One hundred dollars. It doesn’t sound like much, does it? Not in this inflationary epoch. It’s barely enough to buy a moderately interesting hat, let alone secure your future. But then, the universe rarely concerns itself with sensible amounts of currency. It prefers improbability, and in the realm of finance, improbability often manifests as opportunity. Consider, if you will, that $100 as a seed. A rather small seed, admittedly, but one capable of… well, growing. Possibly. (The precise conditions required for financial germination are, as anyone who’s ever attempted to predict the market knows, fiendishly complex. Involve a lot of sunshine, a little luck, and the complete absence of black swans.)

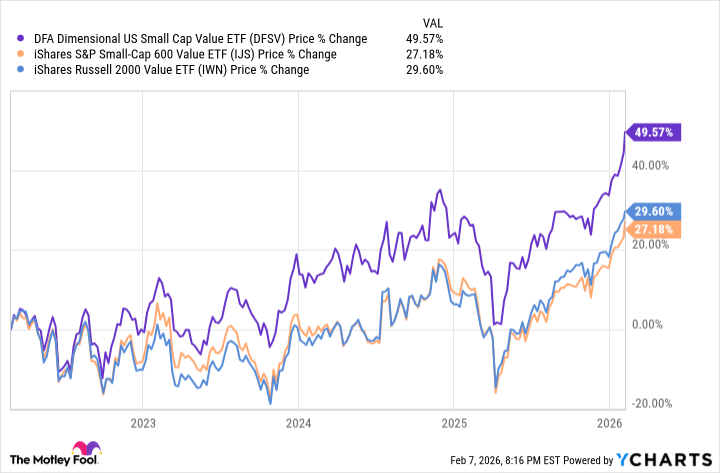

So, where to plant this fiscal seed? Small-cap value stocks. A category that sounds, frankly, like something a particularly enthusiastic accountant dreamed up. But bear with me. Both the Russell 2000 and the S&P SmallCap 600 indexes have been exhibiting a rather uncharacteristic upward trajectory lately – double-digit gains year-to-date, which, in the grand scheme of things, is roughly equivalent to discovering a previously unknown planet made entirely of chocolate.

Now, selecting individual small-cap stocks is a bit like navigating a maze blindfolded while being chased by a mildly irritated badger. Possible, certainly, but needlessly stressful. Thankfully, there are exchange-traded funds (ETFs) to smooth the path. And one, in particular, warrants a closer look: the Dimensional US Small Cap Value ETF (DFSV +0.02%).

With this ETF, DNA matters

At a mere four years old (in ETF terms, roughly equivalent to a mayfly in geological terms), the Dimensional fund is a relative newcomer. But it’s been making waves. It’s outpacing many of its more established rivals, which is somewhat akin to a particularly determined penguin winning a marathon against a fleet of thoroughbreds. How does it do it? Well, it’s all about the DNA. (Not literal DNA, of course. Although, imagine the possibilities if ETFs did have DNA. We could breed them for optimal returns. It would be chaos.)

The Dimensional fund isn’t just passively tracking an index; it’s actively picking stocks. And in the chaotic, often illogical world of small-cap value, active management can actually be… effective. The universe of smaller companies is, let’s say, less efficiently priced than that of its larger counterparts. There’s a lot of noise, a lot of misinformation, and a distinct lack of analysts paying attention. (It’s as if the financial world collectively decided that anything under a certain market capitalization simply isn’t worth bothering with. Which, from a purely existential standpoint, is rather rude.)

Furthermore, active management helps avoid the dreaded “value traps” – companies that look cheap but are, in reality, sinking ships disguised as bargains. (Think of them as financial mirages. Tempting, but ultimately illusory.) This ETF’s approach focuses on companies with actual, demonstrable profitability, which, in the grand scheme of things, is a surprisingly novel concept.

And there’s a lineage to consider. This ETF is essentially the offspring of the DFA US Small Cap Value Portfolio, a mutual fund that’s been around since 1993 and is, by most accounts, exceptionally good at what it does. (It’s a bit like having a financial pedigree. Not a guarantee of success, of course, but certainly a point in its favor.)

What makes this ETF tick

Now, let’s talk fees. The Dimensional ETF has an expense ratio of 0.30% per year. It’s decent for an actively managed fund, but a bit higher than some of its passive counterparts. But consider this: you’re not just getting a basket of stocks; you’re getting a team of analysts actively trying to outperform the market. (It’s the difference between ordering a pre-packaged sandwich and having a chef prepare a meal to your exact specifications.)

The ETF’s “secret sauce” includes limited exposure to capital-intensive sectors like real estate and utilities. Dimensional believes these sectors lack significant upside potential, due to their regulated nature and inherent limitations. (It’s a bit like trying to launch a rocket using only marshmallows and good intentions. Theoretically possible, but highly improbable.)

So, is it a guaranteed path to riches? Of course not. Nothing in finance is ever guaranteed. But in a world of improbable events and fluctuating fortunes, the Dimensional US Small Cap Value ETF offers a reasonably intelligent, and surprisingly well-managed, way to plant that $100 seed. And who knows? With a little luck, and a lot of cosmic improbability, it might just grow.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-02-10 22:44