In a turn of events that could only be described as “well, that’s one way to do it,” Ondo Finance, the asset tokenization firm that’s been busier than a one-legged man in a butt-kicking contest, unveiled its very own Layer-1 (L1) blockchain, aptly named Ondo Chain, during the much-anticipated Ondo Summit.

Now, this revelation comes hot on the heels of the Ondo Global Markets announcement, which is a fancy way of saying they’re trying to make Real World Assets (RWA) as popular as a cat video on the internet. And let’s be honest, that’s quite a feat.

Ondo Finance Develops Layer-1 for RWA

According to the announcement, this shiny new blockchain is set to bridge the yawning chasm between traditional finance (TradFi) and decentralized finance (DeFi). Think of it as a financial Tinder, swiping right on regulatory compliance while keeping the blockchain’s open-access ethos intact. Swipe left on chaos, if you will.

Word on the street (or perhaps the blockchain) is that Ondo Chain has already attracted a gaggle of industry heavyweights. Financial institutions like Franklin Templeton, Wellington Management, and WisdomTree have donned their design advisor hats, adding a sprinkle of credibility and expertise to the project. It’s like having a celebrity chef in your kitchen, but with fewer soufflés and more spreadsheets.

Now, let’s not forget that public blockchains are currently struggling like a cat in a bathtub to meet the requirements of tokenized assets at scale. Ondo Finance has identified five major hurdles that are about as welcome as a mosquito at a picnic:

“Incompatibility with DeFi…fragmented cross-chain liquidity…high and volatile transaction fees…inadequate network security models…and institutional regulatory concerns,” the announcement read, sounding suspiciously like a list of excuses for not doing the dishes.

But fear not! The Ondo Chain is here to tackle these challenges head-on, introducing enhanced security features that allow validators to stake RWAs instead of native crypto tokens. It’s like trading in your old clunker for a shiny new sports car—less risk, more zoom!

And just when you thought it couldn’t get any more exciting, enter Donald Trump Jr., the surprise keynote speaker who added a dash of “wait, what?” to the Ondo Summit. Because nothing says “serious financial discussion” quite like a celebrity appearance.

“We’re delighted to announce our surprise closing speaker at the Ondo Summit: Donald Trump Jr! The future of RWAs in the US is bright, and new leadership has the potential to make the US the global center for crypto,” the network shared on X, which is still a thing, apparently.

His cameo underscores the growing political and regulatory significance of digital assets in the US market. Following the Ondo Finance L1 launch, World Liberty Financial (WLFI), the Trump family’s DeFi project, decided to splash out $470,000 on ONDO tokens. Because why not? That brings their total ONDO token stash to nearly $700,000—enough to buy a small island or at least a very fancy yacht.

“World Liberty Financial swapped 470,000 USDC to 342,000 ONDO 20 minutes ago. ONDO has dropped 15% in the past 7 days, but they seem very bullish on the altcoin, continuing to buy the dip,” Spotonchain reported, as if they were discussing the latest fashion trends.

Indeed, Ondo Finance’s powering token continues to trade with a bearish bias, which is a fancy way of saying it’s not having the best day. According to BeInCrypto data, ONDO price is down by almost 5%, trading for $1.35 as of this writing. It’s like watching your favorite sports team lose, but with more spreadsheets.

Nevertheless, the launch of Ondo Chain is pivotal for the network, which recently announced an ambitious initiative called Ondo Global Markets (Ondo GM). It’s like they’re trying to take over the world, one blockchain at a time.

Last week, they also revealed plans to launch a tokenized US Treasury fund on the XRP Ledger, signaling their broader commitment to expanding the RWA ecosystem across multiple blockchains. Because why stick to one when you can have them all?

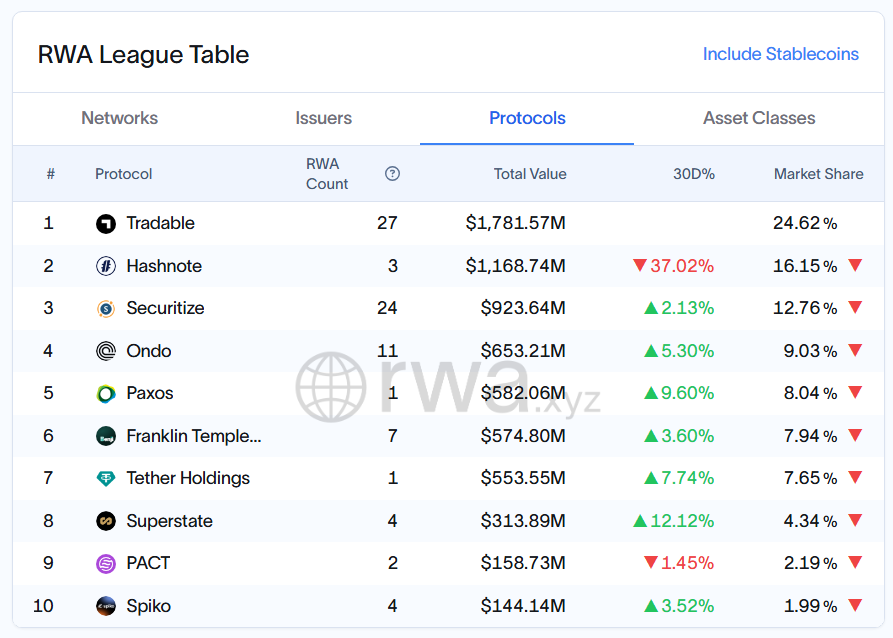

These developments suggest that Ondo Finance is making a serious play to establish itself as a major force in the RWA space. According to data on rwa.xyz, it ranks as the fourth-largest protocol in total RWA value, with over $653 million in tokenized assets. That’s a lot of zeros!

The overall RWA market is approaching $17 billion in value, which is about as much money as you’d need to buy a small country—or at least a very large pizza. Ondo Chain and Ondo GM initiatives could further accelerate this growth, making it easier for institutions to leverage blockchain technology for asset tokenization while maintaining compliance with regulatory frameworks. Because who doesn’t love a good compliance framework?

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Summer Game Fest 2025 schedule and streams: all event start times

- Elden Ring Nightreign update 1.01.1 patch notes: Revive for solo players, more relics for everyone

- ‘This One’s About You’: Sabrina Carpenter Seemingly Disses Ex-Boyfriend Barry Keoghan in New Song Manchild

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

2025-02-07 11:25