Now look, I love a good success story as much as the next guy – especially if the next guy owns beachfront real estate and hands out stock tips with his Mai Tai. There’s Amazon, that behemoth of online commerce, a company that’s climbed more than 300,000% since 1997, like a caffeinated mountain goat. The business just keeps getting bigger—9% top-line growth this year, 10% forecast for next. Jeff Bezos probably mails his own jaw-dropping numbers to himself just for the ego boost.

But as any expert in dividends (and, for that matter, Mel Brooks movies) will tell you, even the biggest fish eventually find themselves dodging smaller, scrappier fish with much sharper teeth. Enter, stage left (possibly tripping over his own shoes for comedic effect): Shopify (SHOP). This plucky Canadian outfit has done for e-commerce what sliced bread did for… well, unsliced bread.

Say Hello to Shopify (But Don’t Expect It to Pay a Dividend)

At its core, Shopify is the deus ex machina for digital shopkeepers. They’ll sell you websites, they’ll manage your shipping labels, they’ll help you pretend you understand SEO. It’s a platform that lets businesses—from fledgling Etsy-wannabes to grizzled retail pros—stand up their online shingle with a few clicks and a prayer to the Google gods. Today, Shopify quietly powers millions (yes, millions) of web stores. I know what you’re thinking—”Millions of stores? How many of them still sell fidget spinners?”

Yet, as a dividend hunter, let me give you the bad news up front: Shopify does not currently offer a dividend. (I checked under the mattress and between the couch cushions. Not a single dividend to be found. If only they shipped them with Prime!)

