One compelling reason to appreciate Pfizer (PFE) now is its substantial 7.1% dividend return, which significantly outperforms the S&P 500 index’s 1.3% yield and the average healthcare stock’s 1.7%. Even Merck (MRK), a Pfizer competitor, offers a dividend of more than 4%, but for income-focused investors, Merck may not be the optimal choice. Here’s why.

Pfizer and Merck have similar business models

In simpler terms, although Pfizer pays a significantly larger dividend compared to Merck currently, both offer appealing dividends at present. Given their similar roles within the pharmaceutical industry, one could argue that it makes sense to invest in the stock with a higher yield. This argument isn’t unfounded or illogical.

Fundamentally, these two industrial powerhouses specialize in pharmaceuticals. They don’t produce the same medications, but rather, they are dedicated to pioneering new groundbreaking drugs. Their primary goal is to develop blockbuster drugs that they can exclusively market until their patents expire. Both entities boast substantial and financially robust research and development sectors. Additionally, they have extensive global distribution networks and powerful marketing departments. Moreover, they possess the clout to acquire smaller companies with promising drug candidates, should the need arise.

For a while, you’ll notice variations in drug offerings between Pfizer and Merck. At certain points, Pfizer may have an advantage over Merck, while at others, Merck might be more favorable. As of now, the stock market, particularly Wall Street, seems to favor Merck due to its higher yields.

The problem with Pfizer is the dividend, not the yield

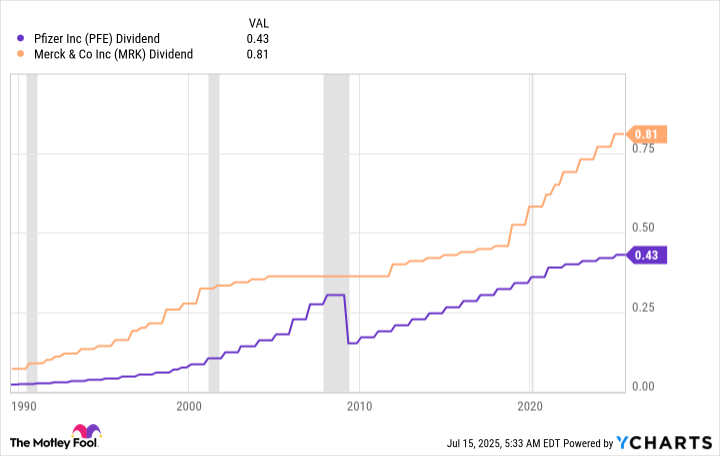

Currently, Pfizer and Merck both have a 15-year record of increasing their dividends consistently. However, about 15 years ago, there was a notable difference: Pfizer reduced its dividend, whereas Merck maintained its payout. As the chart illustrates, this is the key distinction between the two companies’ histories.

Back then, it’s clear that we’re referring to a period long past, and the business climate was significantly distinct. The reduction in profits, you may recall, occurred right during the Great Recession, a time when there was genuine apprehension about the potential collapse of worldwide financial structures. Interestingly, Pfizer made this cut while simultaneously undertaking a major acquisition.

While it might seem surprising given the current circumstances, Merck has managed to maintain its dividend payout rather than reducing it. In fact, this pharmaceutical giant has a history of significant acquisitions under its belt, with one notable instance being its substantial merger back in 2009.

To put it simply, for an income investor like myself, the prospect of no increase in dividends is far more appealing than dealing with a dividend reduction. After all, maintaining steady returns is always better than experiencing a decrease!

Why investors buy Pfizer and Merck

As a fellow enthusiast, if you’re like me, venturing into small pharmaceutical companies developing innovative products during the testing phase might seem like an uncharted territory. Frankly, my limited knowledge doesn’t extend far enough to decipher the intricacies of these companies or predict whether a new drug will receive approval.

Both Pfizer and Merck possess established collections of approved medications, providing a solid foundation for their research endeavors. They’ve consistently demonstrated their ability to conduct successful R&D to discover new drugs over time. If their drug pipeline appears weak, they have shown that they will acquire smaller pharmaceutical companies to strengthen it. In summary, investing in Pfizer and Merck allows you to own a significant stake in the pharmaceutical industry without requiring excessive time and effort to delve deeply into the drug business.

If you decide to rely on a company, it’s crucial to ensure that your faith in it extends beyond this single aspect. For instance, if you are a dividend investor, Pfizer’s reduction of its dividend during the severe 2007-2009 recession may not instill the same level of confidence as Merck’s consistently growing (though not every year), dividend. Generally, it would be prudent for most investors to lean towards choosing Merck over Pfizer in this case, considering the importance of trust and stability in a company.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-07-20 16:42