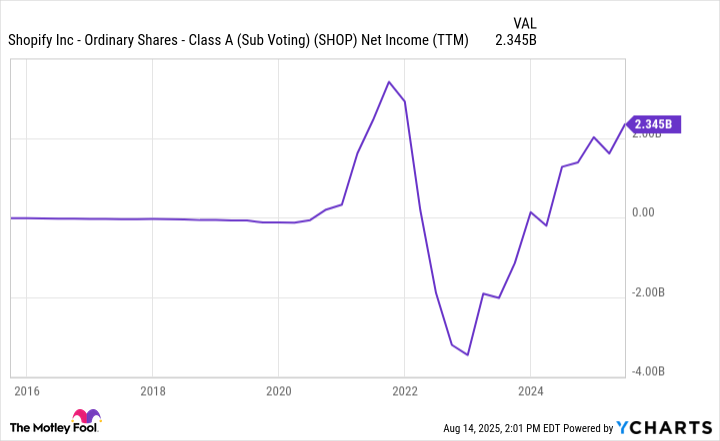

Shopify (SHOP) remains ensnared in the afterglow of its 2021 exuberance, its shares trailing by a rather modest 15% from the euphoric peaks achieved during the great stock market bubble of the pandemic. Oh, what a beautiful time it was when even the most mundane of stocks flirted with the impossible! A 100% rise in the past twelve months might paint a picture of a glorious resurrection, but alas, it has yet to reclaim its former zenith, after a savage ordeal in 2022. But let us not be hasty in our judgments-though the market has punished it, Shopify’s performance is rather unremarkable in its stability, adding fresh commerce tools and inviting more businesses to join its ever-expanding empire.

Now, the question arises-should you, in your infinite wisdom, bet on this stock in 2025? The numbers, they say, are rather revealing, though no stock is quite as enigmatic as the market itself.

Expansion, or an Embrace of the Inevitable?

Shopify, the software provider of our digital age, has already seized dominance in North America. But now, it sets its sights on the rest of the world. How very ambitious, I dare say. In the last quarter, growth in the European division’s payment volume rose by 42%, a figure that outstripped all expectations, including those of its most ardent supporters. Indeed, even the mighty Starbucks has bowed to the platform, a signal, no doubt, of Shopify’s formidable capabilities in the world of e-commerce.

Ah, but let us not confuse expansion with true innovation. Shopify’s revenue has risen by a stately 31% year on year, a rather impressive feat in a world where numbers often grow stale and predictable. Free cash flow margins remain admirable at 16%, which, in this crass and often unsophisticated market, is a cause for gentle applause. Yet, it is not growth alone that has driven this remarkable increase in stock value. It is, rather, the promise of more: new features, more businesses joining, and an inexorable march toward a future where Shopify may, if fortune allows, continue to thrive.

The Dance of Technology: AI, Crypto, and Innovation

And what of the future, you ask? Well, Shopify is far from content with merely existing-it seeks to conquer. Enter artificial intelligence. The company now boasts of two new services, Sidekick and Magic, which promise to elevate its offerings by assisting businesses in their quest for growth. Analyze trends, create content, refine products-ah, but isn’t this all a grand charade of perpetual improvement? A ploy, a ruse to deepen its entanglement with its clients, ensuring that they remain loyal, ever-dependent, and most importantly, profitable.

And if AI weren’t enough, Shopify has also embraced the very spirit of modern finance-cryptocurrency. With the acceptance of Circle‘s stablecoin, USDC, it opens a window into the realm of international transactions, where borders cease to matter and the flow of money becomes, dare I say, almost too easy. This, of course, will not only bolster Shopify’s revenue but cement its place in the global marketplace, where everyone is welcome to shop, pay, and transact at will.

So, the question becomes: is Shopify building an empire, or merely a gilded cage for businesses that dare to rely on its services? The breadth of its tools is vast, unparalleled, but one must wonder-at what cost? Ah, but for now, let us not concern ourselves with such petty matters. The future seems promising, provided they continue their march of innovation.

The Case for Caution: Should You Buy Shopify Stock?

Ah, Shopify-the darling of the moment, yet ever so elusive. It is indeed a fast-growing company, but growth alone does not justify the madness of an investor’s heart. Its revenue stands at a respectable $10 billion for the past year, with projections suggesting a growth of over 20% for the rest of 2025. But let us not forget that growth at such a pace cannot last forever-nothing is immune to the ravages of time, not even the might of Shopify.

Consider, if you will, the nature of exponential growth. As it extends indefinitely, it eventually seeks to consume all in its path, and no company, not even one as grand as Shopify, can absorb the entire global economy. So, while Shopify’s revenue may swell to $20 billion by 2030, the law of diminishing returns will eventually take hold. It is thus that I forecast a 15% growth rate for the next five years, bringing in $4 billion in net earnings. In short, the future is bright-but only for those with the patience to wait.

Yet, one must not ignore the cold, hard facts. Shopify’s market cap of $187 billion gives it a forward P/E ratio of 47. A most intriguing figure, yet one that suggests a degree of overvaluation-almost a case of feverish optimism that borders on the absurd. In light of this, it seems wise to approach Shopify with the caution it deserves, even as its stock has soared over the last year. The stock market, after all, is a game of patience, and patience, as Oscar Wilde once said, is a virtue that is far more becoming in the rarest of hearts.

In conclusion, dear investor, I leave you with this thought: The future of Shopify may well be golden, but its stock is far from a guaranteed treasure. Approach with caution, and remember-true wealth comes not from chasing the ephemeral, but from waiting for the inevitable.

🧐

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Games That Faced Bans in Countries Over Political Themes

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

2025-08-16 18:59