As a seasoned crypto investor with battle-tested nerves and an eye for technical analysis, I must admit that the current state of Shiba Inu (SHIB) has me intrigued yet cautious. The recent price action has been reminiscent of a rollercoaster ride, filled with ups and downs that would make even the most stoic investors sweat.

The price of Shiba Inu (SHIB) is at a crucial point, as various technical signals offer mixed predictions for its near-term direction. This well-known meme token has been undergoing substantial selling activity in the recent week, leading to a 20% decrease and a decline in its market capitalization from $15 billion to $12.5 billion.

Currently, the Shiba Inu coin is facing important support points as it undergoes price fluctuations. Its RSI (Relative Strength Index) is climbing out of an oversold region, suggesting a possible reversal in trend. Yet, there’s some doubt about an immediate recovery due to a drop in whale holdings and the appearance of a ‘death cross’ on December 18th.

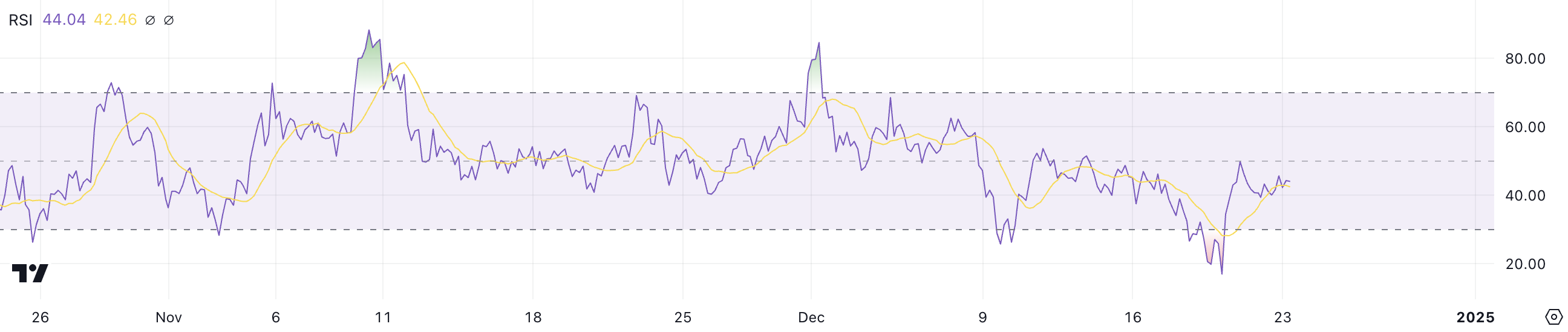

SHIB RSI Is Currently Recovering From Oversold

As a researcher, I’ve noticed an impressive rebound in the Relative Strength Index (RSI) of SHIB. Three days ago, it was severely oversold at a level of 16.9, but now it stands at 44, demonstrating a clear recovery.

This swing signifies a significant change in market trend, since the Relative Strength Index (RSI) gauges how fast and intensely prices have moved in the recent past on a scale of 0 to 100. An RSI value below 30 indicates that the asset might be overbought, while values above 70 suggest it could be oversold.

Right now, Shiba Inu’s Relative Strength Index (RSI) stands at 44, indicating a neutral or balanced position that could hint at potential growth in the immediate future. Since the RSI has already rebounded noticeably from oversold conditions without yet reaching overbought levels, there seems to be more scope for price increases.

A swift increase in the Relative Strength Index (RSI) suggests a change in market sentiment towards optimism. However, it’s crucial for traders to keep an eye on whether this positive trend can continue.

