The current enthusiasm for the market, one observes, is almost touching. For those possessed of a mere five hundred dollars – a sum, admittedly, that will not purchase a country estate – a degree of judicious investment remains possible. One must, of course, avoid the more flamboyant offerings, the digital baubles and speculative bubbles that so delight the vulgar. Instead, I propose three entities – Dutch Bros, SoFi Technologies, and MercadoLibre – which, while not entirely immune to the prevailing madness, possess a certain… resilience. One should not anticipate overnight riches, merely a modest preservation of capital, and perhaps a slight increase, if fortune is kind.

1. Dutch Bros

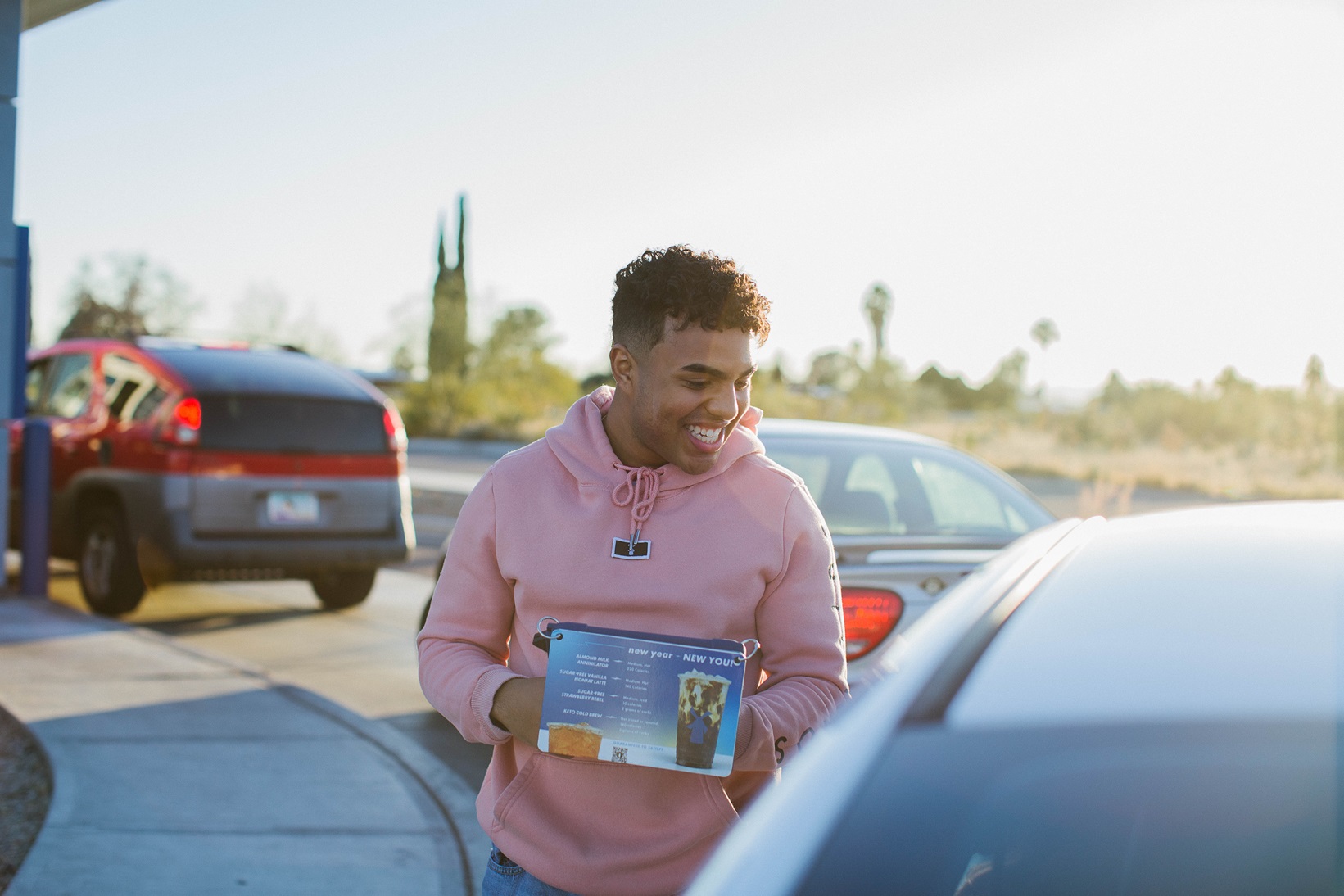

Dutch Bros, a purveyor of caffeinated beverages, is expanding with the relentless efficiency of a particularly determined weed. A thousand stores, they boast, and double that number in prospect. The ambition is, one gathers, to saturate the nation with their offerings. Whether this constitutes progress is, of course, debatable. Still, the appetite for novelty, even in matters of coffee, appears insatiable. Sales are up, naturally, and a mobile ordering system has been introduced, a concession to the modern obsession with convenience. One suspects the drinks themselves are largely irrelevant; it is the experience that is being sold, a fleeting illusion of sophistication.

The company appears, for the moment, to be flourishing. Whether this represents genuine value or merely a temporary craze remains to be seen. One should not, however, dismiss the power of a well-branded stimulant.

2. SoFi Technologies

SoFi, an online banking venture, is attracting customers with the same vigour as a particularly persistent salesman. They claim to be breaking records, a habit, one suspects, indulged in by most modern enterprises. Revenue is up, earnings are climbing, and a new product – international wire transfers via blockchain – is on the horizon. The promise, naturally, is of a seamless, frictionless experience. One wonders, however, if the elimination of friction does not also eliminate a certain… character. The ease with which one can transfer funds, one fears, encourages a certain recklessness.

The ambition, predictably, is to become one of the largest banks in the United States. A lofty goal, and one that, given the current state of the financial world, may not be as difficult to achieve as it appears.

3. MercadoLibre

MercadoLibre, a name largely unknown in these parts, is apparently a giant of e-commerce in Latin America. A region, one gathers, still somewhat resistant to the charms of online shopping. The company is expanding rapidly, with revenue and payment volume both enjoying substantial increases. A profitable enterprise, with a respectable operating margin. One suspects, however, that the true source of their success lies not in innovation, but in simply being the first to offer a reasonably efficient service in a market largely ignored by the more established players.

Five hundred dollars, alas, will only purchase a fractional share. But even a small stake in a dominant player can, with a little luck, prove to be a prudent investment. One should not, however, expect miracles. The world, after all, remains a distinctly unpredictable place.

Read More

- Top 15 Insanely Popular Android Games

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-01-20 22:03