Over the past week, there’s been a significant increase in large-scale Litecoin (LTC) transactions by whales, with these major investors amassing approximately 30 million dollars’ worth of Litecoins, which is more than 10,000 units.

The increased demand for purchasing coincides with heightened excitement about the possible debut of a Litecoin stock-based exchange-traded fund (ETF).

Litecoin Whales Fill Their Bags

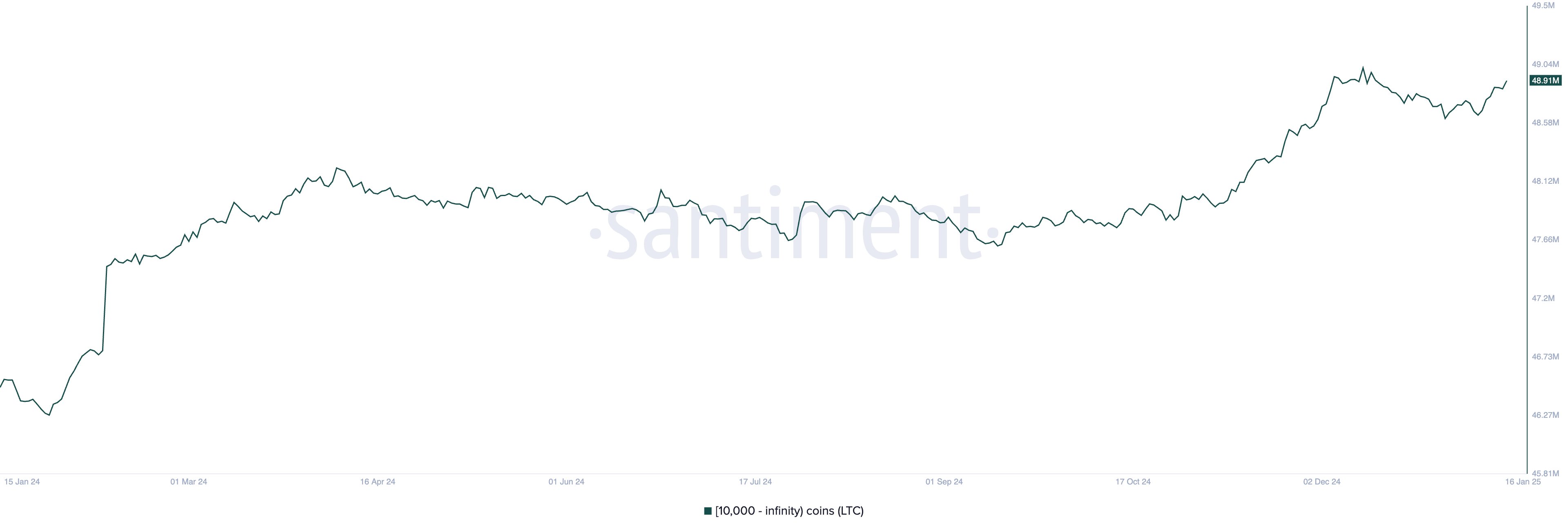

Based on Santiment’s data, over 10,000 Litecoin (LTC) owners (considered as large investors) have purchased approximately 250,000 LTC, equating to around $30 million at present market prices since January 9. This has increased their collective holdings to a record high of 49 million LTC in the past month, which is the largest accumulation seen in the last 30 days.

The increase in whales holding Litecoin (LTC) has sparked an upward trend in its value. Currently trading at $117.55, the cryptocurrency has experienced a 15% rise over the last week.

As a crypto investor, when I see whales increasing their coin purchases, it’s a sign they have faith in the asset’s future growth. This action decreases the available supply, which typically drives up the price due to increased demand. Often, this trend encourages me and other smaller investors to invest as well, following the lead of these larger players.

The ongoing surge in LTC is being driven by increasing hopefulness about the possible authorization of a retail Litecoin exchange-traded fund (ETF) in the United States. On January 15, Canary Capital submitted an update to their S-1 registration form with the Securities and Exchange Commission (SEC), suggesting advancements towards this approval.

On X’s post, James Seyffart from Bloomberg expressed that the amendment suggests the Securities and Exchange Commission (SEC) is actively examining the proposal. Moreover, Eric Balchunas from the same platform mentioned that recent reports indicate the SEC has offered feedback on the Litecoin S-1, boosting optimism regarding the ETF’s potential approval chances.

Balchunas wrote, “This seems to support our assumption that Litecoin is probably the next cryptocurrency to receive approval.

LTC Price Prediction: Can It Break $124 Resistance and Reach $147?

