The lights 가out happen, the modern world grinds to a halt. Without electricity, you’re stranded in a static hush. Supply lines, power plants, high-voltage arteries-it’s a complex network, a web spun by giants like Eaton. An industrial titan tasked with keeping the dark at bay, a player in the endless game of turning sparks into survival.

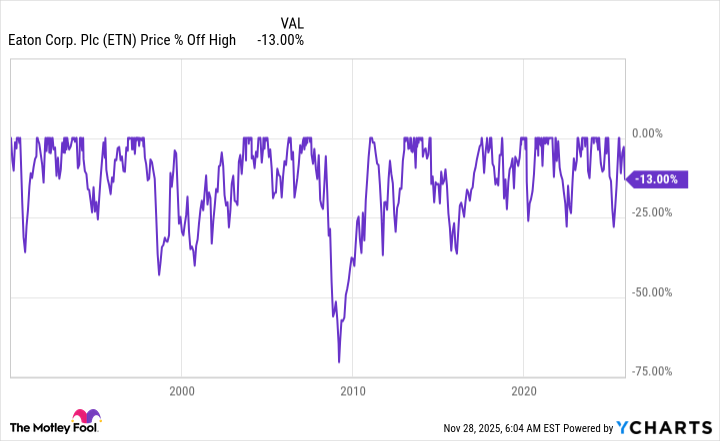

Right now, Eaton’s shares look like a vintage car-still shiny but a little ways from roaring back. Dropped about 13% from last year’s peak; is this a bargain or just another flicker of the market’s fickle mood? Here’s what the wise, and slightly cynical, need to see.

Positioned for Power – But Can It Deliver?

2012 was the turning point. Eaton bought Cooper Industries for a cool $13 billion-an acquisition that was supposed to change everything. The then-CEO called it transformational. That’s corporate code for “we’re betting the farm.” Cooper’s strengths in utility grids, smart tech, and safety gear were added to Eaton’s existing arsenal. A marriage made in industry heaven-only heaven’s got a dark side and patience is a virtue.

They didn’t stop there. Out went the hydraulic business-more cyclical than a drunk at closing time-and in came a streamlined operation, a leaner, meaner machine. Dividend growth paused, investors grumbled. The market’s a savage crowd-lukewarm one minute, hot on your tail the next. But good things take time, and Eaton was shaping up for the storm of demand coming in the next two decades.

Between 2000 and 2020, electricity demand nudged up 9%. Not a lot, just enough to keep the lights on. But from now to 2040? Expect 55% growth. Data centers, electric cars, artificial intelligence-each one a node in the network, each pulling at the grid like a gambler at a slot machine. Eaton spotted the trend early, even if the timing was a touch off; they gorged on foresight while the world was busy ignoring it.

The Price of Power – Is Eaton Worth the Ask?

Now, Eaton’s sitting pretty. It’s where it wants to be-diversified, global, riding a wave of power management that won’t crash anytime soon. Trouble is, Wall Street’s no fool. It’s priced the stock high-a premium for the future, a ticket that’s already been punched. Valuation metrics-price-to-sales, earnings, book-above their five-year averages. The market knows the drill. The march of progress, after all, isn’t cheap.

Recent decline? Just a blip, a hiccup in an otherwise rising tide. The stock’s dropped 13% from the peak-less a fall and more a stumble. Historically, Eaton’s no stranger to bigger dips-more than 25%, in fact. Earlier this year, the share price took a nosedive. The market’s a rough neighborhood, and Eaton’s used to riding the rough.

It’s a company that plays it smart, positioned for decades of industrial growth. But smart isn’t cheap-far from it. The recent dip, while notable, doesn’t turn the valuation into a steal. Most wise investors will keep it on their watchlist-an asset for the patient, the contrarian, those who understand that power doesn’t come cheap or easy.

Patience-The Last Asset

If you want in, wait. Watch the drops. When the crowd turns jittery-say, a 25% fall or more-it might be time to consider the raw steel of opportunity. But that’s where your nerve comes into play. It takes a steady hand, a quiet resolve, to buy when everyone else is running for the exits. The market’s a poker game-knuckle down now, and you might just be holding the winning hand when the cards turn in your favor.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- QuantumScape: A Speculative Venture

- ETH PREDICTION. ETH cryptocurrency

2025-12-02 19:18