Shiba Inu ($SHIB), the cryptocurrency that gained popularity through memes, has experienced a 15% increase in value over the last week as the larger cryptocurrency market recovers. Experts are growing more positive about Shiba Inu’s prospects.

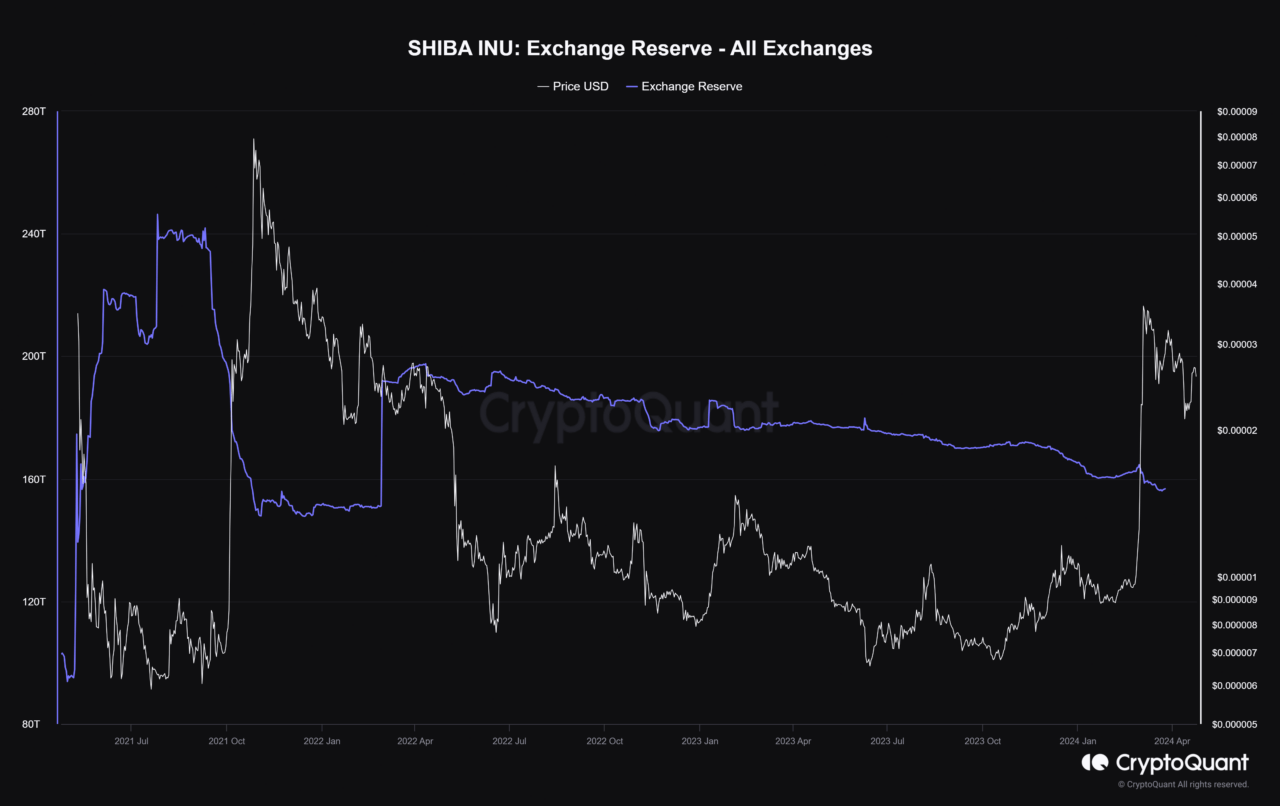

According to data from a top blockchain analysis company, CryptoQuant, Shiba Inu (SHIB) tokens held on centralized cryptocurrency exchanges have reached their lowest point since February 2022, amounting to approximately 150 trillion tokens as initially reported by CryptoPotato.

The reduction in the amount of SHIB up for sale suggests that scarcity may ensue, causing potential price hikes, provided the demand stays constant or grows, assuming this trend continues.

According to CryptoQuant’s data, there has been a significant outflow of SHIB tokens from centralized exchanges to self-custody wallets over the past week. This trend indicates that investors are moving their tokens away from exchanges and into personal wallets for safekeeping. This decrease in selling pressure on the exchanges is often viewed as a positive sign, as it can suggest that demand for SHIB may be increasing.

Another interpretation: Aside from indicators connected to trading, there are other signs within the Shiba Inu community that could lead to an increase in price. One such sign is the rising rate of SHIB being burned, which takes tokens out of circulation and decreases the total amount available on the market.

The vibrant Shiba Inu cryptocurrency community has played a significant role in keeping the coin active on social media. According to Lunar Crush, a social intelligence firm, SHIB exhibited bullish signs during the past few weeks due to heightened social activity, growing market volume, and surging price trends.

According to a report from CryptoGlobe, there’s a possibility that the meme-driven cryptocurrency might experience significant growth in the upcoming period. An expert in technical analysis made this prediction based on chart patterns, specifically identifying a symmetrical triangle formation which is typically viewed as a bullish indicator by traders.

A symmetrical triangle pattern emerges when drawing trendlines – one representing a decline and the other an uptrend – as the price range converges. To ensure a genuine breakout and not a deceptive one, traders must observe an significant increase in trading volume and no less than two sequential closures beyond the trendline, as suggested by Investopedia.

In simpler terms, symmetrical triangles often signal that market prices will persist with their previous trend. Consequently, if a symmetrical triangle emerges following an uptrend, traders anticipate the price to eventually surge upwards.

Last month, Shiba Inu’s layer-2 scaling solution, Shibarium, achieved significant milestones. Recently, the network surpassed 400 million transactions, indicating increasing usage of SHIB. Previously in January, Shibarium had reached 300 million transactions.

Read More

2024-04-25 03:43