Markets

What to know:

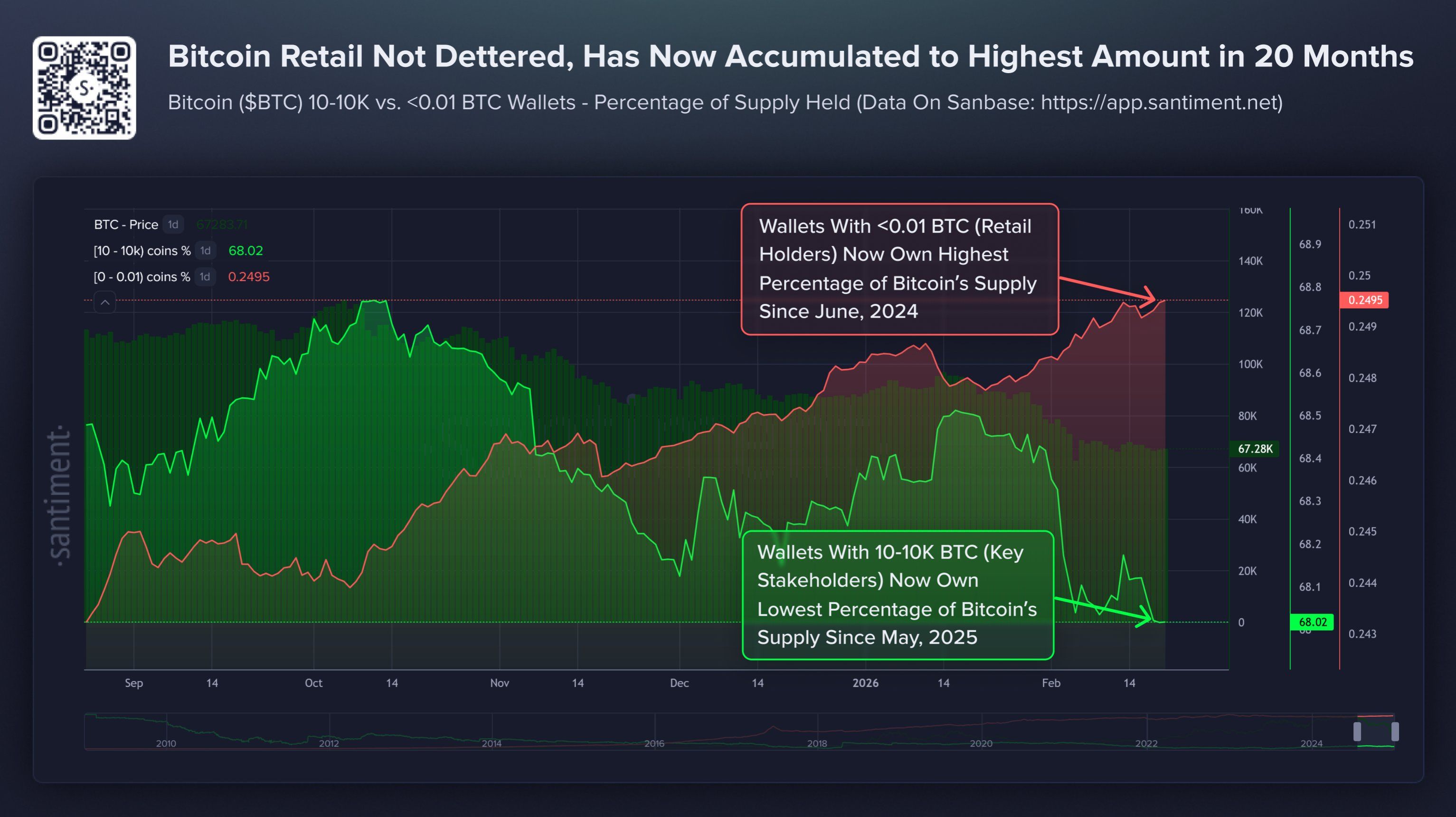

- Behold, the bitcoin wallets clutching less than 0.1 BTC have surged to heights unseen since the quaint summer of 2024, all while the price frolics lazily in the mid-$60,000s.

- Meanwhile, the grand whales and cunning sharks, those titanic beings with 10 to 10,000 bitcoins, have been retreating like timid mice since our last peak in October.

- This divergence creates a delightful cocktail of choppy, fragile price action, as retail demand can only flutter temporarily when the big fish are busy distributing their plunder at every recovery.

For much of this month, bitcoin has been strutting around at the mid-$60,000s-a scene so humdrum one could hear crickets chirping in the background.

Yet, lo and behold! A fascinating rift in coin ownership is brewing, promising to dictate the next chapter of this digital soap opera.

According to the wise sages at Santiment, the number of wallets clutching less than 0.1 BTC-a territory usually inhabited by retail investors-has bloomed by 2.5% since the cryptocurrency reached its dizzying heights last October. The so-called shrimps are now claiming the largest share of supply since mid-2024, perhaps feeling quite smug about it.

Ah, but the true puppeteers of this financial theatre are the larger holders-those illustrious whales and sharks who typically dictate the price’s cha-cha. Alas, these grand figures have chosen to trim their positions by a modest 0.8% instead.

Such a split, dear reader, is the kind that births choppy and exasperating price action rather than the smooth waltz we all long for.

Retail investors may offer a reassuring floor and ignite fleeting bursts of momentum, but alas, for a rally to stick, the bigger players must be willing to partake in the banquet of buying.

This divergence is particularly striking, given that the tableau looked rather different just a few weeks back.

After bitcoin took a nosedive towards $60,000 on February 5-an impressive drop of over 50% from its October pinnacle-Glassnode’s Accumulation Trend Score soared to a robust 0.68, the most vigorous broad-based reading since late November, as CoinDesk dutifully reported.

This metric, which measures the relative strength of accumulation across varying wallet sizes, tells a tale: a score nearing 1 signals accumulation, while a score approaching 0 whispers of distribution.

During the tumultuous flash, the 10-to-100 BTC enthusiasts were the most ardent dip buyers, suggesting a market shifting from despair to an almost romantic synchronization.

However, Santiment’s broader perspective complicates this narrative. Its 10-to-10,000 BTC category encompasses a more extensive range of large holders than Glassnode’s more intimate dip-buying circle, revealing that net positioning since October remains firmly negative.

Perhaps we can harmonize these two perspectives: mid-sized wallets might have genuinely embraced the panic while the behemoths continued to offload their treasures at every chance, dragging the aggregate numbers down into the murky depths.

This distinction matters because bitcoin does not require retail to suddenly appear; they’re already here, waving their tiny flags.

What it truly needs is for the distribution from the large wallets to cease-or even better, reverse. Without such a shift, each rally risks being devoured by the very cohort that must provide structural demand for success.

The shrimps are diligently playing their part, holding their breath and waiting patiently for the whales to finally join the dance.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- QuantumScape: A Speculative Venture

- 20 Movies That Glorified Real-Life Criminals (And Got Away With It)

2026-02-21 08:29