Author: Denis Avetisyan

New research details an auction mechanism that leverages user data to significantly increase revenue for digital publishers.

The Information-Bundling Position Auction (IBPA) achieves a 68% revenue increase over standard auctions through bundled pricing and quantile mapping techniques.

Revealing granular targeting data in digital advertising promises more relevant ads but risks stifling competition and diminishing revenue. This paper, ‘Targeting Information in Ad Auction Mechanisms’, addresses this trade-off by introducing the Information-Bundling Position Auction (IBPA), a novel mechanism that maximizes publisher revenue through personalized pricing and strategic information disclosure. Simulations using real-world data demonstrate that IBPA increases publisher revenue by 68% compared to standard auction formats. Could this approach reshape the economics of online advertising and unlock greater value for both publishers and advertisers?

Unveiling the Inefficiencies of Digital Ad Auctions

The prevailing model for digital advertising auctions, most notably the Generalized Second Price (GSP) auction, frequently results in undervalued ad impressions, ultimately diminishing revenue for content publishers. This inefficiency stems from the auction’s design, which prioritizes simplicity and ease of implementation over maximizing value capture. In a GSP auction, advertisers bid based on their perceived worth of reaching a specific audience, but the winning bid is often determined by the bid of the second-highest bidder, not the actual value the impression holds for the winning advertiser. This disconnect means that publishers frequently sell valuable ad space for less than its true worth, creating a systemic loss of potential revenue. While seemingly minor on an individual impression level, these underpriced auctions accumulate across millions of daily transactions, significantly impacting the financial health of digital publishers and incentivizing the exploration of more sophisticated auction mechanisms.

Current digital advertising auctions frequently fail to maximize value because of inherent limitations in information and pricing. Traditional systems operate with incomplete knowledge of each advertiser’s true willingness to pay for an impression, relying instead on generalized bids. Furthermore, these auctions typically employ uniform pricing, meaning all winning bidders pay the same amount, regardless of their individual valuations. This approach often leaves money on the table, as advertisers who place a high value on a specific impression may secure it at a price far below what they would have been willing to pay, while the publisher misses out on potential revenue. Consequently, a significant opportunity exists to refine auction mechanisms to better reflect the nuanced value each impression holds for different advertisers, thereby optimizing returns for publishers and improving efficiency within the digital advertising ecosystem.

The rapidly evolving digital advertising ecosystem demands auction mechanisms that move beyond the limitations of traditional, static pricing models. Current systems often fail to fully capture the value of each ad impression, particularly as advertisers possess nuanced valuations based on user data and campaign goals. Innovative designs, such as the Incentive-Based Probabilistic Auction (IBPA), address this by dynamically adjusting prices based on individual advertiser bids and the specific characteristics of available ad inventory. Studies demonstrate the IBPA’s capacity to significantly improve revenue for publishers compared to established Generalized Second Price Auctions, showcasing a pathway towards more efficient and value-maximizing transactions within the programmatic advertising landscape. This adaptive approach not only benefits publishers but also allows advertisers to secure impressions aligned with their precise targeting criteria, fostering a more mutually beneficial exchange.

IBPA: Architecting Value Through Bundling and Personalization

The IBPA (Integrated Bidding and Pricing Architecture) aims to increase publisher revenue by moving beyond uniform pricing to reflect specific advertiser demand. This is achieved through bundled pricing, where publishers offer packages of inventory rather than individual impressions, and personalized auctions, which tailor the auction to each advertiser based on historical data and predicted value. By accounting for the nuanced willingness to pay across different advertisers and campaigns, the IBPA facilitates a more efficient allocation of ad inventory, capturing revenue that would be lost with a one-size-fits-all approach. The system considers factors such as targeting parameters, campaign goals, and advertiser quality to dynamically adjust pricing and optimize yield.

The IBPA’s ad slot allocation utilizes a Marginal Revenue Approach, meaning inventory is assigned to bidders based on the incremental revenue each impression is expected to generate. This differs from traditional auction models by considering not only bid price, but also predicted downstream value derived from advertiser quality and targeting data. The system forecasts the potential for increased conversions or other key performance indicators (KPIs) associated with specific advertiser campaigns and user segments. Consequently, slots aren’t necessarily awarded to the highest bidder; instead, they are allocated to the bidder whose impression is projected to yield the greatest overall revenue for the publisher, effectively optimizing for total yield rather than simply clearing price.

Private Information Collection within the IBPA involves publishers strategically limiting the upfront disclosure of detailed inventory attributes-such as specific ad unit sizes, exact remaining impressions, and granular audience segment data-to potential bidders. This withholding of information prevents premature valuation of ad inventory by advertisers and encourages participation in the auction process itself, allowing the IBPA’s algorithms to dynamically assess demand. By obscuring precise inventory details, the system facilitates more effective price discovery and enables publishers to capitalize on varying advertiser willingness to pay, ultimately maximizing revenue through a more nuanced allocation of ad space based on real-time auction dynamics.

