With earnings season drawing near, it’s advisable for investors to scrutinize their investment portfolios and decide whether there’s more potential growth or if an upcoming news event might turn out unfavorably. This could be relevant for Apple (AAPL), as the general sentiment among investors has been cautious towards the stock, with valid reasons to back it up.

Despite most other stocks in the market recovering from their April and May lows, Apple’s stock has remained largely stable but still showing a decrease of around 15% for the year so far. I believe this lack of growth isn’t a sign of a bargain; rather, it could be indicative of future trends. Consequently, it might be wise to sell off shares before Apple releases its next quarterly earnings report on July 31.

Apple has failed to be an innovator lately

Apple requires minimal introduction – it stands as the foremost global leader in consumer technology, with countless individuals worldwide owning their innovative products. Yet, the market size for such products might be approaching saturation, given the existing population.

To put it simply, Apple hasn’t introduced any groundbreaking features lately, as was once common when people eagerly waited for annual iPhone updates. What we now see are mostly minor enhancements to the battery life and cameras, with fewer instances of significant innovation.

In terms of artificial intelligence advancements, Apple seems to be trailing behind its Android competitors, as Apple’s approach to AI, known as Apple Intelligence, hasn’t produced any significant or notable outcomes yet.

This observation points to a company leaning heavily on past achievements, and it’s clearly reflected in Apple’s fiscal reports.

Apple’s growth has been very slow recently

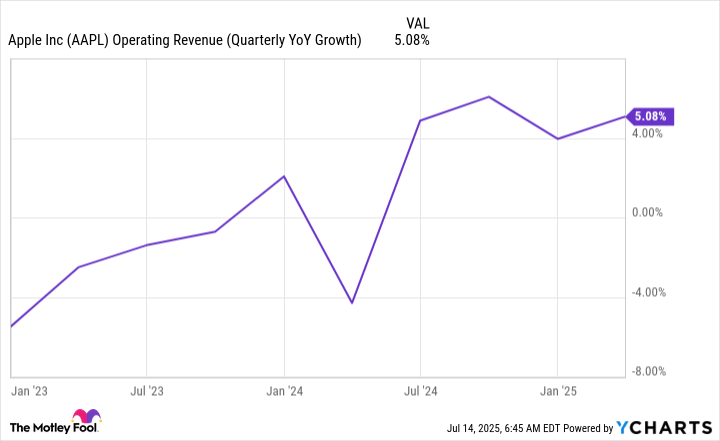

Apple’s revenue growth has been poor over the past few years.

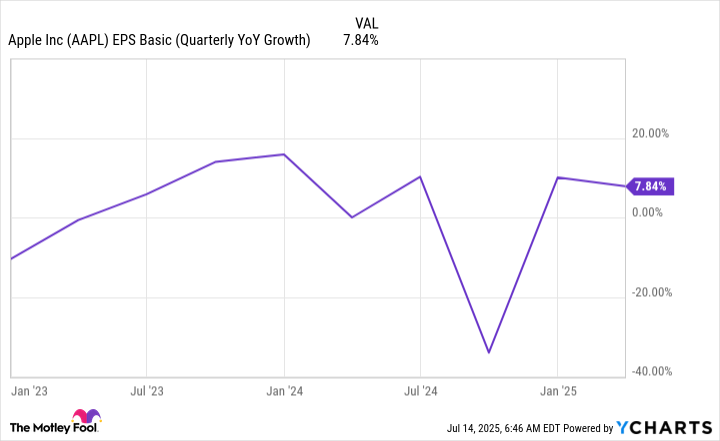

While Apple’s 5.1% increase in the last quarter appears impressive compared to previous quarters, it’s not a particularly strong position. For an established company like Apple, shareholders are more interested in Earnings Per Share (EPS) growth rather than revenue growth. By buying back shares and enhancing margins, Apple can accelerate EPS growth faster than revenue growth, but this strategy may also have its limitations in the long run.

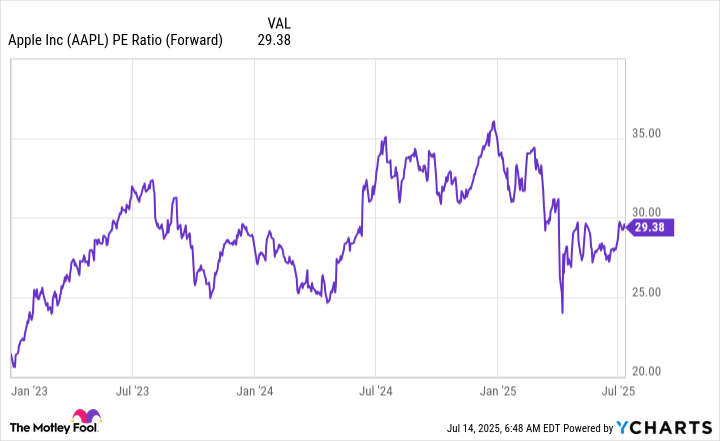

Over an extended period, I’ve noticed that Apple has consistently reported earnings per share (EPS) growth below 10%, which aligns with the market’s long-term average expansion rate. This pattern might imply that Apple could struggle to outperform the broader market in the future. Interestingly, despite Apple’s sluggish growth compared to the market average, its stock price remains significantly higher than the industry norm.

Even though Apple’s market value has decreased, it remains significantly pricier than the S&P 500, with its forward earnings ratio of 29.4 to 1, compared to the S&P 500’s 23.7 to 1.

As a dedicated investor, I find myself pondering over the intriguing possibility that the market might be overvaluing Apple’s shares. The upcoming third-quarter fiscal year 2025 earnings announcement on July 31 could very well function as a much-needed nudge for us investors. To put it simply, the past quarter hasn’t shown any significant growth spurts that would propel Apple’s sales, and with tariffs potentially narrowing its profit margins, the chances of the stock taking a dip are significantly higher than it surging upwards.

It might be wiser for investors to explore alternative investment opportunities, as Apple’s stock has experienced significant growth and high returns. However, it appears that numerous other stocks exhibiting more promising growth potential could be more attractive investments at this moment.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-07-19 12:08