Author: Denis Avetisyan

New research explores whether artificial intelligence can accurately replicate the complex expectation formation processes observed in real-world economic agents.

This study investigates the alignment between Large Language Model-driven agents and the established principles of heterogeneous agent-based modeling, specifically focusing on fundamentalist and trend-following behaviors.

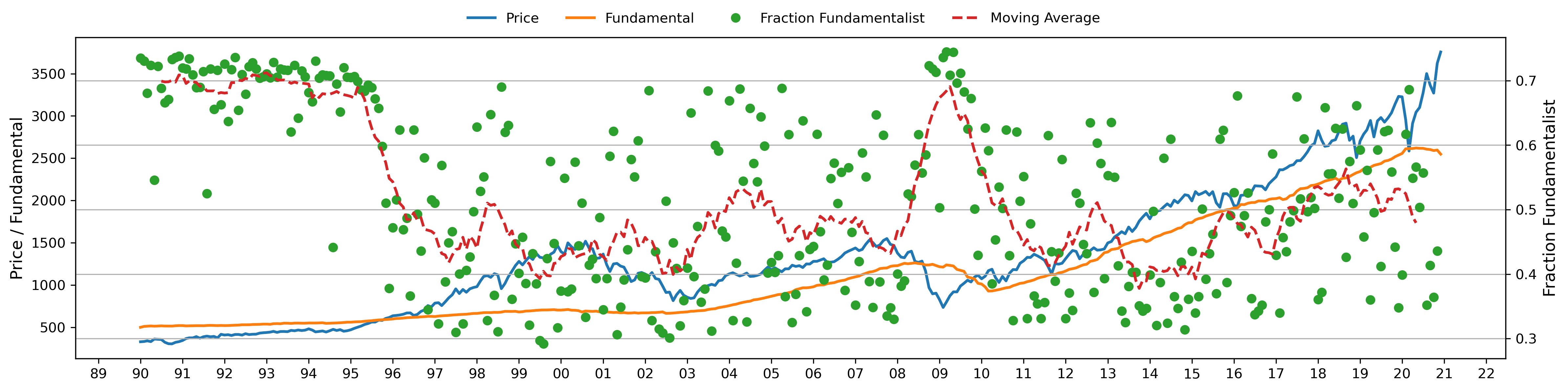

Understanding how expectations form is central to economic modeling, yet capturing the nuanced heterogeneity of agent behavior remains a challenge. This is addressed in ‘Generative Agents and Expectations: Do LLMs Align with Heterogeneous Agent Models?’, which investigates whether large language models can replicate expectation formation observed in established agent-based models. The study finds that a generative agent driven by an LLM exhibits patterns of strategy adoption—balancing fundamental and trend-following approaches—consistent with those reported in the financial economics literature. Could this approach offer a novel pathway to understanding and predicting market dynamics by simulating realistic, diverse agent behaviors?

The Illusion of Rational Markets

Traditional economic models, built on the premise of ‘Methodological Rational Individualism’, consistently fail to predict or adequately explain significant events like the Dot-Com Bubble and the Global Financial Crisis. These models assume perfect information and homogenous expectations, ignoring the complexities of actual market behavior. Their failures stem from oversimplified assumptions and a neglect of prevalent behavioral biases—cognitive shortcuts that systematically influence investor decisions and deviate from purely rational choices. Consequently, mathematically elegant aggregate models miss crucial drivers of market fluctuations.

A nuanced understanding of markets requires moving beyond aggregate models to investigate how diverse and conflicting expectations shape collective outcomes. Exploring the distribution of beliefs and their propagation is essential for building realistic economic forecasts. Psychology, ultimately, explains more than equations ever will.

Beyond the Representative Agent

Traditional models often assume homogenous agents, limiting their ability to capture real-world market complexities. Heterogeneous Agent Modeling offers a powerful alternative, simulating markets as ecosystems of agents with differing beliefs, strategies, and information. This approach acknowledges that agents operate under both ‘Fundamentalist Expectation’—valuing assets based on intrinsic worth—and ‘Trend Following Expectation’—capitalizing on price momentum. The relative weight of each expectation varies among agents, creating a dynamic interplay that drives price formation.

