Silver, that cool, quicksilver metal – a mere ninety dollars or so per ounce, a price that feels almost apologetic for its inherent utility. Unlike its gilded sibling, gold, which largely concerns itself with the abstract notion of value, silver deigns to do things. It conducts, it reflects, it catalyzes—nearly half of its annual output finds itself conscripted into the service of industry, a decidedly pragmatic existence. One might almost suspect a touch of resentment towards the purely speculative fate of its more precious cousin.

The recent surge – a 144% ascent in the last cyclical year – was, predictably, fueled by a confluence of anxieties. Fears of supply constriction emanating from China, that vast and enigmatic workshop of the world, provided the initial impetus. But lurking beneath this immediate concern was the ever-present specter of economic and political instability—a rather tiresome refrain these days, wouldn’t you agree? Elevated inflation, profligate government spending, and a national debt that yawns like a geological fault line—these are not merely numbers on a spreadsheet, dear reader, but symptoms of a deeper malaise.

The iShares Silver Trust (SLV +5.89%), a convenient proxy for the metal itself, allows the investor to participate in this dance of speculation without the bother of secure storage or the insurance premiums that accompany tangible assets. A neat solution, certainly, for those who prefer the illusion of ownership to the reality. But will this particular performance encore? History, that capricious mistress, offers a few tantalizing clues.

The Ideal Conditions for a Further Ascent (and the Delusions That Sustain It)

Silver, while a precious metal, is not particularly rare. Eight times more is wrested from the earth each year than gold—a rather democratic distribution, wouldn’t you say? Gold sustains itself on the weight of tradition, on millennia of accrued symbolic meaning. Silver, however, is stubbornly, delightfully useful. In the last cyclical year, 58% of demand originated from industrial applications—electronics, solar panels, the relentless march of technology. Another 18% succumbed to the allure of jewelry, a rather frivolous expenditure, if you ask me. Only 16% was attributable to investors, those restless souls forever seeking a hedge against the inevitable.

China, that behemoth of manufacturing, is the world’s second-largest exporter of silver (after Hong Kong, a curious detail). Towards the year’s end, it announced restrictions on exports, a move ostensibly designed to protect domestic supply chains. A perfectly reasonable explanation, of course. But it also provides China with a rather convenient lever in its ongoing negotiations with other economic superpowers—a subtle game of geopolitical chess, played with ounces of silver. One suspects a touch of strategic calculation beneath the veneer of national interest.

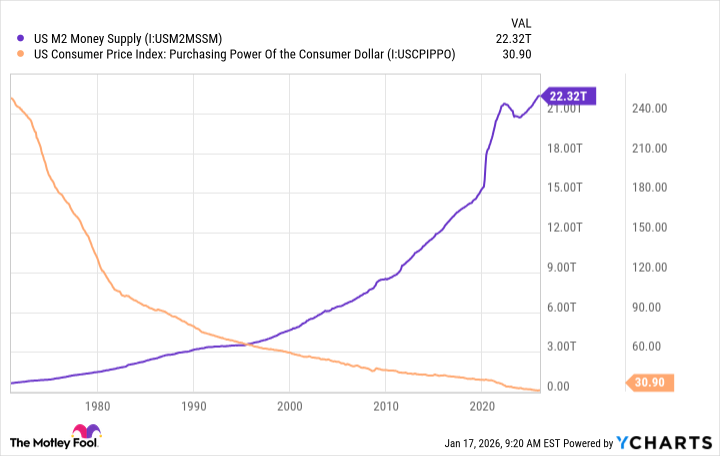

And then there’s the matter of currency. The United States, once anchored by the gold standard, abandoned that discipline in 1971, unleashing a torrent of fiat currency. The purchasing power of the dollar has, predictably, eroded—a 90% decline, to be precise. Thus, any asset priced in dollars—silver included—experiences a corresponding increase in perceived value. A rather elementary principle, yet so often overlooked in the frenzy of speculation. It’s a bit like inflating a balloon—everything appears larger, but the substance remains the same.

The U.S. government, in its infinite wisdom, managed a budget deficit of $1.8 trillion in the last cyclical year, pushing the national debt to a record-breaking $38.5 trillion. Another trillion-dollar deficit looms on the horizon, and investors are increasingly concerned that the only solution is to further devalue the dollar. Hence, the flight to precious metals—a rather predictable response, wouldn’t you agree? It’s a bit like rearranging deck chairs on the Titanic—a futile gesture, perhaps, but a comforting one nonetheless.

A Word of Caution: The Illusion of Perpetual Ascent

The bull case for precious metals remains, admittedly, intact. But those expecting another triple-digit percentage gain in silver might be advised to temper their expectations. Over the past half-century, silver has delivered a compound annual return of a mere 5.9%—a far more realistic target for the coming year. A rather pedestrian performance, perhaps, but a more sustainable one.

It’s also worth noting that silver is a rather volatile beast. Prior to the recent surge, it hadn’t reached a new record high in fourteen years, and it had suffered declines of over 70% on more than one occasion. I’m not suggesting a crash is imminent, but China possesses a considerable amount of leverage in this market. Should it decide to lift its export restrictions tomorrow, silver would almost certainly experience a sharp correction. A rather sobering thought, wouldn’t you agree?

Therefore, investors who wish to own silver should adopt a long-term perspective, smoothing out the inevitable volatility. The iShares Silver Trust, as previously mentioned, offers a convenient means of participation, eliminating the need for secure storage or insurance. It’s not free, of course. The expense ratio of 0.5% represents a small annual fee, but it’s likely cheaper than storing and insuring an equivalent amount of physical metal. A pragmatic consideration, wouldn’t you say?

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-01-20 21:32