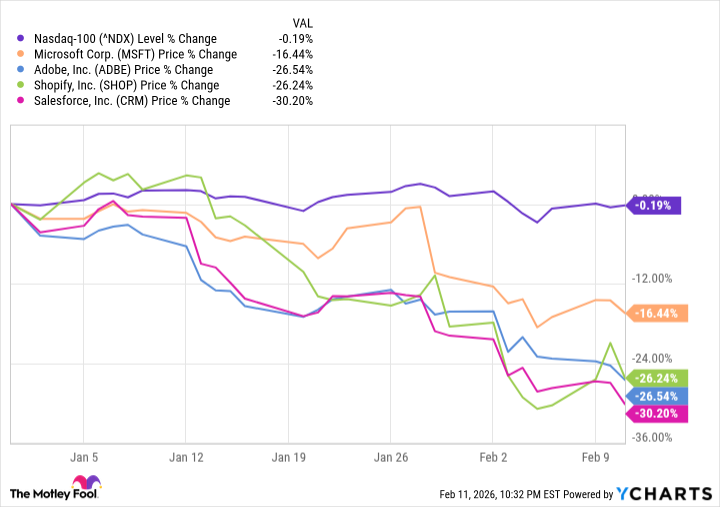

The recent performance of software stocks has been, shall we say, peculiar. It’s as if the entire sector has collectively decided to take a bracing dip in rather chilly waters. The Nasdaq-100, that bellwether of tech enthusiasm, is lagging behind the more generally placid S&P 500, and software-as-a-service (SaaS) companies are feeling the pinch particularly acutely. Microsoft, Shopify, Adobe, Salesforce – all down, some by quite substantial percentages. It’s enough to make one wonder if everyone simultaneously remembered they had forgotten to water their houseplants.

The prevailing explanation, naturally, is Artificial Intelligence. The worry, as it’s being widely circulated, is that AI will somehow render all this perfectly good software… unnecessary. The logic, if you can call it that, is that if AI gets sufficiently clever, it will simply do everything the software does, only better, and at no cost beyond the electricity bill. It’s a bit like fearing the invention of the wheel would put shoemakers out of business. A bit dramatic, perhaps?

However, a recently published note from J.P. Morgan suggests that this particular bout of market jitters might be… well, a bit overdone. It’s not that AI isn’t a big deal – it undeniably is – but the market appears to be applying a rather blunt instrument to a rather delicate problem. The research team politely calls it “broken logic,” which is a wonderfully understated way of pointing out that the current sell-off doesn’t quite add up.

The crux of the matter, as J.P. Morgan sees it, is that you can’t simultaneously fear AI destroying software companies and worry that AI companies are throwing money at infrastructure with no return. It’s a bit like being afraid of both rain and drought. If AI is truly going to disrupt the software world, then those AI companies should be looking rather attractive, not languishing under a cloud of skepticism. And if AI investments are indeed ill-advised, then software companies have a little less to worry about.

The market, it seems, is in a mood to be pessimistic about everything tech-related, regardless of whether it makes sense. It’s a bit like deciding that because one brand of toaster is unreliable, all toasters are inherently flawed. A sweeping generalization, to say the least.

A Possible Course Correction

J.P. Morgan’s analysts, in a separate report highlighted by Bloomberg, suggest that this sell-off represents an “overshoot.” They recommend considering investments in “AI-resilient” software companies – those that are likely to benefit from the integration of AI rather than be replaced by it. Which, frankly, seems a sensible approach. After all, most companies aren’t aiming to avoid progress, are they?

There’s also the rather important point that software often solves highly specific problems for particular industries. It’s not just about general-purpose functionality; it’s about niche expertise and proprietary data. AI might be able to write a passable poem, but it’s unlikely to suddenly understand the intricacies of, say, supply chain management for artisanal cheese makers. At least, not yet.

If you subscribe to the view that this AI-driven sell-off is an illogical overreaction, the iShares Expanded Tech-Software Sector ETF (IGV +2.24%) might be worth a look. It’s currently down 22% year-to-date, but it has delivered a rather respectable 18% average annual return over the past decade. And at an expense ratio of 0.39%, it won’t eat too deeply into your profits. It provides exposure to a broad range of software majors, including Microsoft, Palantir, and Applovin.

In short, this could be a buying opportunity for software stocks. It’s a bit like finding a perfectly good umbrella on sale during a heatwave. It might not be immediately useful, but you know it will come in handy eventually.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- All weapons in Wuchang Fallen Feathers

- Where to Change Hair Color in Where Winds Meet

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Top 15 Celebrities in Music Videos

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Macaulay Culkin Finally Returns as Kevin in ‘Home Alone’ Revival

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

2026-02-17 13:52