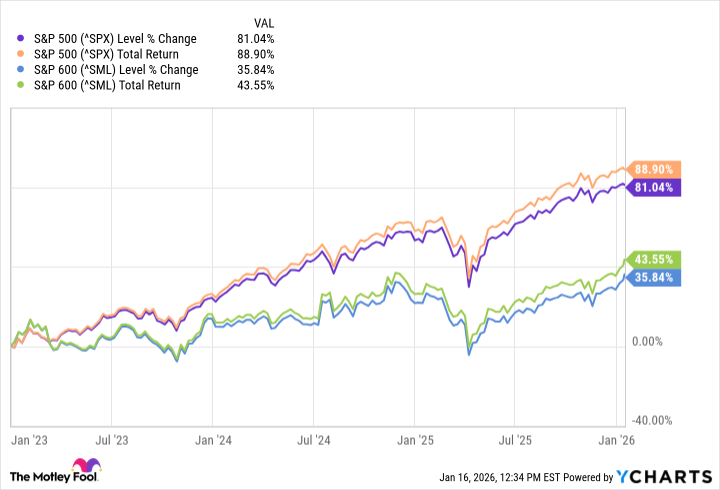

The stock market, you see, has been doing alright for itself lately. Three years, give or take. The S&P 500 is up a good eighty percent from where it was at the end of 2022. Not bad for a species that mostly just worries.

Artificial intelligence, mostly, is to blame. Or credit. It depends on how you look at things. A handful of companies, the so-called Magnificent Seven, did the heavy lifting. Without them, the S&P 500 would be…smaller. About half as impressive, actually. So it goes.

This creates a bit of a situation. A dangerous one, some might say. Or an opportunity. I tend to think the latter. If you’re looking to participate, maybe consider holding a little less of the big stuff – Vanguard S&P 500 ETF (VOO) or the SPDR S&P 500 ETF Trust (SPY) – and a little more of the small-cap variety. Something like the iShares Core S&P Small-Cap ETF (IJR) or Vanguard’s S&P Small-Cap 600 ETF (VIOO). They’re both under two hundred bucks a share, which, in the grand scheme of things, isn’t much.

A Strange Disconnect

Indexes, naturally, don’t move in perfect unison. They never do. But usually, they more or less follow the same general direction. Lately, though, that hasn’t been the case. The S&P 500 has been doing quite well, thanks to the AI boom. The S&P 600 Small Cap Index? Not so much. It’s been lagging, to put it mildly. More than doubled the gains of the S&P 500.

What’s going on? Well, people got excited about AI. Understandably. They started buying the big stocks, the ones everyone thought would benefit the most. They traded in their small caps, essentially. A perfectly logical, perfectly human thing to do. So it goes.

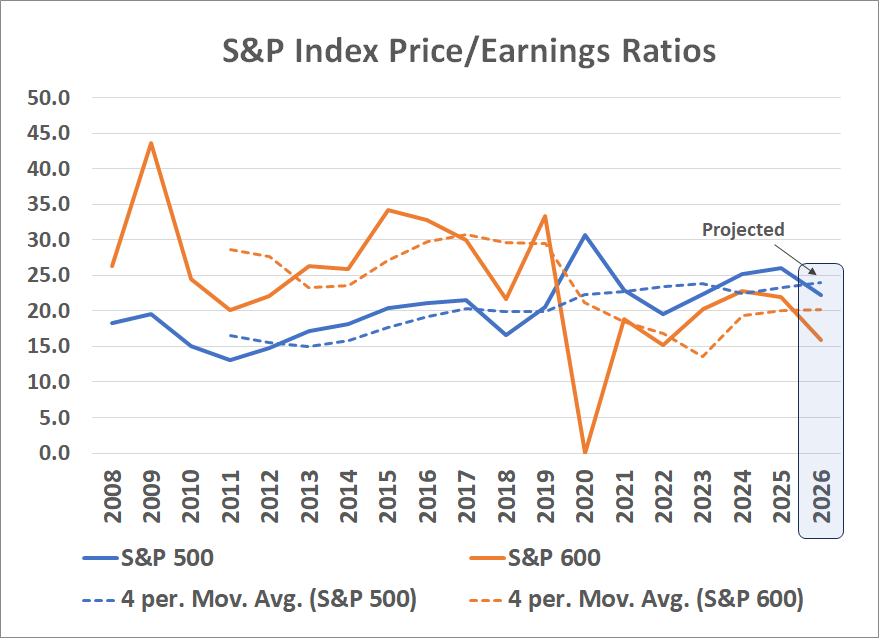

The numbers bear this out. The S&P 500 is valued at over 26 times its earnings. The S&P 600? Only 22 times. Small caps are cheaper. Historically, they’ve been more expensive. But things change. The pandemic, the AI boom…it all adds up.

Looking ahead, the gap widens. Yardeni Research says the S&P 600’s forward P/E ratio is around 16, while the S&P 500 is over 22. People have been “trading in” their small caps for AI stocks. The pattern is clear, if you bother to look.

The Inevitable, Probably

AI isn’t going away anytime soon, of course. It’s probably here to stay. But nothing lasts forever. Experienced investors know this. They also know that the time to expect a shift is when you least expect it. The S&P 500’s progress has been slowing down since last year, while the S&P 600 has actually been picking up speed. Maybe, just maybe, we’re starting to see a shift.

Now, I’m not suggesting you dump all your S&P 500 holdings and go all-in on small caps. That would be foolish. But given the size of this disconnect, it might be worth considering a slight adjustment. A little more exposure to the small-cap side of things. Small caps have lagged large caps for over a decade. This sets the stage for a reversal. The AI boom might just be the catalyst.

Holding a little more exposure to small caps at this time couldn’t hurt. And in the grand scheme of things, a little bit of strategic thinking is never a bad thing. Especially when it comes to money. So it goes.

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Silver Rate Forecast

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-01-20 22:02