Shiba Inu (SHIB) has climbed approximately 14% over the past week, raising its market value to $14 billion and securing its position as the second-largest meme coin behind DOGE. The recent upward trend suggests robustness, but SHIB’s Relative Strength Index (RSI) indicates a moderately bullish phase, implying that further growth could occur if the momentum continues to strengthen.

The ADX indicates that Shiba Inu (SHIB) continues its upward trajectory, yet the strength of this trend is diminishing due to increased selling pressure. A possible golden cross could propel SHIB to challenge resistance points for potential additional gains. However, if momentum wanes, a correction might occur, taking SHIB back towards crucial support levels.

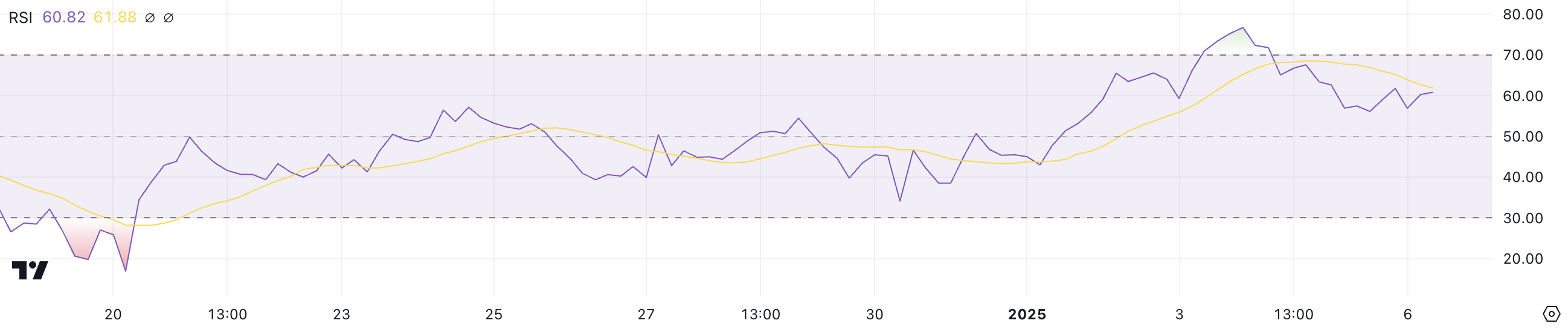

Shiba Inu RSI Is Down After Touching 76

right now, the Shiba Inu’s Relative Strength Index (RSI) stands at 60.8. This value increased from its lowest point of 56 on January 5, which followed a peak of 76 on January 3. The RSI is a tool used to evaluate an asset’s price momentum, providing a reading between 0 and 100 that reflects the rate and size of price changes.

Readings exceeding 70 usually signal an overbought state, which may predict a possible reversal or pullback. On the other hand, values dropping below 30 typically indicate an oversold market, suggesting that a price increase or rebound might occur.

Right now, the Relative Strength Index (RSI) of Shiba Inu is showing a strong upward trend, yet it’s still below the point where it’s considered overbought. This suggests there could be more potential for its price to increase.

In simpler terms, this setup suggests a moderate increase in buyers (moderate buying pressure), which might lead to short-term profits if the Relative Strength Index (RSI) approaches 70. But, if the RSI starts falling again, it may indicate weakening momentum and could hint at a pause (consolidation) or even a decrease (retracement) in price.

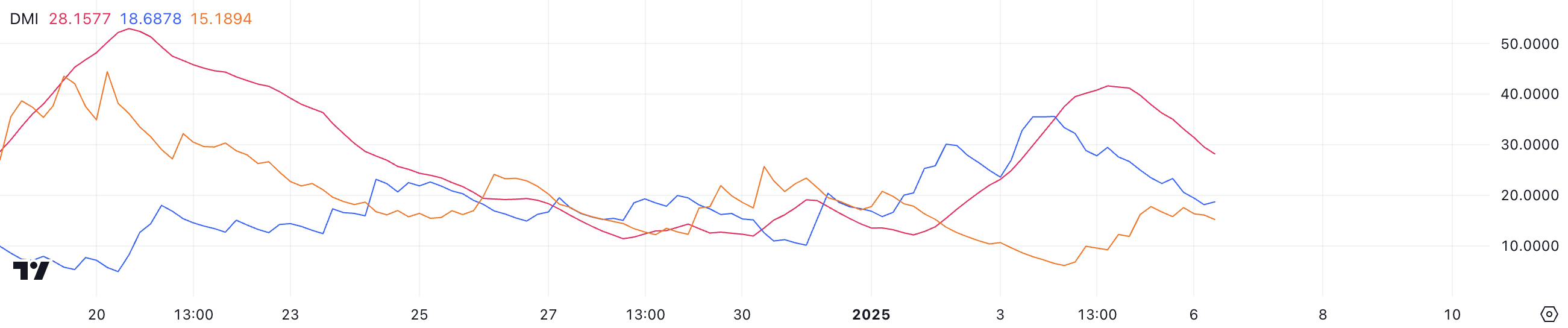

SHIB DMI Shows the Uptrend Is Still Strong

Right now, SHIB’s Average Directional Index (ADX) is at 28.1, which is quite a drop compared to its value of 41.6 only two days ago. The ADX gauges the strength of a trend between 0 and 100, where numbers above 25 suggest a strong trend, while values below 20 imply weak or non-existent momentum.

Even though it’s showing a decrease, the ADX (Relative Strength Index) remains over 25, implying that Shiba Inu’s market trend is still upward, albeit with reduced vigor.