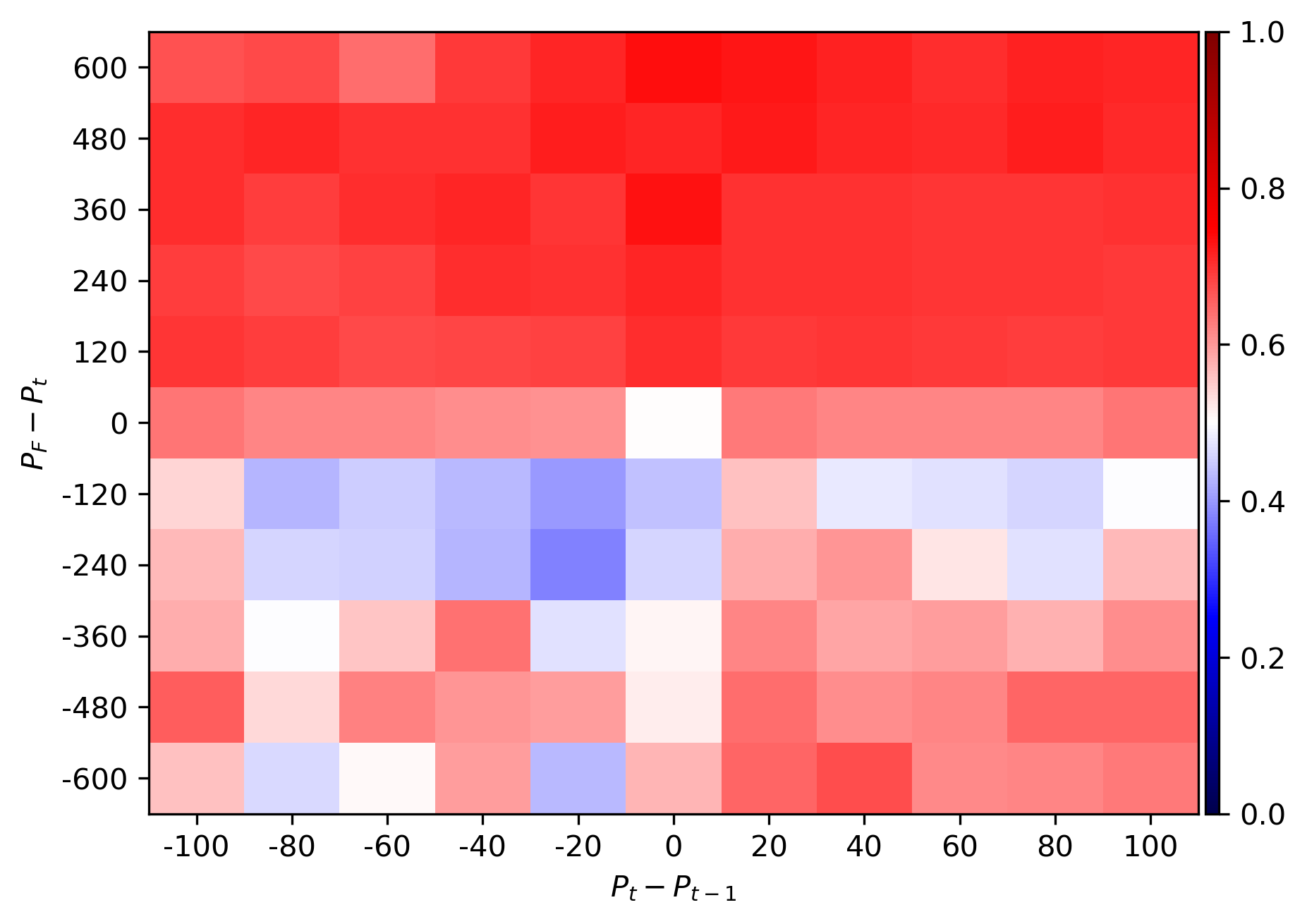

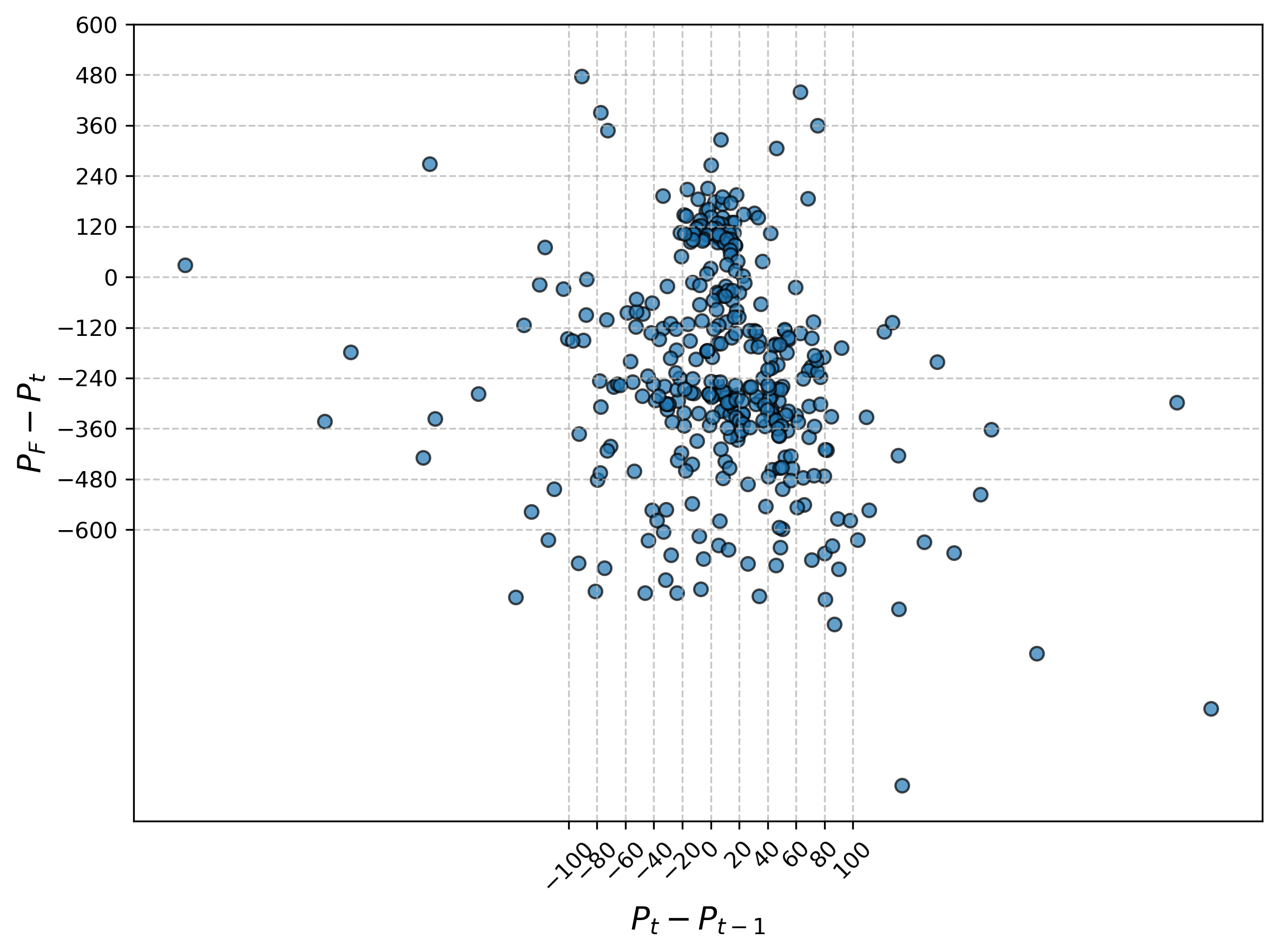

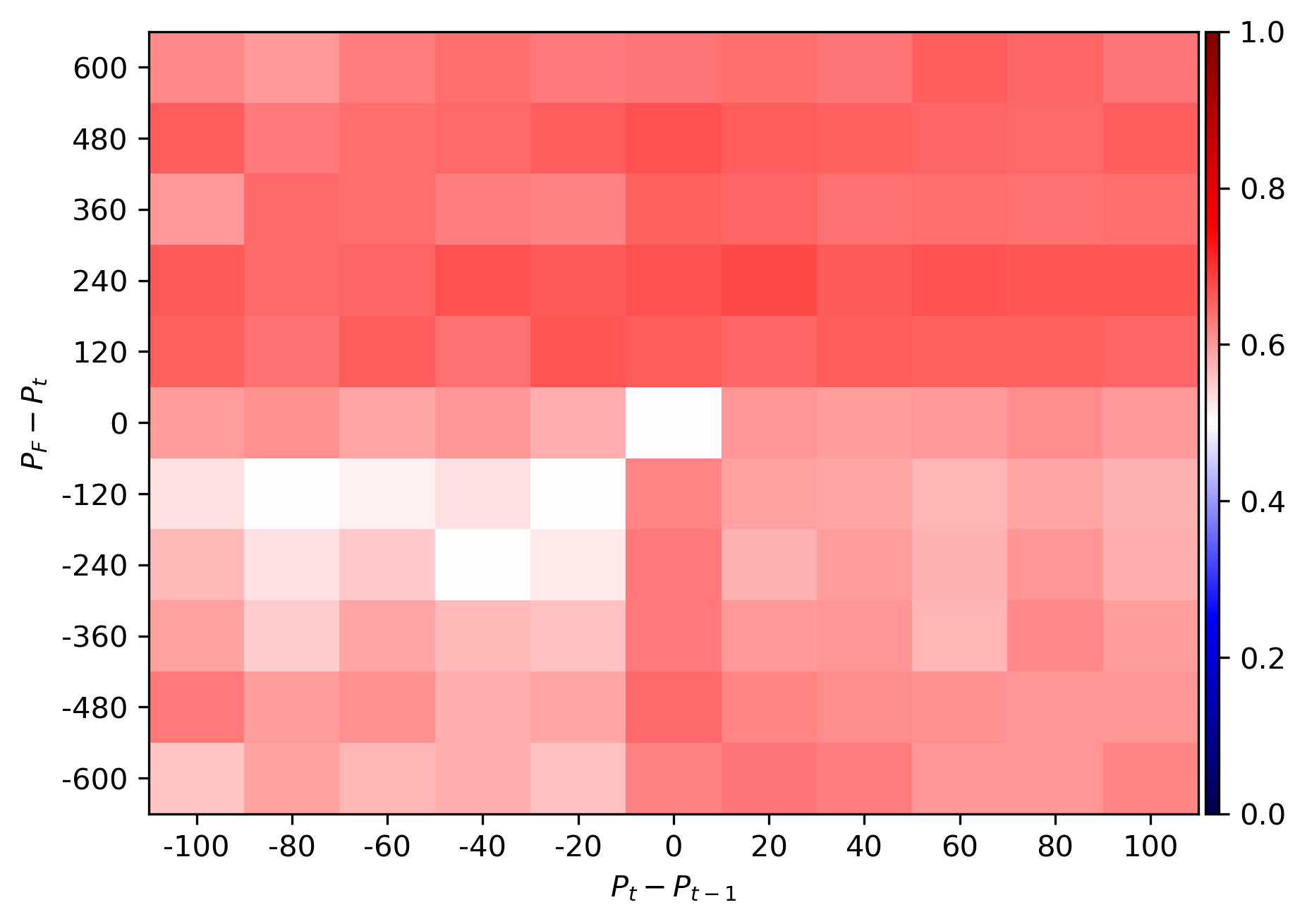

The model replicates key patterns in Heterogeneous Agent Models, exhibiting a preference for fundamentalist strategies when prices fall below fundamental values, introducing a stabilizing force. Parameters α and β govern the responsiveness of the fundamentalist strategy, influencing market volatility.

