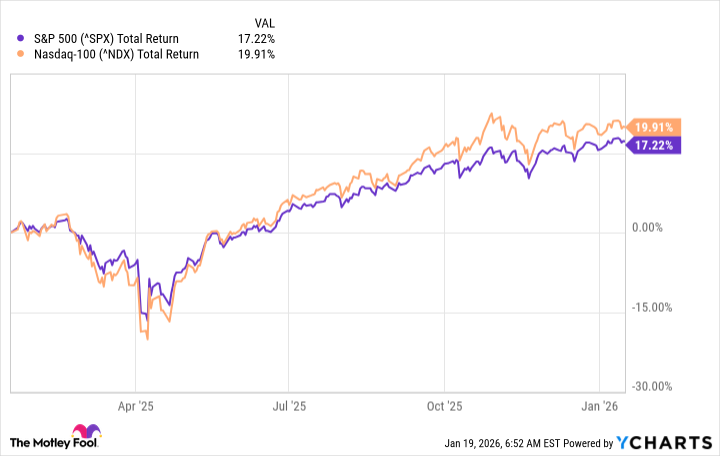

The chronicles of capital, if one may indulge in such a grandiloquent phrasing, are replete with instances of fleeting ascendancy. The current epoch, however, appears particularly enamored with entities designated ‘high-growth’ – a curious label suggesting a defiance of the inherent entropy that governs all things. One observes, with a detached fascination, a correlation between the fortunes of these ventures and the oscillations of the Nasdaq-100, a numerical construct representing a selection of technological pursuits, contrasted against the broader, more deliberately paced S&P 500. It is as if a single, accelerated algorithm dictates the tempo of a larger, more conservative orchestra.

These ventures, while possessing an undeniable allure, are not without their inherent risks. They resemble, perhaps, the more elaborate chambers of a labyrinth, promising treasure but demanding a careful navigation. The subject of this brief inquiry, SoFi Technologies, presents itself as a particularly intriguing specimen. It is a relatively recent arrival upon the financial landscape, a construct born not of centuries-old tradition, but of the digital age. It has, according to the available data, navigated its initial, more precarious phase, and now demonstrates a degree of profitability. This, in itself, is a noteworthy event, a small victory against the statistical probabilities.

SoFi: From Cooperative to Digital Bank

SoFi’s origins, as best one can reconstruct them, lie in the provision of student loans, a seemingly modest beginning. It has since expanded its scope, evolving into a full-service digital bank, a transformation not unlike the metamorphosis described in certain apocryphal texts. Its appeal appears to be concentrated amongst students and young professionals, a demographic seemingly predisposed to the allure of digital interfaces. The proliferation of accounts – 905,000 added in a single quarter, a figure that borders on the fantastical – suggests a rapid assimilation into the habits of its target audience. One wonders if this growth is sustainable, or merely a temporary fluctuation within the larger, incomprehensible currents of the market.

The numbers, when examined with a scholar’s detachment, are indeed curious. A 38% increase in adjusted net revenue, a 129% increase in adjusted net income – these are not insignificant figures. The addition of 1.4 million new products, bringing the total to 18 million, suggests a relentless expansion of its offerings. The lending segment flourishes, benefiting from the ebb and flow of interest rates. Financial services revenue increases, and even the business-to-business segment, the ‘tech platform,’ demonstrates a modest, but consistent, growth.

The Potential for Perpetual Growth

Management, predictably, envisions a future of limitless potential. The strategy, as articulated in various reports, centers around the ‘monetization’ of existing customers – a phrase that, when stripped of its jargon, simply means extracting maximum value from each individual. The idea is to foster a long-term relationship, providing increasingly sophisticated financial services as the customer’s needs evolve. This is not a novel concept, of course, but the digital infrastructure allows for a degree of granularity and personalization previously unattainable.

New products are constantly being introduced, including innovations in blockchain technology, such as a ‘stablecoin’ – a digital currency designed to maintain a fixed value. Perhaps the most intriguing offering is the ‘Smart Card,’ a device that aggregates all the user’s accounts into a single, unified interface. It is a curious concept, reminiscent of the Borges’s Library of Babel, a vast repository of knowledge contained within a single, infinitely expanding structure. Whether this card represents genuine innovation, or merely a repackaging of existing services, remains to be seen.

SoFi, therefore, presents itself as a growing and, at present, profitable entity. It may, or may not, add ‘incredible value’ to a portfolio, as some analysts suggest. But it certainly provides a fascinating case study in the ever-evolving landscape of finance, a realm as complex and unpredictable as any labyrinth ever conceived.

Read More

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- EUR UAH PREDICTION

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-01-22 02:52