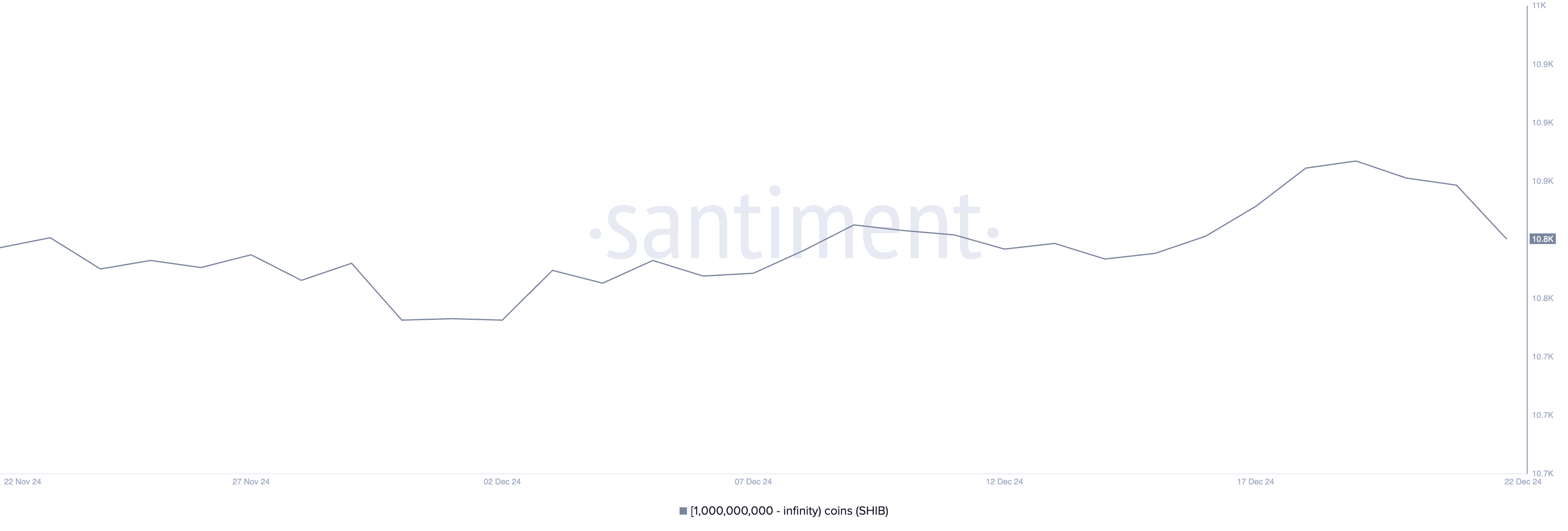

Shiba Inu Whales Are Not Accumulating Anymore

As an analyst, I observed a growth in the number of significant Shiba Inu token holders (whales) from December 14th to December 19th. The count increased from approximately 10,861 addresses on the 14th, to 10,930 by the 19th.

This measurement plays a vital role in market analysis because the actions of large investors (often referred to as “whales”) tend to predict significant price changes due to their significant market impact. The way they trade can indicate increasing faith in an asset when they amass it, or potential downward pressure on prices when their holdings decrease.

Contrarily, the number of Shiba Inu “whales” has now turned around, decreasing to 10,875 by December 22. This drop suggests that the sentiment among these significant investors may be changing. Over a mere three days, the loss of 55 whale accounts could signal the start of a distribution phase, during which larger investors might be offloading their holdings or scaling back their involvement.

Exhibiting such behavior can lead to an escalation of selling pressure in the near future, because when ‘whales’ distribute their holdings, they typically introduce more supply into the market. This doesn’t necessarily mean a quick drop in Shiba Inu prices, but it does call for vigilance among traders, as they should be mindful of potential negative price fluctuations.

