January, 2026. The markets, they do what markets do. Up, down, mostly sideways if you look at it long enough. Shopify, this company that helps people sell things on the internet – a surprisingly robust business, when you think about it – is down 16% already. So it goes.

Now, some folks get rattled by that. A 16% drop. Like the world is ending. It isn’t. It’s just money rearranging itself. Shopify, they did pretty well last year. Crushed it, they said. But past performance, as the lawyers are so fond of pointing out, is no guarantee of future results. A comforting thought, actually.

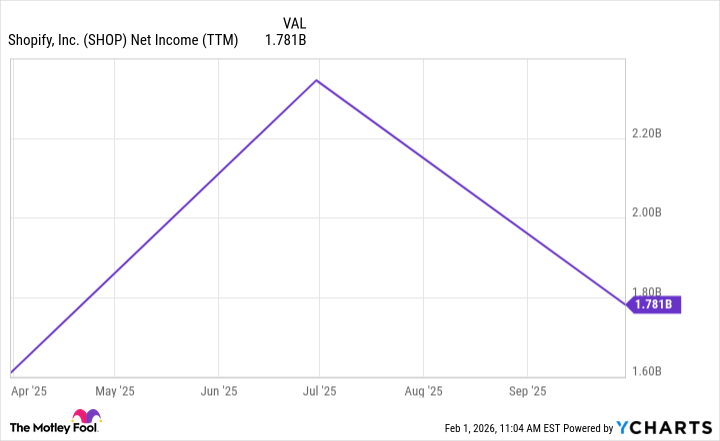

The business itself? Solid enough. In the third quarter, revenue jumped 32%. They moved $92 billion worth of goods. That’s a lot of stuff. People are buying things. Mostly things they don’t need, but who are we to judge? And they’re inching toward actual profit. Not a lot, mind you. An equity investment threw a wrench in things, but they’re not bleeding money like some of these other tech ventures. A minor miracle, really.

Here’s the rub. They want a lot of money for each share. 75.7 times forward earnings. That’s… optimistic. The sector average is a more reasonable 26.3. But reason doesn’t always apply when it comes to growth stocks. It’s all hope, really. Hope and a bit of desperation. So it goes.

A Closer Look, If You Have the Time

Shopify makes it easy for anyone to open a store online. That’s a good thing. It democratizes commerce, they say. It also means more competition. More choices for the consumer. Which is fine, I suppose. As long as you don’t think about the sheer volume of useless trinkets being shipped around the planet.

Is the valuation a problem? Probably. They haven’t been consistently profitable for very long, so those fancy metrics are a bit… unreliable. But the price/earnings-to-growth ratio is a respectable 1.1. Not terrible. And if you plan on holding the stock for a decade, which is a long time, valuation becomes less important. You’re betting on the future, not the present. A dangerous game, but what isn’t?

There will be volatility. There always is. Since their IPO in 2015, it’s been a bit of a rollercoaster. But e-commerce isn’t going away. People will keep buying things. Shopify will keep providing the tools. And the stock, well, it might go up. It might go down. So it goes.

A 16% drop this year? A perfectly reasonable entry point, if you’re feeling lucky. Or foolish. It’s often hard to tell the difference. Invest if you wish. Or don’t. The universe, as far as I can tell, won’t particularly care either way.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The Weight of Choice: Chipotle and Dutch Bros

- The Best Actors Who Have Played Hamlet, Ranked

2026-02-03 23:23