On July 31st, one of the leading global corporations, namely Apple Inc., which is renowned for producing items like the iPhone, Apple Watch, Air Pods, among others, will release its earnings report for the second quarter of 2025. Over the past five years, this company’s stock has experienced significant growth; however, it has faced a challenging period in 2025, with shares declining by 14% year-on-year (YOY) primarily due to worries about decreasing expansion rates and tariffs imposed by the United States on various countries.

It appears that 2025 could mark a significant point in Apple’s journey as they explore fresh avenues for expansion. However, whether this calls for buying or selling the stock prior to their July 31 earnings isn’t straightforward. A definitive answer can be gleaned by closely examining the financial data.

Struggles to keep growing with peers

The iPhone, one of the world’s most financially successful products, is experiencing a maturity phase in terms of global sales each year. Although pricing power might enable it to achieve minor growth in the upcoming years, the increasing time between customer upgrades will present a persistent challenge for the product’s expansion. In recent times, new iPhone models have shown little technological advancement compared to their predecessors, which may discourage consumers from purchasing the latest devices.

Half of Apple’s total earnings come from the iPhone, and since its revenue hasn’t increased since 2021, Apple’s overall income has barely budged in recent years. They’re on the hunt for their next major computing breakthrough. Last year, they introduced the Apple Vision Pro, a $3,000 mixed reality headset, but it seems this product has been a disaster for them, with only a small number sold. Yes, their service sector is thriving, reaching a record $100 billion in revenue over the past year, but it’s not expected to significantly impact a company with a market cap of $3.1 trillion.

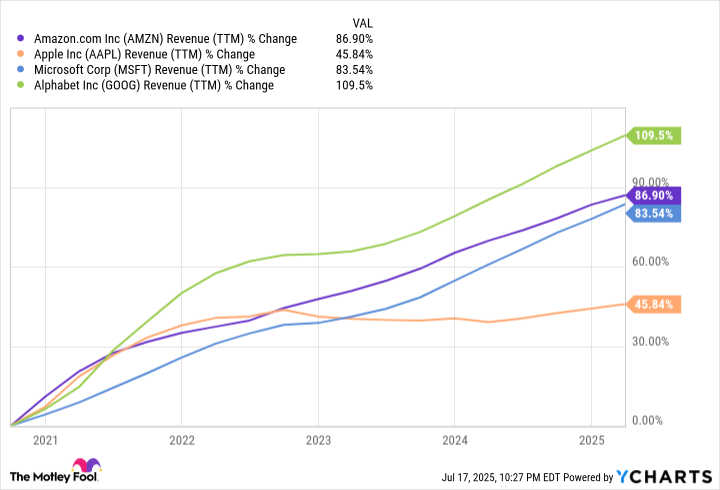

To propel Apple further in its industry, it requires a novel hardware device. Failure to do so could result in Apple lagging behind its major tech competitors. This is evident when comparing revenue growth over the past five years for Apple, Microsoft, Alphabet (Google’s parent company), and Amazon. While Apple’s revenue has increased by 46% since 2017 and hasn’t grown since 2022, Microsoft’s has risen by 83.5%, Amazon’s by 86.9%, and Alphabet’s by a staggering 109.5%. The other tech giants are outpacing Apple significantly.

Potential recovery in China

In China, Apple has faced challenges as local tech companies and smartphone manufacturers have been gaining ground against iPhones, leading to a decline in revenue since March 2022. Historically, Apple’s growth in China was significant, but this trend reversed recently. Interestingly, there are indications that the situation may be improving this year, with third-party analysts projecting an 8% increase in Apple’s revenue from China for Q2 compared to the same period last year.

Over an extended period, maintaining a positive outlook for Apple’s performance in China might prove challenging due to several factors. The Chinese government has launched the “Made in China 2025” initiative, which may lead to decreased demand for foreign brands like Apple. Despite Apple’s strong appeal in China, it faces significant hurdles when confronted with governmental policies such as this one.

Additionally, there is the ongoing trade dispute between the United States and China, a conflict that could potentially ensnare Apple given its substantial manufacturing presence in China. This potential entanglement poses a risk for investors considering purchases of Apple stock.

In other nations like India, which boasts a massive populace, some degree of revenue support might be observed. Yet, these markets account for just a minuscule fraction of Apple’s current sales, and their impact on the company’s overall financial statements won’t be noticeable for quite some time. Instead, it’s primarily North America and China that will fuel Apple’s growth in the foreseeable future.

Should you buy or sell Apple stock before earnings?

Currently, Apple’s stock price relative to its earnings (P/E ratio) stands at approximately 33 in the current market capitalization. This figure surpasses Apple’s historical norm, and it is also higher than some rapidly expanding tech competitors such as Alphabet, whose revenues are growing at a faster pace.

Moving forward, it seems challenging to identify factors propelling Apple’s growth beyond increasing iPhone prices and additional income from services. The company has yet to make a significant mark in artificial intelligence (AI), lacks a comprehensive cloud computing strategy, and has not demonstrated leadership in emerging computing paradigms. For the foreseeable future, investors may find themselves limited to the familiar Apple offerings – iPhones, computers, and accessories – with no major innovations on the horizon.

Despite being a top-notch global brand, it might be wise for investors to consider selling their Apple shares prior to the release of their Q2 earnings report. The potential for further growth with this stock seems limited at present.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-07-21 16:11