It is a habit amongst those who observe the markets – a rather understandable one, I confess – to scrutinize the movements of capital guided by individuals of established acumen. Peter Thiel, a figure whose early discernment has demonstrably shaped the technological landscape, naturally attracts such attention. He is, after all, a co-founder of PayPal and Palantir Technologies, and possessed the foresight to recognize the potential within Facebook – now Meta Platforms – in its nascent stages. To witness a shift in his portfolio, therefore, is to observe a subtle recalibration within the larger currents of investment.

Through the mechanism of Form 13F filings – a quarterly accounting of holdings exceeding $100 million, mandated by the Securities and Exchange Commission – we gain a fleeting glimpse into the strategies of such funds as Thiel Macro. It is a necessary transparency, allowing those of us engaged in the more deliberate study of equity to interpret the signals – often faint, and always subject to revision – that these movements convey. Recently, a notable alteration has occurred. Mr. Thiel has divested entirely from Nvidia, a company long considered the very engine of the current artificial intelligence fervor, and redirected his resources towards two established titans of the technological realm.

Nvidia’s Ascendancy and the Weight of Expectation

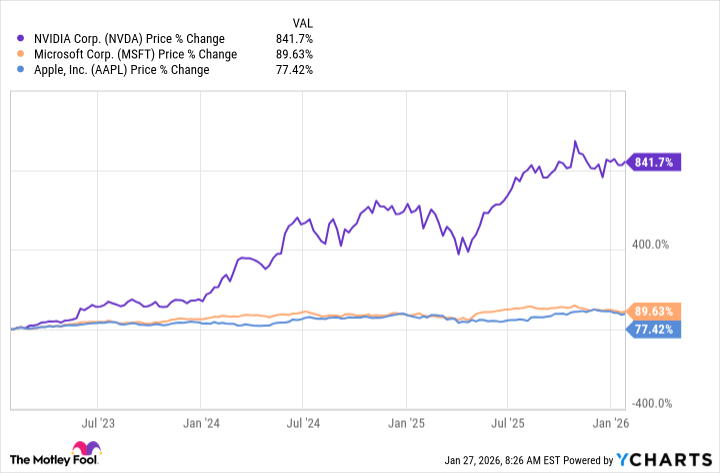

To understand the significance of this shift, one must first acknowledge the extraordinary ascent of Nvidia. For some time, the company has been perceived – and with considerable justification – as the principal beneficiary of the burgeoning AI revolution. Its graphics processing units (GPUs) – the essential components powering the development and application of artificial intelligence – have consistently outperformed those of its competitors. The resulting financial gains have been, quite simply, remarkable. Last fiscal year alone, revenue surpassed $130 billion – a sum that speaks volumes about the prevailing enthusiasm. The stock, predictably, has followed suit, achieving growth that, while impressive, carries with it a certain weight of expectation.

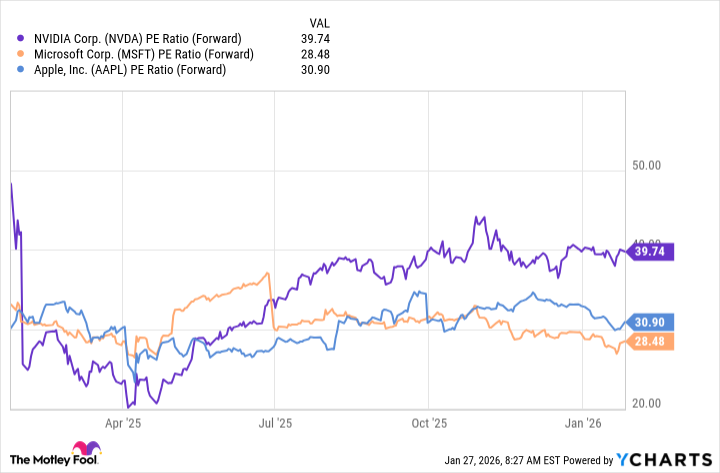

Nvidia’s commitment to annual chip updates further solidified its position, promising continued leadership. Analysts predict an AI market exceeding $2 trillion by the start of the next decade – a vast expanse of potential growth. Yet, such exuberant projections inevitably cast a long shadow, and it is often in the aftermath of such rapid ascent that the true character of a company is revealed. Mr. Thiel’s decision, therefore, appears less a rejection of Nvidia’s capabilities and more a reassessment of its valuation within the broader context of the market.

A Rotation Towards Established Ground

The capital released from Nvidia has been allocated to two familiar names: Microsoft and Apple. Mr. Thiel acquired 49,000 shares of Microsoft, now comprising 34% of his portfolio, and 79,181 shares of Apple, accounting for a further 27%. This is not, one suspects, a simple pursuit of greater returns, but a deliberate shift towards companies possessing a more diversified revenue stream and a more established presence in the technological ecosystem.

It is as if Mr. Thiel, having observed the initial surge of enthusiasm surrounding Nvidia, has chosen to reposition his holdings in companies that offer a more enduring foundation – a solid ground upon which to navigate the inevitable fluctuations of the market. He has, in essence, traded a stake in the vanguard for a share in the established guard.

The Burden of Dependence

It is important to recognize that Nvidia’s growth is, to a greater extent than that of Microsoft or Apple, inextricably linked to the success of artificial intelligence. While this has undoubtedly fueled its recent performance, it also introduces a degree of vulnerability. Microsoft, with its diverse portfolio – spanning software, cloud computing, and a host of other ventures – possesses a resilience that Nvidia, focused as it is on a single, albeit potent, technology, cannot match. Apple, while a more recent entrant into the AI arena, benefits from a vast and loyal customer base, providing a buffer against potential setbacks.

Mr. Thiel’s maneuver, therefore, is not a condemnation of Nvidia’s capabilities, but a prudent diversification – a recognition that even the most promising technologies are subject to the vagaries of fortune. It is a move that speaks to a seasoned investor’s understanding of risk – a quiet acknowledgement that even in the midst of innovation, the enduring qualities of stability and diversification remain paramount.

Whether one should emulate Mr. Thiel’s actions is, of course, a matter of individual judgment. For the cautious investor, or those concerned about the potential for an AI-driven bubble, Microsoft and Apple offer a sensible and secure harbor. But for those with a greater appetite for risk, and a belief in the transformative power of artificial intelligence, Nvidia may still offer the potential for substantial gains – a gamble, perhaps, but one that could yield a considerable reward.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- QuantumScape: A Speculative Venture

- Is Taylor Swift Getting Married to Travis Kelce in Rhode Island on June 13, 2026? Here’s What We Know

- Here Are the Best TV Shows to Stream this Weekend on Hulu, Including ‘Fire Force’

2026-01-31 12:12