Snap (SNAP), proprietor of the ephemeral charm that is Snapchat, finds itself in a state of terminal démodé. Its stock, once a phoenix soaring to 2021 heights, now languishes 91% below its peak-a casualty, one suspects, of Apple’s 2021 privacy edicts, which rendered ad-targeting a bureaucratic snarl. The iPhone, that sapphire jewel of the lucrative American market, became a cage for Snap’s advertisers, who could no longer peep through the keyhole of user data. The ad platform, once a glittering bazaar, now resembles a deflated soufflé.

Snap’s revenue growth, sluggish as a tortoise in a monsoon, is met with a flurry of “innovations”-a word that, in corporate parlance, often means “desperate gambles.” The company has taken to AI and machine learning with the fervor of a Victorian alchemist, convinced these tools will transmute its leaden ad performance into gold. Its Smart Campaign Solutions, a digital charlatan’s panacea, promises to optimize bids in real time, though one wonders if this is a solution in search of a problem.

Yet, a European sportswear brand, in a feat of modern sorcery, doubled conversions and halved costs using Smart Bidding. One might conclude that, in the alchemy of advertising, Snap has struck a faint glimmer of leaden ingenuity. Meanwhile, its Sponsored Snaps, now invading user inboxes like uninvited dinner guests, have seen a 22% conversion uptick. Perhaps the future of advertising lies in mimicking the tyranny of friendship.

