Ah, silver-that mischievous sprite of the metals, the so-called “devil’s metal”-has once again pirouetted past the plebeian barriers of fiscal restraint, breaching the $64 mark per ounce with the audacity of a cat burglar in a moonlit museum. And yet, the crescendo of this metallic aria is far from its finale; analysts, those modern-day soothsayers, whisper of triple-digit fantasies as the world reappraises this lustrous rogue.

Silver’s Relentless Ballet: $64 and Counting, Darling 🎭✨

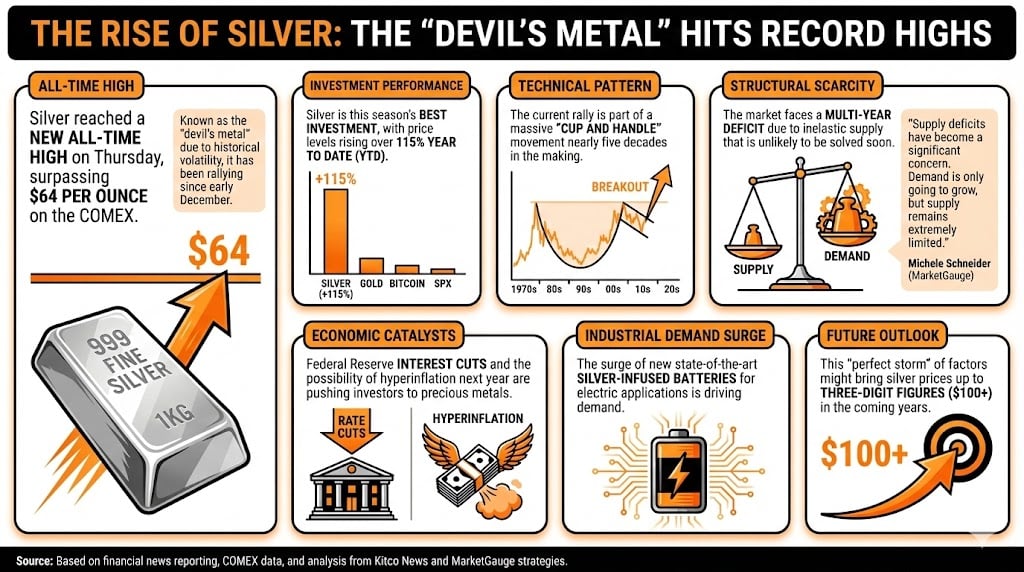

Silver, that volatile minx, achieved a new zenith on Thursday, surpassing $64 per ounce on the COMEX. Since its December awakening, this metal has been a prima donna, ascending despite the naysayers’ cries of “overbought!”-a term as tiresome as a Chekhovian protagonist’s existential sigh.

This season, silver has outshone even the most vaunted rivals-gold, Bitcoin, and the SPX index-with a 115% year-to-date surge. A cup-and-handle pattern, brewing for half a century, has finally spilled its secrets, much to the delight of those who worship at the altar of commodity markets.

The pundits, ever keen to dissect the entrails of this phenomenon, attribute it to structural whims-chiefly, a supply scarcity so stubborn it makes a Nabokovian narrator look decisive. The silver market, it seems, has been in deficit for years, a condition as intractable as a family feud in a Russian novel.

Michele Schneider, the oracle of MarketGauge, opines that silver’s current price is but a modest curtsy in a grand ballet. “It’s astounding,” she remarked to Kitco News, “that silver is not already waltzing at higher altitudes. Supply deficits are the drama queens of this narrative, and demand, my dear, is the insatiable diva.”

“Supply remains as elusive as a plot in one of my novels,” she might as well have added, with a wink and a flourish of her cigarette holder.

The Federal Reserve’s recent interest rate cut, coupled with whispers of hyperinflation, has sent investors scurrying to precious metals like moths to a flame. And let us not forget silver’s newfound stardom in electric batteries-a role as unexpected as a Lolita reference in a financial report.

In short, the stage is set for silver to pirouette into three-digit territory, a spectacle as dazzling as a Nabokovian metaphor on a summer’s day.

FAQ 🧐

- What recent milestone did silver achieve?

Silver, that sly temptress, reached a new all-time high of over $64 per ounce on the COMEX, continuing her December dalliance with destiny. - How much has silver’s price increased this year?

A staggering over 115% year-to-date, leaving gold, Bitcoin, and the SPX index in her glittering wake. - What factors are driving the rise in silver prices?

A supply deficit as chronic as a family curse and a demand surge fueled by electric batteries-a modern-day alchemy. - How could future economic conditions impact silver further?

With the Fed’s rate cut and hyperinflation looming like a Chekhovian gun, silver may well become the darling of the doomsday portfolio. 🌪️💎

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- Macaulay Culkin Finally Returns as Kevin in ‘Home Alone’ Revival

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Solel Partners’ $29.6 Million Bet on First American: A Deep Dive into Housing’s Unseen Forces

- Where to Change Hair Color in Where Winds Meet

- Hulk Hogan Dead at 71: Wrestling Legend and Cultural Icon Passes Away

2025-12-12 17:38