SoFi Technologies (SOFI) is no longer the new kid on the block. It’s growing faster than a thief in the night, already shaking up the banking world with a 450% increase in stock value over the last three years. But the real kicker? They’ve got plans to reach the upper echelons of American banking-top 10, to be exact-within the next decade. And, trust me, they’re not just whistling in the dark.

They’ve already made their mark as a mid-sized player, but the road to the top isn’t paved with gold. The biggest banks in the U.S. have assets that make SoFi’s $36 billion look like pocket change. Still, in the dog-eat-dog world of banking, size doesn’t always mean everything.

Climbing the Ladder

The top four banks in this country have trillions in their vaults, but don’t be fooled into thinking the rest of them are small potatoes. Here’s the pecking order:

1. JPMorgan Chase: $3.8 trillion

2. Bank of America: $2.7 trillion

3. Citigroup: $1.8 trillion

4. Wells Fargo: $1.8 trillion

5. U.S. Bank: $664 billion

6. Capital One Financial: $648 billion

7. Goldman Sachs: $625 billion

8. PNC: $555 billion

9. Truist Financial: $536 billion

10. Bank of New York Mellon: $398 billion

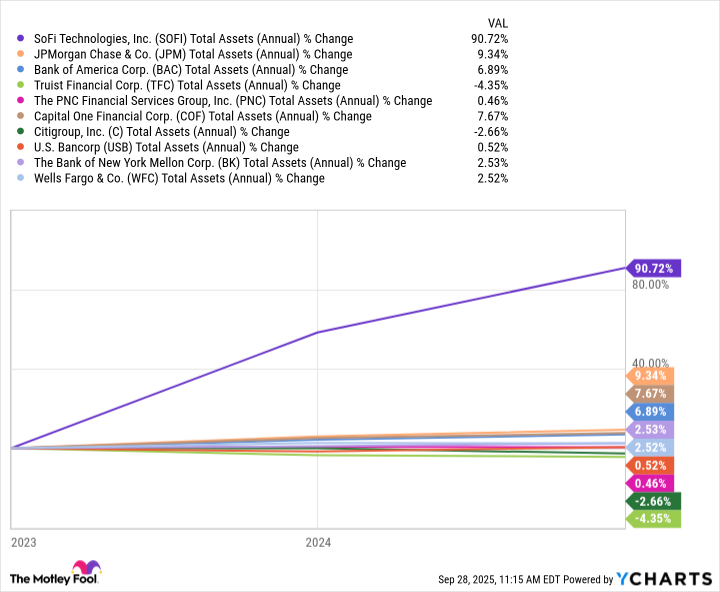

SoFi? They’re small, but they’ve got something these big boys don’t-speed. Right now, they’re sitting at the bottom of this list, but they’re not here to make friends. They’re here to climb. And climb they will.

SoFi’s Appeal

What makes SoFi tick? It’s simple: they’ve become the bank of choice for the younger generation, those digital-first folks who’d rather handle their finances on an app than walk into a stuffy branch. SoFi’s pulling in new members like a flytrap lures the unwary. A record 850,000 new members signed on in the second quarter alone. These are the college kids, the young professionals-the ones who want quick, clean, online services. It’s a no-frills approach that’s working, and it doesn’t need to offer the full suite of traditional banking services. Not yet.

But don’t mistake simplicity for naiveté. SoFi’s been busy. They’re not content to just offer basic services. They’ve been adding features left and right-cryptocurrency trading, blockchain-based services, partnerships with sports events and entertainment. They’re building a brand that appeals to the new breed of customer, and they know where to find them. The Country Music Association’s CMA Fest isn’t just a fest; it’s a well-placed marketing tool. Noto’s right: “As the only one-stop shop for digital financial services, our investments can drive greater long-term growth because we have more ways to attract members to our platform and more ways to grow with them once they’re here.” You don’t get to the top by sitting still.

How SoFi Gets There

The company’s been growing like wildfire. But it’s not just about numbers on a page. SoFi’s real edge lies in its network effect. More customers lead to more services, which in turn leads to more customers. It’s a virtuous cycle, like a predator stalking its prey. As revenue continues to climb-44% year over year in the second quarter alone-their growth is snowballing, and it’s only a matter of time before it’s a juggernaut. Sure, right now they may only be handling student loans for their clients, but the day will come when those same customers will be applying for home loans. As they move up in life, their banking needs will evolve, and SoFi will be right there, offering the next step on the ladder.

For all the noise the top 10 banks make, SoFi’s been quietly making strides. While other banks are plodding along, SoFi’s been moving at a speed that could leave some of these big boys eating their dust.

Now, here’s the kicker: SoFi’s not just pulling in customers-they’re keeping them. 90% of their money deposits are set up through direct deposit. That’s loyalty. When customers get settled, the deposits grow, the loans follow, and eventually, SoFi can start carving out a niche in investment services. In short, SoFi’s customers aren’t just passing through-they’re sticking around.

If the company can maintain its pace, it won’t just be sitting pretty in the top 10. It’ll be climbing that ladder with all the fury of a man with a grudge. If you’ve got a keen eye for growth, now might just be the time to get in while the stock’s still climbing. Because once SoFi hits its stride, it’ll be a force to be reckoned with. And those who got in early? They’ll have a seat at the table.

It’s a long road ahead, but for the brave and the savvy, the view from the top’s gonna be worth the climb. 🏦

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Gay Actors Who Are Notoriously Private About Their Lives

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- Banks & Shadows: A 2026 Outlook

- 9 Video Games That Reshaped Our Moral Lens

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-10-01 05:00