The User Base: A Bastion of the Unrepentant

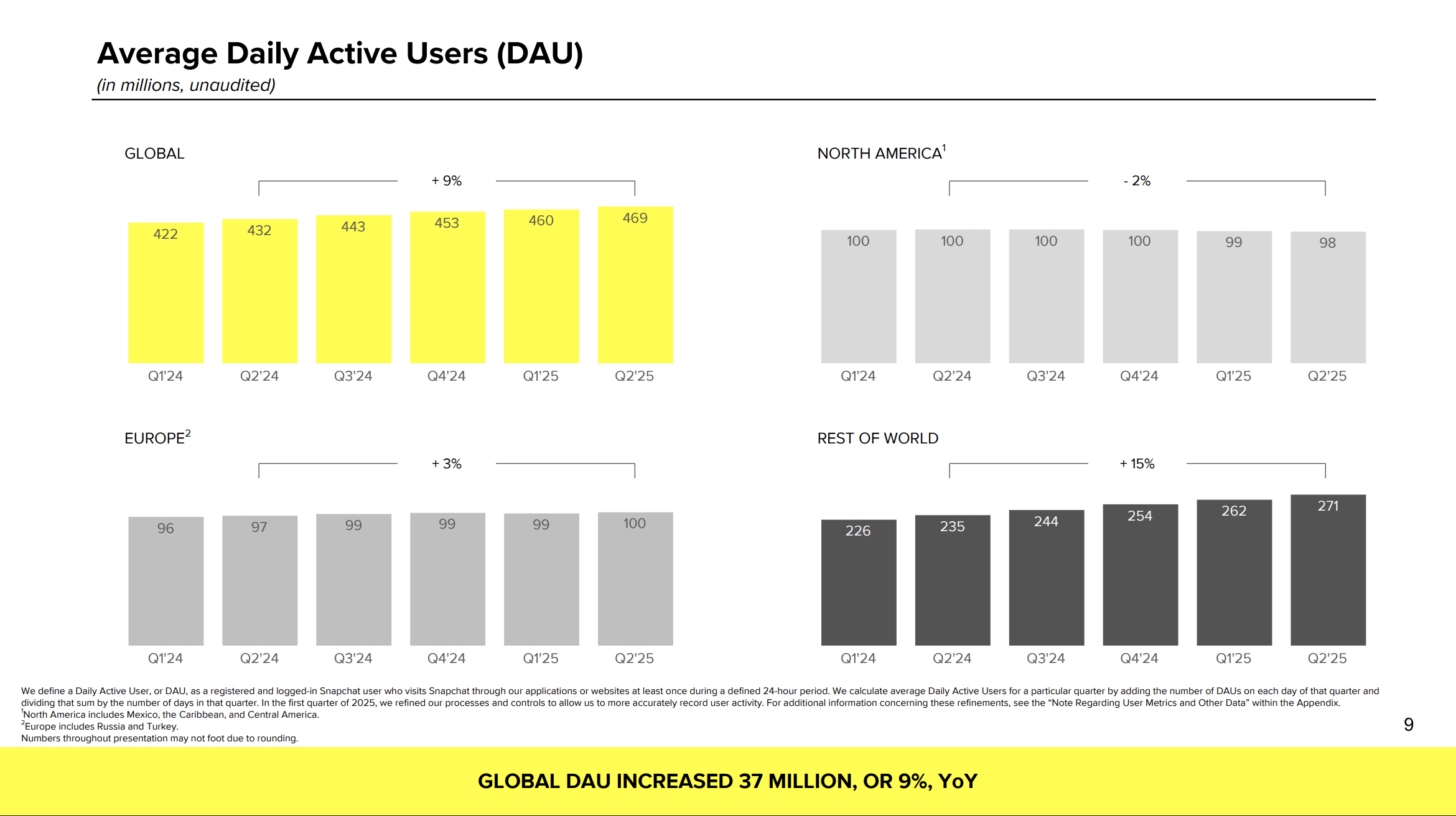

Q2 revenue, a modest $1.34 billion, suggests Snap’s coffers are more sieve than sanctuary. Yet, its 469 million daily users, a number that climbs like a Victorian drawing-room parlor game, offer a glimmer of hope. Advertisers, ever the pragmatists, will follow the crowd-even if the crowd is a herd of Gen Zs swiping through filters. The platform’s growth, though, is a slow drip in the desert of investor impatience.

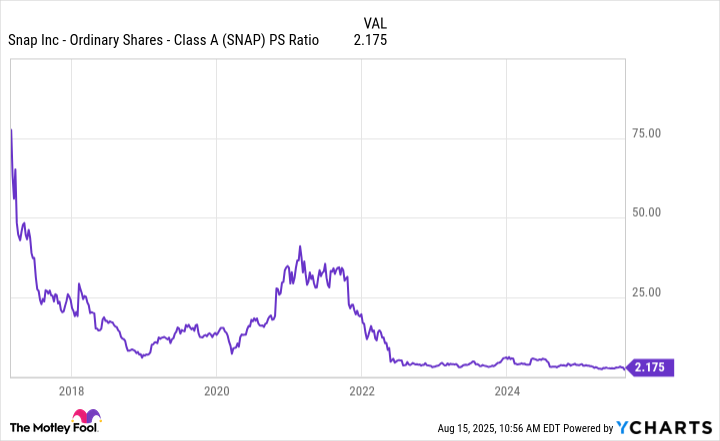

Snap’s P/S ratio, a paltry 2.1, is the sort of valuation that would make a beggar blush. It is the price of a stock that has fallen so far, it now trades in the realm of the absurd. For the patient investor, this is a bargain; for the impatient, a purgatory. Snap’s $3.5 billion debt, however, is a shadow it cannot outrun. Only $557 million of it is due by 2027, but the company’s GAAP losses are a red flag, fluttering like a jester’s cape in the wind.

Snap’s future is a bauble of uncertainty. Its innovations may yet prove to be the key to the kingdom-or a paper crown. For 2025, one might reasonably expect nothing more than a protracted purgatory. The true test lies in the next year or two, when the alchemy of AI and user growth will either transmute this enterprise into something worthy or consign it to the ash heap of forgotten tech. Investors, ever the optimists, should proceed with the caution of a man walking a tightrope over a volcano. 🦄

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- EUR UAH PREDICTION

2025-08-18 11:37