The IBPA utilizes two primary forms of price discrimination to optimize revenue. Second-degree price discrimination is achieved through bundled pricing and tiered auction options, allowing advertisers to self-select price points based on their budget and desired inventory characteristics. Simultaneously, the system implements first-degree price discrimination by leveraging collected private data on advertiser value – specifically, willingness to pay for impressions – to dynamically adjust auction prices on a per-bid basis. This granular pricing mechanism aims to extract maximum value from each advertiser by charging a price closer to their individual valuation of the ad inventory, rather than applying a uniform price across all participants.

Decoding Value Capture: The Mechanics of Incentive Compatibility

The Incentive Compatibility (IC) of the IBPA’s payment construction is achieved by designing payments such that truthful bidding is a dominant strategy for advertisers. This means an advertiser maximizes their expected revenue by bidding their true valuation for an impression, regardless of the bids of other participants. The IBPA accomplishes this through a mechanism where payments are directly tied to the value the advertiser places on reaching the target audience, rather than solely on the auction price. This alignment between stated value and payment received removes the incentive to strategically misrepresent valuation, ensuring bidders participate honestly and contributing to maximized revenue for the platform and improved outcomes for advertisers.

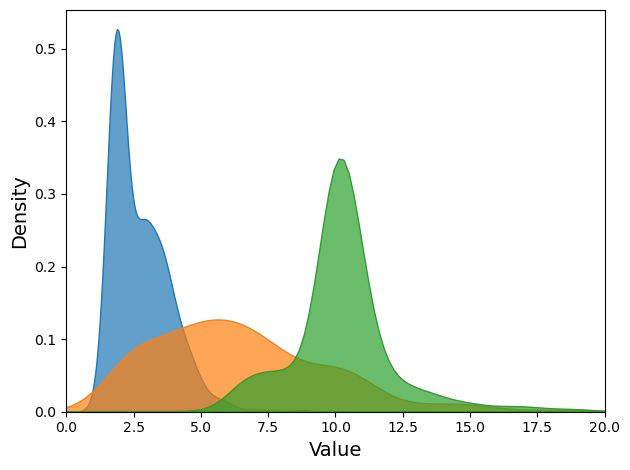

Quantile mapping within the IBPA functions as a statistical technique to align the distribution of advertiser valuations with the resulting distribution of auction prices. This process involves determining the quantiles of advertiser bids – effectively dividing bids into groups based on their rank – and mapping these quantiles to corresponding quantiles of the desired price distribution. By ensuring that, for example, the 25th percentile of bids corresponds to the 25th percentile of achievable prices, the IBPA establishes a direct relationship between bid value and payment amount. This method facilitates the calculation of optimal payments by translating a bidder’s stated valuation into a price that reflects their position relative to all other bidders, thereby optimizing revenue and ensuring allocative efficiency.

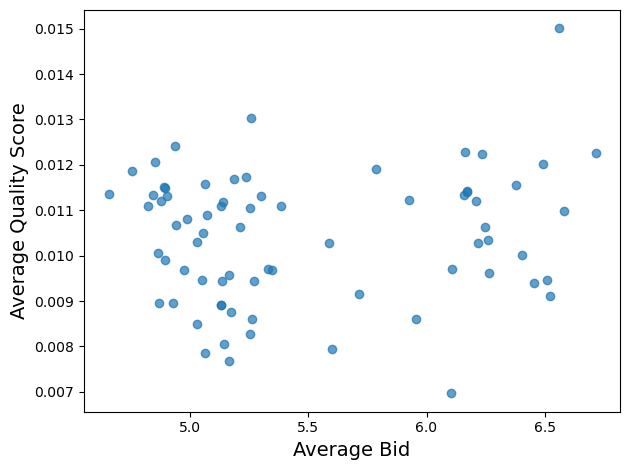

Analysis of 9.6 million auction instances sourced from Retail Media Data indicates the IBPA’s ability to enhance both advertiser welfare and overall market efficiency. This assessment was conducted through empirical observation of auction outcomes and payment structures within the IBPA framework. The data demonstrate a measurable improvement in resource allocation, contributing to increased value for advertisers, and a more efficient distribution of advertising spend across available inventory. The scale of the dataset – 9.6 million auction instances – provides a statistically significant basis for evaluating the IBPA’s performance characteristics and its impact on key market metrics.

The implementation of the IBPA demonstrably improves advertiser welfare through increased allocation rates. Analysis of 9.6 million auction instances reveals a 29% improvement in this metric, indicating that advertisers are securing impressions at a higher frequency compared to previous auction mechanisms. This enhanced allocation is a direct result of the IBPA’s design, which prioritizes efficient matching of advertiser valuations to available inventory, thereby maximizing the value derived from each auction participant and contributing to overall market efficiency beyond simple revenue gains.

