Eaton Corporation (ETN), a company once as unassuming as an electrical panel in your basement, has recently attracted attention from investors eager to catch a ride on the data center boom. But here’s the thing: Is the price tag on Eaton stock justified, or are we looking at a market misstep? Let’s unpack this, shall we?

A Shift in Perspective

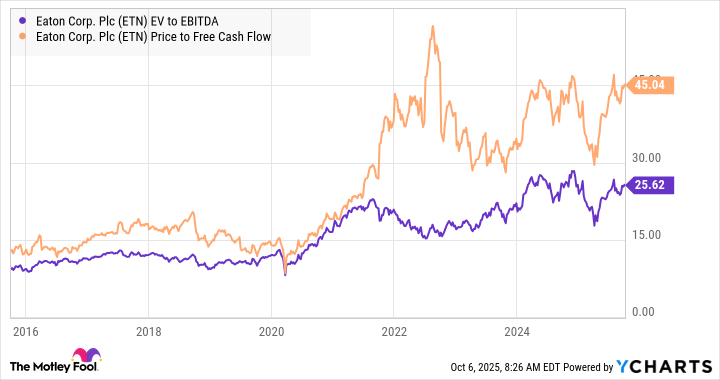

If you had asked a seasoned trader a few years ago about Eaton, you’d have likely heard something along the lines of, “Oh, they’re just your typical power and electrical company, reliable but not thrilling-sort of like a light bulb: bright, but not dazzling.” And, indeed, historically, these companies were valued as rather staid, almost sleepy, with growth forecasts barely nudging the GDP rate. Investors, perhaps looking for a bit of excitement, usually pegged them with an enterprise value to EBITDA ratio of around 11 or a price-to-free-cash-flow ratio of about 20.

However, something curious has happened. Over the past few years, investors have started paying far more for Eaton, and here’s why: The sleepy electrical company has found itself at the heart of something far more dynamic-the rise of data centers and AI-powered infrastructure. As we’ll see, this has resulted in a rather eye-opening valuation change, much like the moment when you realize your favorite pub is now a “hipster hotspot.”

Why Investors Are More Interested Now

What’s the reason behind this transformation, you ask? Well, for starters, Eaton’s growth rate has taken a sharp turn upwards. In 2019, its three-year average revenue growth rate was a humble 2.7%. Fast forward to 2024, and that number jumps to a rather impressive 8.2%. So, it’s not exactly a case of “hope springs eternal”-it’s more like “we’ve got data centers and artificial intelligence on our side.” Eaton’s revenue, particularly in North America’s data center market, is expanding rapidly. And data centers, it turns out, are a big deal, largely due to the insatiable appetite of artificial intelligence (AI).

Take a moment to reflect on this: AI, as we know it, requires massive amounts of data processing power, and where does that power come from? Yes, indeed, data centers. Eaton is positioned nicely in this ecosystem, as shown in the breakdown of their revenue by segment:

| Segment | Operating Profit 2022 | Operating Profit 2023 | Operating Profit 2024 | Share of Profit Increase From 2022 to 2024 |

|---|---|---|---|---|

| Electrical Americas | $1,913 million | $2,675 million | $3,455 million | 87.5% |

| Electrical Global | $1,134 million | $1,176 million | $1,149 million | 0.9% |

| Aerospace | $705 million | $780 million | $859 million | 8.7% |

| Vehicle | $453 million | $482 million | $502 million | 2.8% |

| eMobility | ($9) million | ($21) million | ($7) million | 0.1% |

The lion’s share of Eaton’s growth comes from its Electrical Americas segment, which now accounts for a hefty chunk of the company’s profits. In fact, this segment is expected to make up 17% of Eaton’s total revenue by 2025. And let’s not forget that Eaton is riding the “electrification of everything” wave, benefiting from robust demand in sectors like aerospace and defense. You can practically hear the hum of growth from industries all around the world. But the big question: Can this growth continue at such a feverish pace?

Is Eaton Stock Worth a Buy?

Let’s cut to the chase. Eaton’s growth narrative is convincing, with analysts predicting a 9% compound annual growth rate (CAGR) through 2027. That’s no small feat. Earnings, meanwhile, are expected to grow at a near 14% annual rate. As any trader worth their salt knows, that’s the kind of growth we all dream of-just don’t expect it to come wrapped in a bow.

But-and there’s always a “but”-there are a few things to consider. First off, data centers and utilities are expected to contribute a combined 28% to Eaton’s revenue in 2025. While data center spending has been red-hot, there’s no guarantee that the flames of AI-driven demand will continue to blaze indefinitely. A slowdown in data center growth could throw a wrench into the works, and investors will need to keep a watchful eye on that.

Secondly, Eaton’s eMobility segment, focused on electric vehicles, isn’t exactly a profit powerhouse at the moment. It’s expected to grow, sure, but for now, it’s operating in the red. Meanwhile, Eaton’s traditional vehicle business, which deals in internal combustion engine components, is expected to grow at a slower pace. This shift in automotive revenue could lead to margin pressure-something to keep in mind when evaluating the stock.

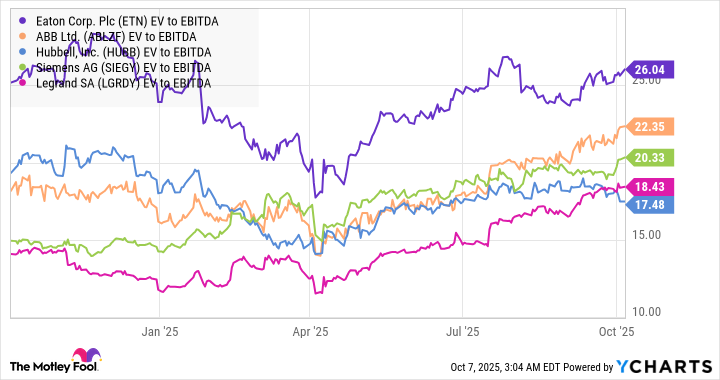

And then there’s the matter of valuation. With Eaton trading at an EV/EBITDA of 19 based on 2027 estimates and a price-to-free-cash-flow ratio of 28.6, it’s clear that the stock is priced for a rosy future. But is it really worth the premium? Or should investors consider a more dedicated data center play, like Vertiv, which specializes in that exact arena?

In conclusion, Eaton’s stock may not be a “bargain” at current levels, given its hefty valuation. But if you’re confident in the continued boom of data centers and the electrification megatrend, it might still have some room to run. Just make sure you’re not the last person to get off the train when it finally arrives at its peak station. 🚂

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-10-12 18:09