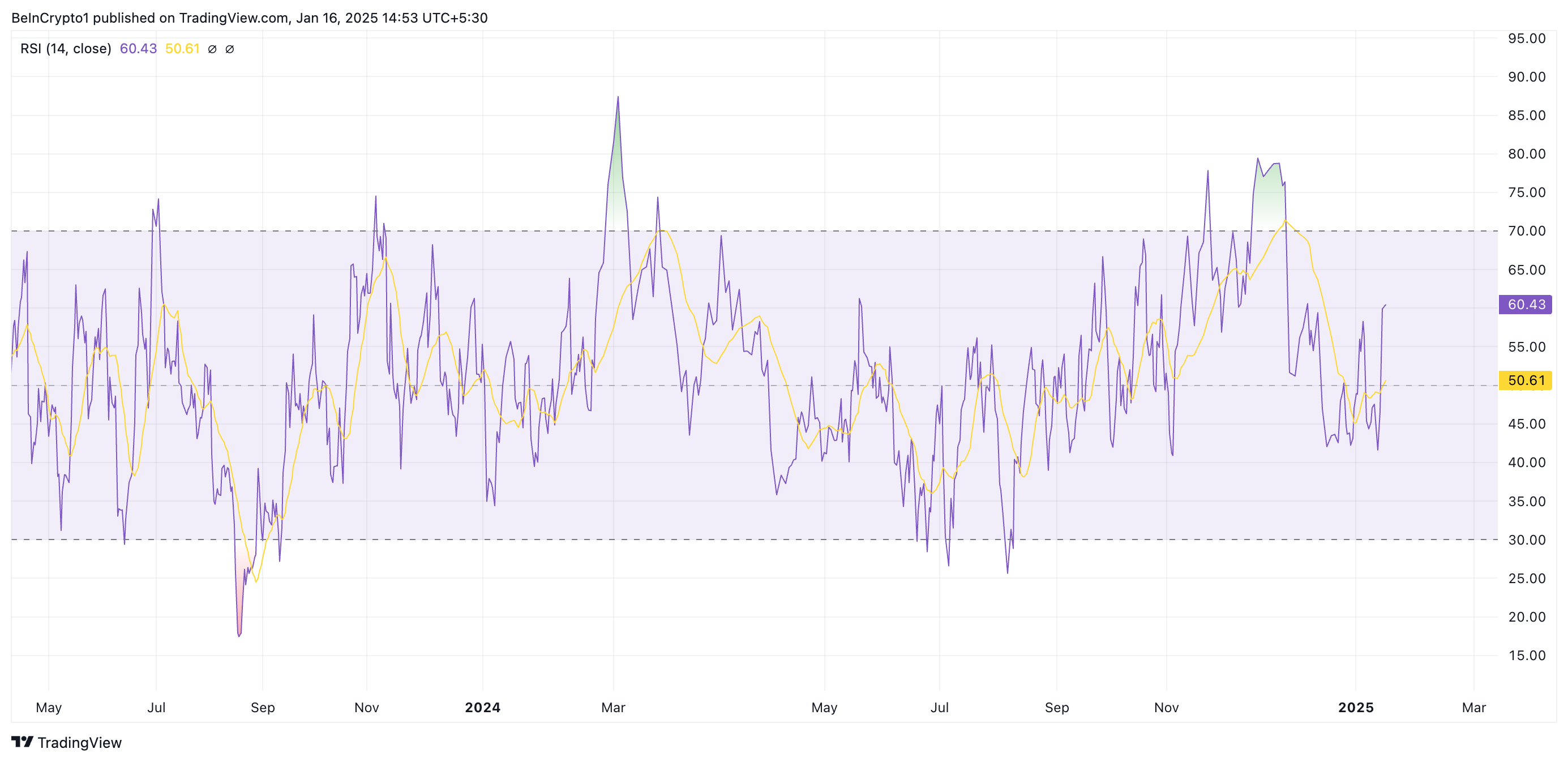

On a day-to-day scale, the Relative Strength Index (RSI) of LTC indicates a growing interest in the altcoin. Currently, it’s showing an upward trend at 60.43.

This indicator for momentum in the market shows when an asset is either overbought or oversold based on its current conditions. It has a scale from 0 to 100, with figures exceeding 70 meaning the asset is considered overbought and might need to correct itself. On the other hand, values below 30 imply that the asset is oversold and could potentially experience a recovery.

At 60.43 on the Relative Strength Index (RSI), LTC appears to be experiencing a strong upward trend, as buying activity outweighs selling activity. If this trend persists, LTC’s price may exceed the resistance point at $124.03, potentially returning it to its three-year peak of $147.

But should the whales pause their accumulation and selling resumes instead, the LTC price might decrease to approximately $109.81.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- SD Gundam G Generation ETERNAL Reroll & Early Fast Progression Guide

- Jurassic World Rebirth: Scarlett Johansson in a Dino-Filled Thriller – Watch the Trailer Now!

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- How a 90s Star Wars RPG Inspired Andor’s Ghorman Tragedy!

2025-01-16 19:37