Now, silver. A peculiar metal, wouldn’t you agree? Last year, it went absolutely bonkers, shooting up a whopping 144% – a proper rocket ride! It continued its antics into 2026, reaching a peak of over $120 an ounce on January 30th. Some folks treat it like a shiny safety blanket, clutching it whenever the world feels wobbly. Others see it as a useful thing – a bit of metal for making all sorts of gadgets.

Many, rather cleverly, choose the iShares Silver Trust (SLV +4.78%) as a way to own silver without the bother of digging a hole in the garden and burying it. It’s a sort of magical box that follows the price of silver, and you can buy and sell bits of it with a few clicks. Very convenient, if you ask me.

But here’s the rub. This magical box recently took a tumble – a rather nasty plunge of 38% in just a week! The silver rocket, it seems, has run out of puff. And history, my dear readers, has a habit of repeating itself, often with a mischievous grin.

The Silver Supply: A Curious Case

Silver isn’t quite as popular as gold for hiding your treasures, mainly because there’s a lot more of it kicking about. Miners are digging up about eight times as much silver as gold each year. Gold, you see, is a bit of a snob – too precious to be used for everyday things. Silver, on the other hand, is happy to get its hands dirty, appearing in all sorts of gadgets and gizmos. Nearly half of it ends up in electronics, which is rather clever when you think about it.

China, a land of clever inventors and even cleverer manufacturers, is the world’s second-largest exporter of silver, trailing only Hong Kong. They recently decided to put a bit of a squeeze on how much silver they let leave the country, which, unsurprisingly, sent the price soaring. They’re protecting their own supply chains, you see, and perhaps giving themselves a bit of leverage in negotiations with the likes of Europe and the U.S. A bit of a power play, if you ask me.

However, silver’s 2025 rally started long before December. Investors, jittery about governments spending money like drunken sailors, were piling into precious metals. And indeed, the U.S. government managed to rack up a deficit of $1.8 trillion during fiscal 2025, pushing the national debt to a record-breaking $38.5 trillion. A truly astonishing sum!

You see, metals don’t magically sprout revenue or earnings. But they do tend to hold their value when paper money loses its worth. There used to be something called the gold standard, which stopped governments from printing money willy-nilly. A sensible idea, really.

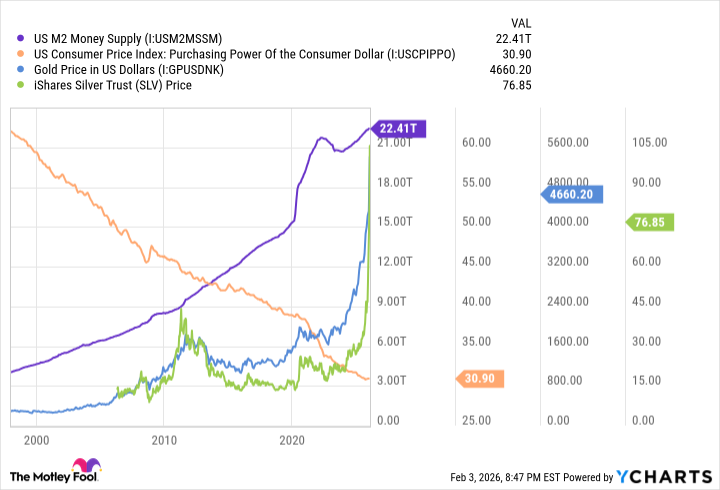

Since abandoning the gold standard in 1971, the money supply has exploded, and the dollar has lost about 90% of its purchasing power. So, gold and silver have naturally gone up in value – a bit of a revenge story, if you ask me.

A Tricky Path Ahead for Silver

The U.S. government is on track for another trillion-dollar deficit in 2026, so the conditions that sent precious metals soaring last year are likely to persist. However, remember that silver, being an industrial metal, is vulnerable to supply and demand shifts, especially when governments decide to meddle. As they did last December.

And let’s be honest, a 144% return in a single year is utterly ridiculous. Over the past 50 years, silver has only managed an annual return of 6.3%, woefully underperforming the S&P 500 stock market index, which climbed by 11.8% annually over the same period. A rather dismal performance, wouldn’t you say?

And here’s the worrying part. History suggests that silver’s recent 38% plunge might be just the beginning. In 1980 and 2011, silver experienced similar surges, followed by losses of 70% to 90% of its peak value. A rather unpleasant experience for those who bought at the top.

If you’d bought silver near its peak in 2011, you’d have been nursing a loss for a full 14 years before it finally hit a new high in 2025. So, if you’re thinking of buying silver today, be prepared for a very long wait and a bumpy ride.

The iShares Silver ETF is a convenient way to own silver without the hassle of storage and insurance. It does have an expense ratio of 0.5%, which means you’ll pay $50 a year for every $10,000 invested. But that’s almost certainly cheaper than storing physical silver, which, let’s face it, is a bit like guarding a pile of shiny trinkets.

Read More

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Gold Rate Forecast

- EUR UAH PREDICTION

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-02-06 23:03