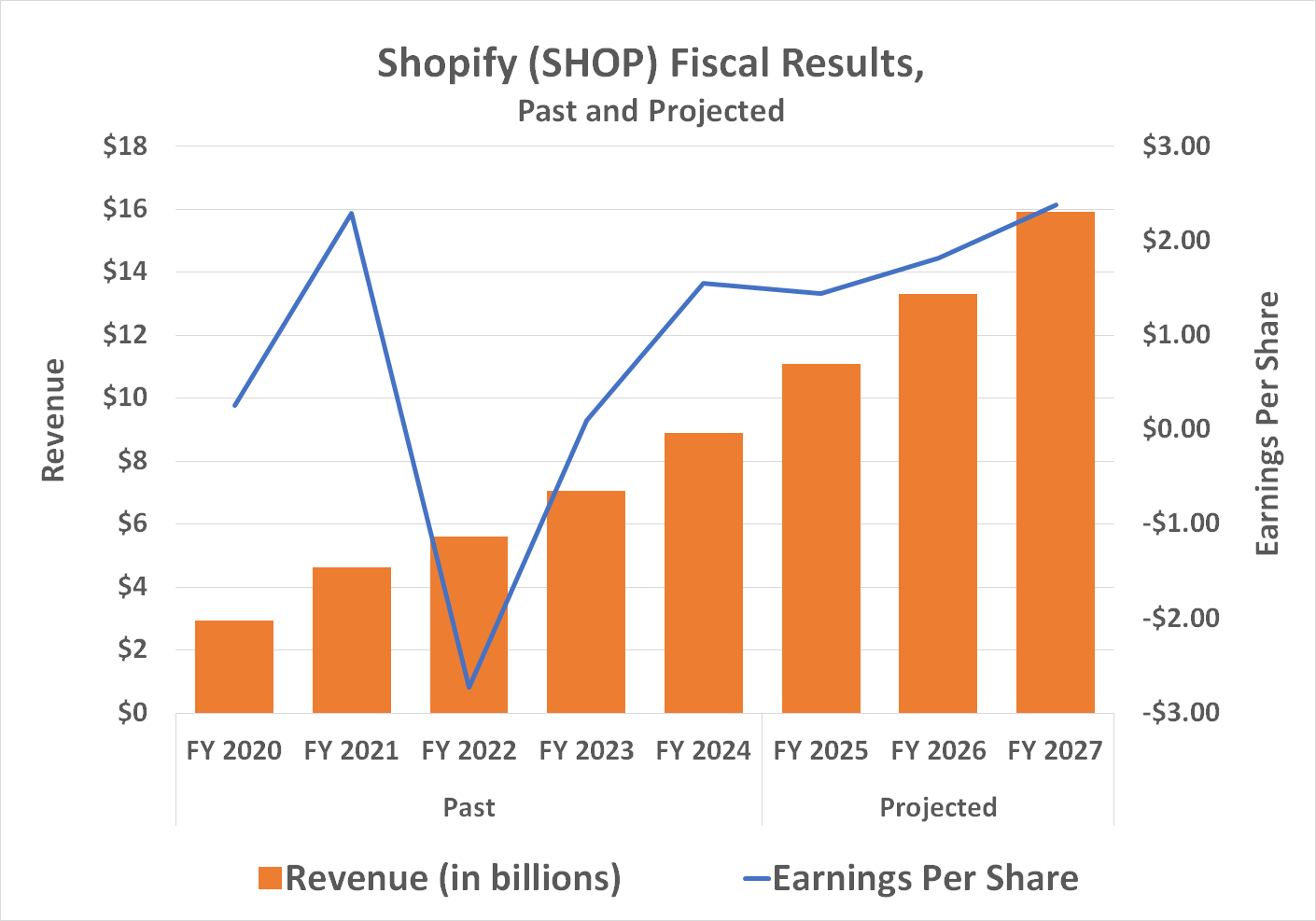

But wipe away those tears with your quarterly distribution statement—there’s more to life than just dividends. (Not much more, but humor me.) Shopify facilitated $292.3 billion in gross merchandise volume last year, which is basically a mountain of cash large enough to buy Luxembourg, or at least rent it for a weekend. Shopify’s revenue reached $8.9 billion, with operating income breaking the billion-dollar mark for the first time. To compare: Amazon hauled in $638 billion in sales and $59 billion in net income, so don’t worry—no one’s raiding the Seattle HQ with pitchforks just yet.

But for an investor like me, perpetually in search of companies that spit off cash like an overcaffeinated ATM, the hope is always that these numbers eventually lead to—you guessed it—dividends. Could Shopify one day line our pockets with actual payouts? Stranger things have happened (I once bought shares in a company called “Electronic Sprockets” and made a tidy sum. It went bankrupt two years later, but we don’t talk about that at dividend club meetings.)

Shopify: The Underdog’s Revenge (Or: Why the Small Guy Sometimes Wins)

Shopify’s backstory has all the trappings of a Mel Brooks setup: a couple of plucky entrepreneurs, a failed snowboard store, and an “Aha!” moment worthy of a Broadway number. Tobi Lütke and friends realized that most e-commerce tools were as user-friendly as a medieval chastity belt, so they built something better.

And here’s where we break the fourth wall (which, let’s face it, was already pretty wobbly): Shopify isn’t out to eat Amazon’s lunch, at least not yet. Instead, Shopify hands out lunchboxes to every merchant who’s tired of eating in the Amazon cafeteria. Amazon’s marketplace, you see, is efficient but colder than a February morning in Minnesota. The company pits sellers against one another, then charges them for advertising just to be noticed. Last year, Amazon’s ad revenue topped $56 billion—enough to keep Dr. Evil happy for at least a week.

Shopify, meanwhile, lets the little guy run his own show, with control over branding, storytelling, and customer relationships. Think “The Producers” but with slightly less singing and fewer lawsuits. Forrester research claims 70% of shoppers favor authentic brands. Turns out, customers like buying from humans, not algorithms—who knew?

Sellers on Amazon tend to lose their relationships to the big beast. With Shopify, the business actually gets to own that all-important customer data—email addresses, birthdays, possibly even their preferred pineapple-on-pizza status. It’s all up for grabs.

Diving in a bit deeper with my dividend monocle, the e-commerce platform market is booming—annualized growth of 12% through 2033, which is about as fast as a dividend hunter runs to the mailbox on ex-dividend day. Shopify commands 28% of the U.S. market. The odds that Shopify keeps growing like a musical number crescendo? Pretty darn good.

Valuation: Or, How I Learned to Stop Worrying and Love the Price Tag

Alright, let’s talk turkey, or at least something you could theoretically buy on Shopify. Valuation is, as the kids say, not cheap. Shopify trades at almost 90 times this year’s expected profits, 70 times next year’s. For reference, that’s more expensive than front-row tickets on Broadway, and the show isn’t even over yet.

Is that too steep for a dividend connoisseur like myself? Sure, my ideal company showers me with distributions like confetti at a wedding. But some businesses, much like Mel Brooks himself, are so loaded with opportunity you almost forgive them for holding onto their cash. Shopify’s price is high because folks expect the happy ending: big profits, maybe a dividend curtain call someday.

Now, here’s the plot twist—a strong economy means online shopping keeps growing. GDP growth, consumer spending, robust June sales: all these chorus lines sing the same tune. Maybe, just maybe, Shopify finally grows into an income-generating dynamo worthy of the dividend hunter’s nest egg.

So—should you forget Amazon? Maybe not. But keep an eye on Shopify’s act. If you’re lucky, you might just catch a surprise encore. And if you’re very lucky, a dividend. Until then, I’ll be waiting in the wings, calculator in one hand, bagel in the other. 🕺

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Top gainers and losers

- 9 Video Games That Reshaped Our Moral Lens

2025-08-04 03:09