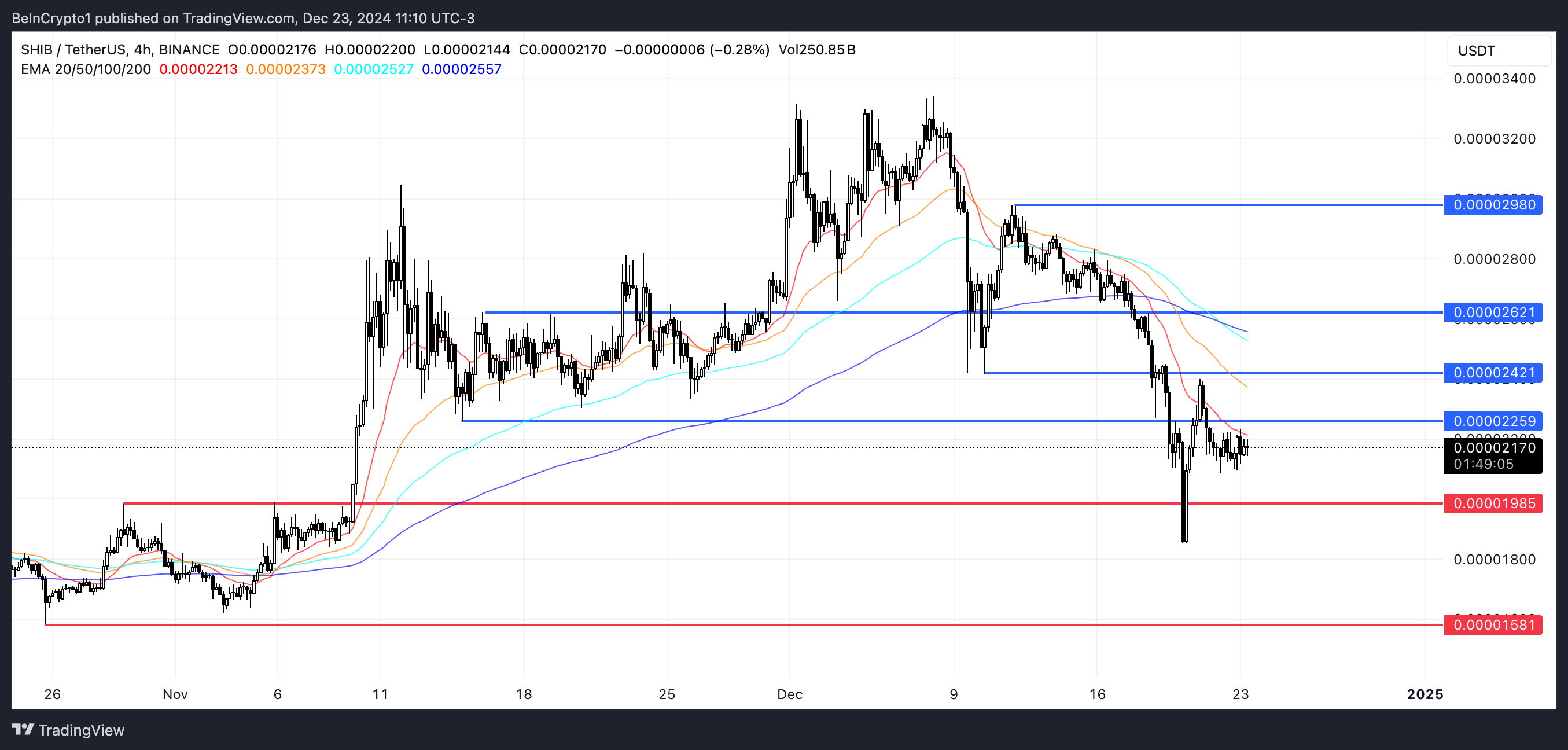

SHIB Price Prediction: Will SHIB Lose The $0.000019 Support?

The current price of Shib faces a significant challenge at a technical resistance point of $0.000022, which could potentially impede any future price growth or recovery.

If we manage to surpass this current level, it could pave the way for potential new highs at approximately 0.000024 and 0.000026 cents. With increased bullish energy, we might even see gains extending to around 0.0000298 cents.

As an analyst, I’ve noticed a troubling development in our market outlook: the emergence of a ‘death cross’ on December 18. This technical formation indicates that short-term moving averages have crossed below longer-term ones, which historically suggests bearish forces may still be prevailing. Given this bearish pattern and the existing downtrend, I find myself concerned about potential further market declines.

If Shiba Inu coin’s price doesn’t keep above the significant support of $0.00001985, it might lead to a more substantial drop, reaching towards the lower support area around $0.0000158.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- How a 90s Star Wars RPG Inspired Andor’s Ghorman Tragedy!

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

2024-12-24 01:08