Real-World Considerations: Navigating Constraints and Expanding Impact

The implementation of the Incentive-compatible Budget-Paced Auction (IBPA), despite demonstrating substantial revenue gains, is intrinsically linked to the budgetary realities faced by advertisers. Practical application reveals that advertisers often operate with pre-defined, and sometimes limited, campaign budgets. Consequently, the auction mechanism must account for these constraints to ensure sustained participation and prevent premature budget exhaustion, which could lead to reduced bidding and overall auction efficiency. This necessitates a dynamic pacing strategy within the IBPA, allowing advertisers to intelligently allocate their funds over the auction duration and maintain a consistent presence without exceeding pre-set limits. Ignoring these budgetary factors risks undermining the incentive compatibility of the auction, potentially driving advertisers towards alternative platforms or curtailing their engagement, ultimately diminishing the potential for increased revenue and market optimization.

Advertisers frequently maintain a presence on multiple digital platforms, a practice known as multi-homing, and auction designs must account for this common behavior. Ignoring multi-homing can lead to inaccurate revenue predictions and suboptimal auction outcomes, as an advertiser might participate in an auction not necessarily to win that specific impression, but to maintain a competitive presence across the broader advertising landscape. Consequently, the Incentive-compatible Bundled Payment Auction (IBPA) incorporates strategies to address this, recognizing that an advertiser’s value for an impression isn’t isolated to a single platform, but rather derived from its contribution to a larger, cross-platform campaign. This nuanced understanding of advertiser behavior ensures the auction remains effective even when faced with the realities of a multi-faceted digital advertising ecosystem, allowing for a more stable and predictable revenue stream.

The Iterative Bundle Potential Auction (IBPA) emerges as a significant advancement over conventional Generalized Second Price (GSP) auctions, demonstrably offering a pathway to heightened revenue and improved market efficiency. Recent studies reveal a substantial 68% increase in revenue when employing the IBPA, a figure that underscores its potential to reshape digital advertising landscapes. This improvement isn’t simply theoretical; the auction’s design encourages more strategic bidding, drawing greater value from available ad inventory. By allowing advertisers to express valuations for bundles of impressions, rather than individual ones, the IBPA unlocks previously unrealized revenue opportunities and fosters a more dynamic and competitive auction environment. This enhanced efficiency benefits both advertisers, who can target their campaigns more effectively, and publishers, who realize increased returns on their advertising space.

The success of the Incentive-Based Proxy Auction, or IBPA, hinges significantly on a foundation of open information access within the digital advertising ecosystem. This transparency isn’t merely about disclosing auction results; it fundamentally reshapes advertiser behavior by allowing them to verify the system’s fairness and accurately assess the value of their bids. Without this level of visibility into the auction process – including confirmation that proxies are being executed as intended – advertisers may hesitate to fully participate, fearing manipulation or unfavorable outcomes. Consequently, a transparent IBPA fosters trust, encouraging greater advertiser engagement and ultimately maximizing revenue potential by ensuring a perceived equitable exchange of value. This creates a virtuous cycle where increased participation further validates the system’s integrity and attracts even more bidders.

The research detailed within reveals a complex interplay between information asymmetry and revenue optimization, mirroring a fundamental tenet of political philosophy. As Thomas Hobbes observed, “The value of a thing is no more than what one is willing to pay for it.” This holds true within the Information-Bundling Position Auction (IBPA) mechanism; the system effectively extracts value based on revealed user preferences. By bundling information and employing quantile mapping, the IBPA doesn’t merely facilitate transactions-it defines value through personalized pricing. Each bid represents a willingness to pay, shaped by the perceived worth of targeted information, ultimately demonstrating that even in digital markets, the dynamics of self-interest and valuation remain constant.

Beyond the Bid: Charting Future Auctions

The introduction of the Information-Bundling Position Auction (IBPA) offers a compelling demonstration: revenue optimization isn’t merely about faster computation, but about fundamentally re-evaluating what is being auctioned. The 68% revenue increase isn’t a ceiling, but a signal. It suggests current auction designs operate far from efficiency, treating information as a negligible externality rather than a core asset. However, the immediate extrapolation to all digital advertising contexts requires caution. The current model assumes a relatively static user base and a predictable response to bundled information. A longitudinal study, observing behavioral shifts as users adapt to this new pricing structure, is crucial.

A key unresolved question concerns incentive compatibility in the face of increasingly sophisticated bidders. While the IBPA demonstrates short-term gains, it doesn’t explicitly address how bidders might learn to game the system over time. Could bidders strategically underreport information quality to lower their bids, thereby eroding the publisher’s advantage? Exploring dynamic auction formats, incorporating elements of Bayesian learning, might be necessary to maintain long-term equilibrium.

Ultimately, this research highlights a broader principle: auctions aren’t simply mechanisms for price discovery; they are systems for information exchange. The next frontier lies in developing auction designs that not only maximize revenue but also incentivize truthful information revelation and promote market welfare. Perhaps the true metric of success isn’t revenue, but the efficiency with which information flows between advertisers, publishers, and, ultimately, the user.

Original article: https://arxiv.org/pdf/2601.09541.pdf

Contact the author: https://www.linkedin.com/in/avetisyan/

See also:

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘Zootopia 2’ Wins Over Critics with Strong Reviews and High Rotten Tomatoes Score

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2026-01-16 03:37