NIO Corporation, the Chinese auto manufacturer, is experiencing rapid progress and anticipates selling an impressive 450,000 vehicles this year – a significant increase over its sales from last year. Given this explosive growth trajectory, potential investors might be pondering whether it’s the right moment to invest in NIO Corporation.

As Nio surges in the electric vehicle competition, it encounters tough rivalry in its domestic market and must maneuver through the intricate web of international geopolitical conflicts. Given that the stock is trading below $5 ($4.47 at 9:30 a.m. ET on Monday), should investors consider buying? Let’s delve into the business and investment prospects that lie ahead.

Nio’s sales growth has been excellent

Nio consistently boosts its automobile shipments and broadens its market influence. In the past year, the company hit an all-time high with 221,970 vehicle deliveries, marking a significant 39% rise compared to the preceding year. Moreover, it announced sales of 72,056 units during Q2, signifying a 26% growth compared to the same timeframe last year.

One distinctive feature of Nio’s operations involves the provision of a battery-service model, catering to a frequently voiced worry among electric vehicle (EV) operators: extended charging times. By employing battery swapping technology at designated sites, Nio swiftly exchanges an empty battery with a fully charged one in mere minutes – typically between 3 and 5 minutes.

Using this system, customers can buy a vehicle with a lower initial cost and instead make regular payments over time. This arrangement benefits Nio as it provides them with a continuous income stream. Experts at Western Securities, a Chinese investment bank, predict that this aspect of Nio’s business could achieve profitability by the year 2026.

It faces some serious headwinds

In the fiercely competitive electric vehicle market, especially in China, Nio encounters substantial hurdles. Analysts have remarked that the battery electric vehicle industry within China is incredibly tough. This intense rivalry eventually influences Nio’s capacity to boost sales, preserve affordable pricing, and attain profitability.

In the first quarter, my observation shows that the company’s revenue didn’t meet expectations and fell below their own forecast. The main cause seemed to be lower product prices and a surge in promotions to clear out older Nio models, along with an increased number of sales from the Onvo brand, which caters to the mainstream family market. This shift, however, affected the company’s profit margins negatively.

Apart from the usual challenges, the manufacturer must navigate various geopolitical pressures as well. For example, recently, the European Commission has decided to impose duties on battery electric vehicles (BEVs) imported from China starting October 30, 2024, for a five-year period. This move stems from worries about significant financial aid provided to Chinese electric vehicle manufacturers through government subsidies. Furthermore, former U.S. President Joe Biden increased tariffs on Chinese EVs to 100%, while current President Donald Trump announced additional tariffs on goods imported from China.

Nio’s cost-cutting efforts

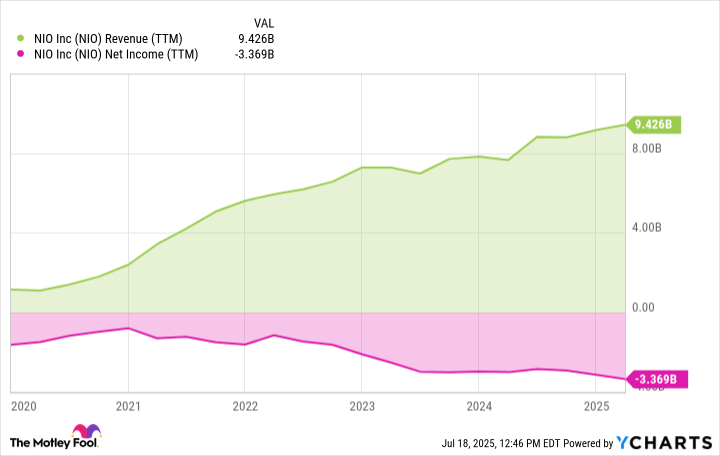

One point often raised as criticism towards Nio is its persistent financial losses. Since its beginning, the company has faced ongoing challenges in achieving profitability, largely due to its capital-heavy business structure that necessitates significant investments in research & development, expanding manufacturing capabilities, and developing power and service infrastructure.

Last year, Nio recorded a net loss amounting to approximately 22.4 billion Chinese Yuan or around $3 billion. In the first quarter of this year, their losses escalated to roughly 6.75 billion Chinese Yuan, which is equivalent to about $930 million. This marks a 30% increase compared to the same period last year.

The business is making efforts to boost its earnings, as evident in the first quarter where its vehicle profit margin rose to 10.2%, compared to 9.2% during the same period last year. Nio has implemented cost-cutting measures by decreasing expenditure, with restructuring and enhancing efficiency being key strategies across research & development, supply chain management, and sales & service departments.

Goldman Sachs has moved its assessment of the automaker to a neutral stance, attributing this to the firm’s cost reduction strategies and predicting an increase of 4%-10% in profitability within the next three years. In the future, Nio’s CEO William Bin Li remains hopeful that the company will reach profitability as early as Q4 2025, thanks to its focus on cutting costs and restructuring. The company aims to double its sales to 450,000 units, but Goldman analysts believe actual sales may be around 337,000.

Is Nio stock a buy?

In China, Nio is seeing a surge in growth, marked by higher delivery rates and increased revenue. The company stands out due to its distinctive battery-on-demand service, setting it apart from other players in the market. Yet, it encounters fierce competition within China and faces challenges posed by geopolitical trade disputes.

At present, the stock’s price-to-sales ratio stands at 0.95. Those investors with a positive outlook for its future prospects and who are prepared to disregard geopolitical issues and intense competition might find it worthwhile to think about purchasing this stock at this price point.

In simple terms, the company’s persistent lack of profit and exposure to economic and political risks make it a challenging investment choice. Before buying, I would seek evidence of efficiency improvements, increasing market presence in China, and strengthening financial performance. Until these signs appear, many investors might prefer to look for opportunities elsewhere.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Why Nio Stock Skyrocketed Today

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- EUR UAH PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

2025-07-22 03:38