During the period spanning 2020 to 2021, lasting for two years, Pool Corporation‘s (POOL) stock experienced a significant increase of approximately 167%. This surge was likely fueled by an abundance of stimulus money in people’s pockets, low-interest rates, and a widespread desire to create personal backyard oases reminiscent of Xanadu.

Over the last few years, things have become significantly more challenging for Pool Corp., as their shares have dipped 14%. In 2025 alone, they’ve experienced a further drop of approximately 10%. Given that Pool Corp. is a recognized industry leader, is it advisable to purchase stocks at this lower price point?

Pandemic hangover

Worldwide, Pool Corporation functions as the biggest wholesaler of swimming pool equipment and supplies, and it ranks high among U.S. distributors for irrigation and landscaping products. With approximately 450 outlets spread across North America, Europe, and Australia, this corporation distributes over 200,000 items to around 125,000 wholesale clients. These customers are primarily pool builders and renovators, service providers, retailers, and landscaping professionals.

During the surge of pool sales caused by the pandemic, the company experienced record-breaking financial success. In 2022, their net sales reached a staggering $6.2 billion, which was almost twice as much as they made in 2019. Additionally, the diluted earnings per share (EPS) soared to an unprecedented $18.70, representing nearly a 200% increase compared to the EPS from 2019.

Over the last two and a half years, it’s been a humbling experience facing such high benchmarks. Sales dropped by 10% in 2023 and 4% in 2024. In the first quarter of 2025, we saw a 2% decrease in sales when comparing to the same period of time previously, considering the number of business days in the quarter.

Difficult competition isn’t the only issue we’ve been facing; rising inflation and increased interest rates have created a double problem for the pool industry. Predictions indicate that there were approximately 61,000 in-ground pools installed in 2024, a significant decrease from the 117,000 installed in 2021. In February, our CEO, Peter Arvan, mentioned that consumer spending on discretionary items needing financing continues to be a challenge.

A resilient business model

2024 was a remarkable year for me as a Pool Corp. enthusiast! Contrary to some assumptions, the company didn’t drown in pandemic-era profits; instead, it thrived. Last year, we raked in an impressive $5.3 billion in net sales. Interestingly, only 14% of those sales were from building new pools. The majority of our income, about 65%, came from areas like maintenance, repairs, and product replacements. This includes essential items such as water treatment chemicals, pumps, filters, and cleaning equipment. Clearly, the demand for these products remains strong, even during challenging times.

This consistent income stream allows Pool Corp. to navigate through fluctuations in the housing market and economy. Crucially, this spending is necessary and non-negotiable, as it ensures pools remain safe, clean, and operational. As time passes and more in-ground pools age, Pool Corp. anticipates a continuous demand for both necessary repairs and aesthetic enhancements – from updating worn-out pumps to renovating tiles, lighting, landscaping, and more.

Investments in digital systems by Pool Corp. are expected to boost the ongoing growth of their repair and maintenance sales. The Pool360 software suite empowers pool professionals to manage their businesses more effectively and enhance customer satisfaction. By using the Pool360 platform, builders, renovators, service providers, and retailers can easily place orders directly from Pool Corp.’s online marketplace, leading to increased sales of its proprietary chemical products.

For homeowners, Pool Corp. has unveiled the Regal and E-Z Clor mobile apps aimed at assisting in keeping pool water chemistry balanced. These apps are capable of interpreting test results from the water and diagnosing any issues that may arise, while also suggesting suitable products for resolution.

By expanding their collection of digital resources for both professional pool managers and consumers, Pool Corp. aims to strengthen their sales channels, foster customer loyalty, and boost sales of their high-profit internal products.

Fundamentals remain strong

Despite a significant drop of approximately 50% in installations of in-ground pools since 2021, Pool Corp. has consistently achieved annual sales exceeding $5 billion over the past four years, mainly due to robust earnings from their maintenance and repair division. In the first quarter of 2025, net sales amounted to $1.1 billion. The company forecasts full-year diluted EPS between $11.10 and $11.60 for the current year, which is slightly higher compared to the previous year’s figure of $11.30.

In 2024, Pool Corp. produced an operating cash flow of $659.2 million and retained a robust 11.6% operating margin. Equally significant is how this company uses its cash. Pool Corp. demonstrates strength in this area with its consistent history of reinvesting profits back into the business and distributing a substantial portion of capital to shareholders.

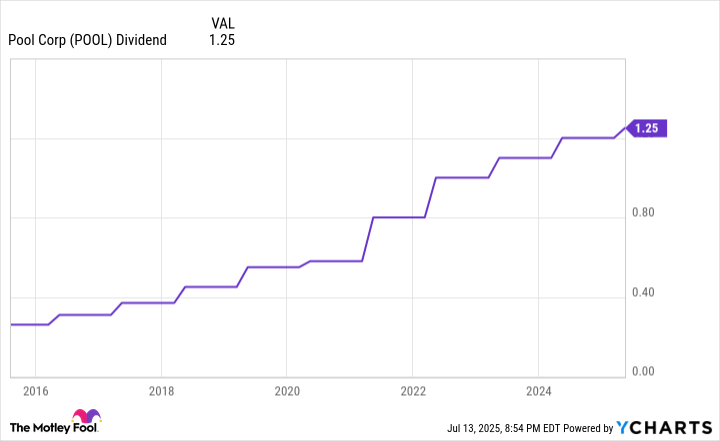

Ever since it went public, I’ve been thrilled to be a part of Pool Corp., knowing that over 46% of their cash flow – approximately $2.7 billion – has been invested in share buybacks. Additionally, they’ve dedicated about 21% to dividends. And just this past April, they boosted their quarterly dividend by an impressive 4%, upping it to $1.25 per share. As a shareholder, moments like these, where the company is actively investing in its own growth and rewarding its loyal investors, are what make the journey truly exciting!

Pool Corporation’s shares are currently trading at a forward price-to-earnings (P/E) ratio of 28, which is slightly lower than its average P/E of 29.6 over the past ten years. The company boasts a robust cash flow, expanding digital platform, and prudent capital allocation strategy that appeals to investors. Despite my concerns about the pool industry’s vulnerability to economic fluctuations, I find comfort in Pool Corporation’s consistent revenue stream, which acts as a balancing factor and lays a solid groundwork for growth during favorable market conditions.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- QuantumScape: A Speculative Venture

- 9 Video Games That Reshaped Our Moral Lens

- Elden Ring’s Fire Giant Has Been Beaten At Level 1 With Only Bare Fists

2025-07-18 01:23