In a most curious turn of events, Chainlink’s blockchain protocol has taken the stage, facilitating a rather dapper simulated exchange between Hong Kong’s prototype central bank digital currency (CBDC) and an Australian dollar stablecoin, all in the splendid Phase 2 of the e-HKD+ Pilot Programme. Quite the mouthful, isn’t it? 🍵

Chainlink Pulls Off a Daring e-HKD to Australian Stablecoin Exchange in a Dazzling Test

Now, gather round, dear readers, for the Hong Kong Monetary Authority (HKMA) has embarked on a jolly initiative involving the likes of Visa, ANZ, Fidelity International, and ChinaAMC Hong Kong. They are testing cross-border transactions using tokenized assets, which sounds rather like something out of a science fiction novel, doesn’t it? The experiment revealed how our friends down under could acquire Hong Kong money market fund (MMF) units using either the e-HKD or tokenized bank deposits. Quite the financial escapade! 🏦

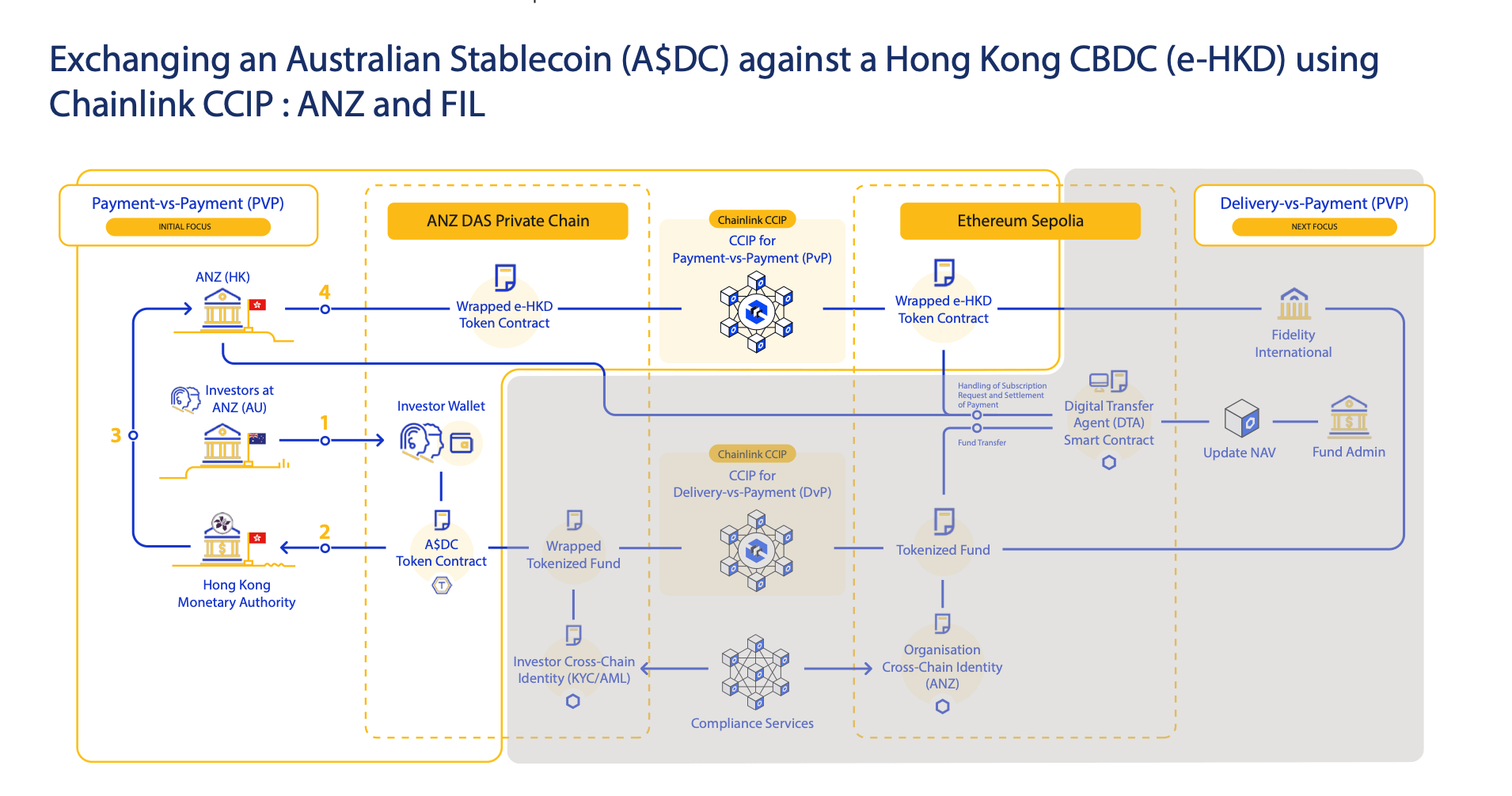

Our chums at Chainlink have employed their Cross-Chain Interoperability Protocol (CCIP) to connect ANZ’s private blockchain (DASchain) with the public Ethereum Sepolia testnet, executing the exchange with all the flair of a seasoned magician. This allowed for atomic settlement—yes, you heard that right!—where the Australian stablecoin (A$DC) and e-HKD were transferred simultaneously, reducing counterparty risk faster than you can say “Bob’s your uncle!” 🎩

In a rather riveting twist, pilot participants evaluated Ethereum‘s ERC-20 and ERC-3643 token standards for compatibility. The e-HKD, being the popular chap, used the widely adopted ERC-20 standard, while tokenized deposits opted for the more sophisticated ERC-3643, which comes with regulatory compliance features like identity verification. How very proper! 🎓

However, the test did shine a light on the interoperability challenges between public and permissioned blockchains. Financial institutions, being the cautious lot they are, typically prefer private chains for controlled operations but require public chains for broader asset distribution. CCIP’s messaging protocol, bless its heart, enabled cross-chain data transfer without the need for asset bridging. Quite the clever contraption! 🛠️

Looking ahead, the next stage of testing will assess end-to-end transactions, including those delightful MMF unit purchases. The outcomes aim to inform global standards for CBDCs, tokenized deposits, and settlement infrastructure. Results from further phases of this grand adventure are expected later in 2025. Stay tuned, dear friends! 📅

Read More

2025-06-09 19:27