The year 2025, as it turns out, was exceptionally kind to Robinhood Markets (HOOD 1.75%). A surge of over 200%—a feat that, in the grand scheme of things, is less a testament to shrewd investment and more to the enduring human appetite for a flutter. A three-year gain of 1,000%? One almost expects a brass band and a parade. However, as any seasoned gambler—or, indeed, any equity researcher—knows, fortunes are as fleeting as a summer breeze. The stock has since begun its descent, shedding 23% in the last three months. The concerns? Predictable, really: an overreliance on the whims of the cryptocurrency market and a valuation that aspires to the heavens. A cautionary tale, wouldn’t you say?

If one seeks a financial institution with a slightly more grounded trajectory—a vessel less prone to capsizing in the turbulent seas of speculation—SoFi Technologies (SOFI 3.38%) merits a closer look. It’s not about avoiding risk entirely, dear reader, but about calibrating it with a modicum of sense.

A Solid Foundation, Not a House of Cards

SoFi has been quietly, diligently building something resembling a business. Robust growth last year, and a growing capacity to turn a profit—a concept often overlooked in the current climate. They’ve been adding customers at a respectable clip—over 900,000 new accounts in the third quarter of 2025 alone. A veritable stampede, if you will, though thankfully not of lemmings.

These aren’t merely accounts; they’re the profiles of young professionals, individuals with decades of potential ahead of them. A wise investor doesn’t chase immediate gratification; they cultivate long-term relationships. And, crucially, 90% of SoFi Money deposits are direct deposits – salaries, if you please. This isn’t disposable income fueled by fleeting trends; it’s the bedrock of financial stability. As this cohort progresses in their careers, those deposits, naturally, are likely to increase. A predictable outcome, wouldn’t you agree?

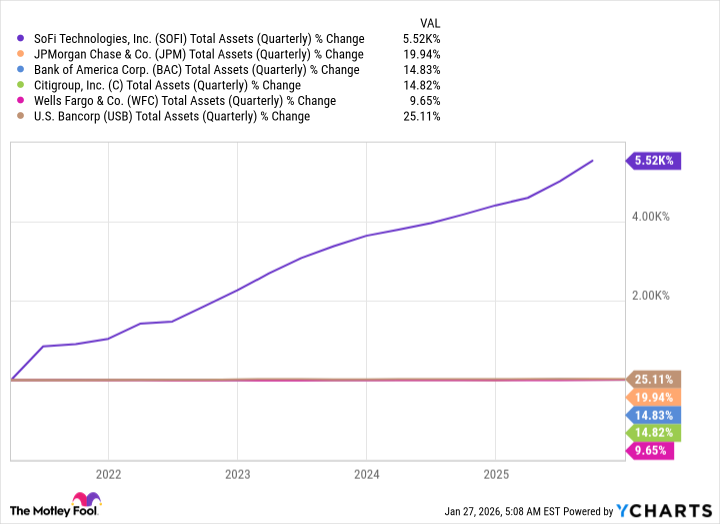

Let us consider SoFi’s asset growth over the last five years, juxtaposed with the behemoths of American banking—JPMorgan Chase, Bank of America, Citigroup, Wells Fargo, and U.S. Bank:

SoFi, it’s true, remains a modest player in this arena. But therein lies the opportunity. A small ship can turn far more quickly than an ocean liner. The growth runway is, shall we say, substantial. Management, with a commendable degree of ambition, is expanding beyond mere customer acquisition, diversifying its offerings and cross-selling services to an evolving clientele. A sensible strategy, even if it lacks the dramatic flair of a casino.

A Less Perilous Course

SoFi’s stock gained 70% in 2025—a respectable performance, even if it didn’t quite match the meteoric rise of Robinhood. But it’s a safer gain, built on a more sustainable model. Less susceptible to market whims, less reliant on the volatile world of cryptocurrency. SoFi’s growth is fueled by reliable revenue streams, and a willingness to innovate without abandoning prudence.

It’s more than just a trading platform, you see. It appeals to a broader demographic—individuals seeking accessible, digital financial services. People who prefer a quiet, reliable journey to the dizzying heights of speculative excess. That, dear reader, is why I recommend it as an excellent financial stock to consider in 2026. It’s not about getting rich quick; it’s about building something lasting. And in the long run, isn’t that a far more satisfying endeavor?

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- 17 Black Actresses Who Forced Studios to Rewrite “Sassy Best Friend” Lines

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- Elden Ring’s Fire Giant Has Been Beaten At Level 1 With Only Bare Fists

- Anime Series Hiding Clues in Background Graffiti

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

2026-01-29 13:14