The directional indicators offer extra understanding about Shiba Inu’s trend. Over the past three days, the +DI (buy signal) has decreased from 35 to 18.6, suggesting less bullish actions. Simultaneously, the -DI (sell signal), previously at 6.4, has climbed to 15.1, signifying a strengthening bearish feeling.

This change indicates that although the upward trend remains, the equilibrium is gradually tipping in favor of sellers. If this pattern persists, the price of SHIB might experience stabilization or potentially reverse direction, unless strong buying activity reasserts itself.

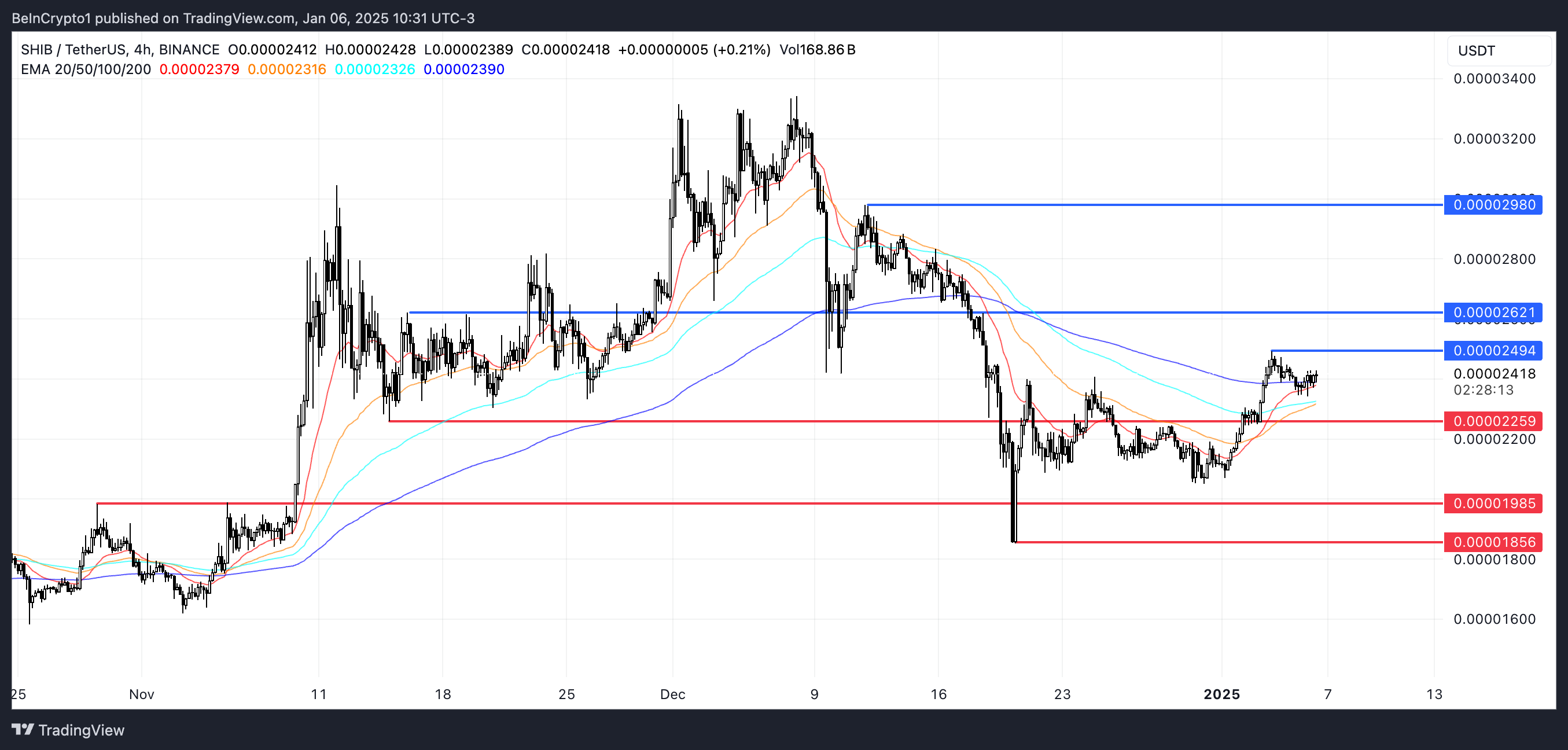

SHIB Price Prediction: A Potential 23% Surge

Looking at Shiba Inu’s Exponential Moving Averages (EMA), there’s a possibility of a ‘golden cross’, where the shorter EMA is about to move above the longer one, hinting at an impending bullish trend. This could rekindle buying interest, enabling SHIB to challenge the resistance level around $0.0000249.

Should the current stage experience a break, there’s a strong possibility that the Shiba Inu (SHIB) price might persist in its upward trend, aiming for approximately $0.000026 and possibly reaching $0.0000298. This could translate to a potential increase of around 23.6%.

Should the anticipated golden cross not occur, and the trend shifts instead, as indicated by the waning DMI, I foresee potential downward risks for SHIB. The first significant support can be found at $0.000022; a breach below this point might intensify selling pressure.

Given these circumstances, the Shiba Inu coin’s value could potentially drop to around $0.0000198 or even as low as $0.0000185, indicating a substantial dip in its pricing.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Elder Scrolls Oblivion: Best Battlemage Build

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- ALEO PREDICTION. ALEO cryptocurrency

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- 30 Best Couple/Wife Swap Movies You Need to See

- Revisiting The Final Moments Of Princess Diana’s Life On Her Death Anniversary: From Tragic Paparazzi Chase To Fatal Car Crash

- Who Is Emily Armstrong? Learn as Linkin Park Announces New Co-Vocalist Along With One Ok Rock’s Colin Brittain as New Drummer

2025-01-06 23:14