Simulating the Human Algorithm

This research leverages Large Language Models to create Generative Agents capable of forming expectations and strategies based on market data. These agents operate within a simulated market, allowing for the observation of emergent behavior and replication of observed patterns. The framework allows for controlled exploration of how diverse agent expectations shape market dynamics—a challenge often difficult to isolate in real-world financial analysis.

Investment decisions utilize Price Momentum and fundamental analysis, grounded in the Gordon Growth Model. This dual approach allows agents to exhibit both rational valuation and behavioral biases, mirroring the complexities of human investment behavior.

The simulation incorporates reaction parameters to control agent behavior. The reaction parameter (α) for fundamentalist agents remains between 0 and 1, while the reaction parameter (β) for trend followers exhibits both positive and negative values, demonstrating the ability to act as both pro-trend and contrarian agents. This parameterization allows nuanced control over agent responsiveness and exploration of varying market regimes.

The Fragility of Collective Belief

Simulations reveal that markets composed of agents with diverse expectations are susceptible to collective instabilities and, potentially, crashes—even when each agent’s individual expectations are internally consistent and grounded in rational decision-making. This volatility isn’t a consequence of irrationality, but an emergent property of complex interactions within the system.

This research challenges the exclusive reliance on ‘Rational Expectations’ theory as a comprehensive predictor of market behavior. While valuable under specific conditions, it fails to account for the dynamics introduced by heterogeneous beliefs and resulting feedback loops. The model demonstrates that even slight variations in anticipated future values can amplify, leading to significant price swings and systemic risk.

Understanding the interplay between heterogeneous agents provides policymakers with opportunities to develop more effective interventions aimed at promoting market stability. By recognizing the limitations of purely rational models and incorporating behavioral realities, it becomes possible to design regulatory tools and risk management strategies that better mitigate the potential for large-scale failures. Model results remained consistent across different language models and temperature settings, confirming the robustness of the findings. Perhaps markets aren’t seeking equilibrium—they’re simply seeking a comfortable story to tell themselves, and when that story frays, the numbers begin to tremble.

The study’s findings regarding LLM agents leaning toward fundamentalist behavior resonate with a deeper truth about predictive models. Humans, and by extension the systems they construct, rarely operate with perfect rationality. Instead, biases aren’t bugs – they’re the operating system of behavior. As Paul Feyerabend noted, “Anything goes.” This isn’t an endorsement of chaos, but an acknowledgement that rigid adherence to a single methodology can blind one to alternative, potentially more accurate, perspectives. The paper demonstrates that even these artificial agents, built on complex algorithms, exhibit predictable irrationalities, mirroring the human tendency to prioritize confirming evidence and resist disconfirming data – a core tenet of expectation formation in heterogeneous agent models.

Where Do We Go From Here?

The finding that Large Language Models stumble into fundamentalist tendencies within agent-based simulations isn’t exactly surprising. Humans aren’t rational actors; they’re emotional algorithms with predictable flaws. This work simply demonstrates that a sufficiently complex mimicry of human language also inherits those flaws. The models aren’t learning economic theory, they’re reenacting the cognitive biases baked into the data they were trained on. Expectation formation, it seems, is less about calculating optimal outcomes and more about confidently narrating a plausible past.

The real question isn’t whether LLMs can simulate heterogeneous agents, but what happens when those simulations scale. A few dozen agents exhibiting trend-following or fundamentalist behavior are interesting; millions might be catastrophic, or merely…boring. The limitations are clear: these models still lack genuine memory, embodied experience, or the capacity for true strategic interaction. They’re echoes in a cave, not players in a market.

Future work must move beyond simply observing behavioral patterns. The focus should shift to identifying the specific linguistic features that drive those patterns. What phrases, what rhetorical devices, reliably nudge an LLM towards irrational exuberance, or crippling fear? Because, ultimately, human behavior is just rounding error between desire and reality, and any model that ignores that is, well, fundamentally flawed.

Original article: https://arxiv.org/pdf/2511.08604.pdf

Contact the author: https://www.linkedin.com/in/avetisyan/

See also:

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- The Best Actors Who Have Played Hamlet, Ranked

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-11-13 10:16