So, it turns out that the recent $1.5 billion Bybit hack has catapulted the North Korean Lazarus Group into the elite club of Ethereum holders. Who knew that a breach could make you a crypto VIP? Talk about a plot twist! 😅

In a delightful chat with BeInCrypto, the brainiacs from Holonym, Cartesi, and Komodo Platform gathered to discuss the fallout, future-proofing strategies, and how to win back the public’s trust in Ethereum. Spoiler alert: it’s not easy! 🙈

A Different Kind of Breach

The Bybit hack didn’t just rattle the crypto community because of the jaw-dropping amount stolen, but also due to the sheer audacity of the breach. I mean, who needs private keys when you can just play with the transaction signing process? 🎭

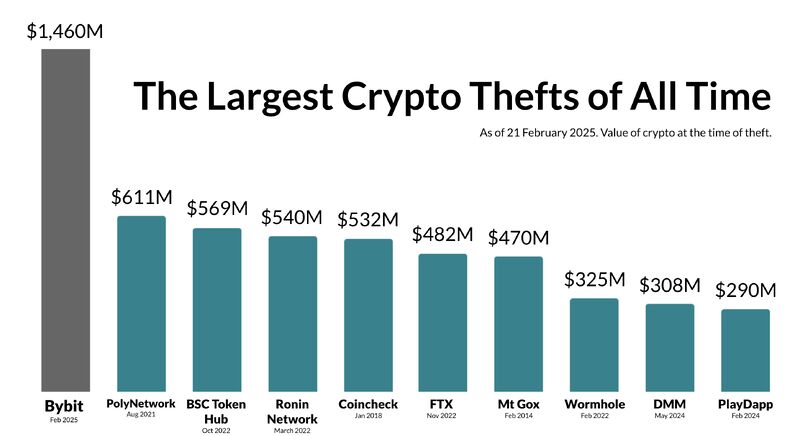

Unlike the classic crypto heists of yore, like the infamous Mt. Gox or Coincheck debacles, this one was a whole new ball game. The hackers didn’t bother with the usual methods; they went straight for the infrastructure. Talk about a bold move! 💪

Forensic sleuths traced the breach back to Safe Wallet, a multi-signature wallet service that apparently needs a serious security makeover. Who knew cloud-stored JavaScript could be so dangerous? 😳

By injecting some sneaky JavaScript into Safe Wallet’s AWS S3 storage, the hackers were able to reroute transactions like a bad GPS. So, while Bybit’s system wasn’t directly hacked, the hackers were still able to play puppet master with the transfers. Yikes! 😬

This little detail revealed a gaping security flaw. It’s like locking your front door but leaving the back wide open. Third-party integrations can be the Achilles’ heel, even for the most fortified exchanges. 🏰

Lazarus Group Among Ethereum’s Top Holders

And just like that, North Korea is now rubbing shoulders with the top 15 Ethereum holders. Who would have thought? 🤷♀️

According to on-chain data, Gemini, which used to hold the 15th spot, is now sitting pretty with 369,498 ETH. But wait! The Bybit hackers snatched over 401,000 ETH, so they’ve officially taken the crown. 👑

The fact that a notorious group like Lazarus now holds such a hefty amount of Ether raises eyebrows and trust issues galore. While some speculated that this was a sign of Ethereum’s decentralized nature crumbling, Nanak Nihal Khalsa, Co-Founder of Holonym, was quick to dismiss that theory. 🙄

He pointed out that Ethereum’s governance relies on validators, not just token holders. So, Lazarus owning a chunk of ETH doesn’t really shake the network’s decentralization. Phew! 😅

“Lazarus still owns less than 1% of ETH in circulation, so I don’t see it as highly relevant beyond simple optics. While it’s a lot of ETH, they still own less than 1%. I’m not worried at all,” Khalsa told BeInCrypto.

Kadan Stadelmann, the Chief Technology Officer at Komodo Platform, agreed, emphasizing that the real issue lies in Ethereum’s infrastructure design. It’s like building a castle on sand! 🏰🏖️

“It proves a vulnerability in Ethereum’s architecture: illicit actors could expand their holdings further by targeting exchanges or DeFi protocols, and thus wield an influence over market dynamics and possibly change governance decisions in Ethereum’s off-chain processes by voting on improvement proposals. While Ethereum’s technical decentralization has not been compromised, Lazarus Group has eroded trust in Ethereum,” Stadelmann told BeInCrypto.

But while token holders can’t sway Ethereum’s consensus mechanisms, they can definitely play the market like a fiddle. 🎻

Potential Impacts and Market Manipulations

Even though the Bybit hackers have already laundered their ill-gotten gains, Stadelmann laid out some potential scenarios for how the

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-03-11 17:33