Okay, let’s talk small-cap ETFs. Because honestly, trying to pick individual small-cap stocks is like trying to predict which contestant on a reality dating show will actually end up happy. It’s a gamble, and the odds are… not in your favor. We’re looking at the State Street SPDR Portfolio S&P 600 Small Cap ETF (SPSM +0.55%) and the Schwab U.S. Small-Cap ETF (SCHA +0.42%). Both aim to give you a slice of the little-guy pie, but they’re baked with slightly different recipes. And, as with any good baking competition, there’s a winner… or at least, a more strategically sound choice.

The core question isn’t if you should dabble in small-caps – because, growth potential, people! – but how. Do you want broad diversification, or a slightly more focused approach? Think of it as choosing between a buffet and a curated tasting menu. Both can be delicious, but one requires a lot more willpower (and antacids).

Snapshot (The Cliff’s Notes Version)

| Metric | SPSM | SCHA |

|---|---|---|

| Issuer | SPDR | Schwab |

| Expense ratio | 0.03% | 0.04% |

| 1-yr total return (as of 2026-02-20) | 18.4% | 22.3% |

| Dividend yield | 1.5% | 1.2% |

| Beta | 1.19 | 1.00 |

| AUM | $14.8 billion | $20.8 billion |

SPSM is the slightly cheaper option, which is great if you’re a fan of squeezing pennies. But let’s be real, we’re talking fractions of a percent here. It’s like arguing over who gets the last french fry – ultimately, it’s not worth the drama. SCHA, meanwhile, is the slightly more popular kid on the block, boasting a bigger asset base. Because in the ETF world, size does matter. It generally means more liquidity and tighter trading spreads.

Performance & Risk Comparison (aka, Where the Rubber Meets the Road)

| Metric | SPSM | SCHA |

|---|---|---|

| Max drawdown (5 y) | (27.94%) | (30.79%) |

| Growth of $1,000 over 5 years | $1,244 | $1,223 |

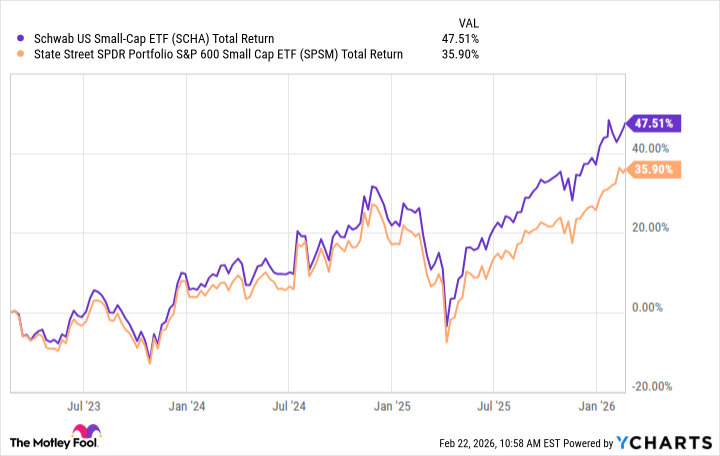

Okay, so SCHA took the lead on that one-year return. Not a massive difference, but in the world of investing, every percentage point counts. It’s like trying to win a marathon by a single stride. The max drawdown is interesting – SPSM held up slightly better during the worst of times. But honestly, trying to time the market is a fool’s errand. Just accept that there will be dips, and focus on the long-term potential.

What’s Inside (The Ingredient List)

SCHA is the “everything bagel” of ETFs, holding 1,724 stocks. It’s diversified across sectors like financial services, industrials, and healthcare. Its top holdings are… well, a lot of companies you’ve probably never heard of, which is kind of the point. It’s not trying to be flashy. It’s just quietly building a solid foundation.

SPSM, on the other hand, is a bit more selective, with 607 stocks. It’s tilting towards industrials, financial services, and consumer discretionary. It’s like a curated playlist – a little more focused, a little more opinionated. Whether that’s a good thing depends on your risk tolerance and investment style. If you like a little spice, SPSM might be your jam. If you prefer a more predictable experience, SCHA is the safer bet.

What This Means for Investors (The Bottom Line)

Small-cap stocks are volatile. Let’s just get that out of the way. They’re like teenagers – full of potential, but prone to mood swings. You need patience, a long-term perspective, and a healthy dose of skepticism. If you’re easily spooked by market fluctuations, this might not be the right asset class for you.

SCHA, with its broader diversification, is the more sensible choice for most investors. It’s like having a well-rounded portfolio – you’re spreading your risk and maximizing your chances of success. SPSM, with its more concentrated approach, is a bit of a gamble. It could pay off big time, but it could also leave you holding the bag.

Ultimately, the best ETF for you depends on your individual circumstances. But if you’re looking for a low-cost, diversified way to tap into the small-cap market, SCHA is a pretty solid option. Now, if you’ll excuse me, I need to go find a therapist. Investing is stressful, okay?

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- QuantumScape: A Speculative Venture

- ETH PREDICTION. ETH cryptocurrency

2026-02-22 19:03