As a seasoned researcher with years of experience navigating the cryptocurrency market, I can’t help but feel a sense of déjà vu while analyzing Shiba Inu‘s recent price movements. The 10% decline over seven days is not an uncommon sight for those who have been in this space for a while.

Over the last week, the price of Shiba Inu (SHIB) has dropped by 10%, mirroring its peak on December 7 which marked its highest point since early January 2024. This recent dip underscores a weakening trend, as technical indicators like RSI and DMI suggest a growing pessimism among traders, indicating a bearish change in market sentiment.

Although SHIB’s current decline doesn’t show much power, ongoing selling might drive the value to crucial support points. Yet, if it overcomes important resistance levels, this could hint at a possible turnaround and a surge of fresh bullish energy in the near future.

SHIB RSI Has Been Neutral Since December 20

As a researcher observing the market trends, I’ve noticed that the Relative Strength Index (RSI) for Shiba Inu has taken a notable dip from around 57 two days ago, down to 40.4 now. This substantial decrease suggests a weakening buying momentum, implying that the market is tilting towards a more bearish outlook.

Moving towards lower RSI (Relative Strength Index) values indicates that sellers are currently dominating the market, causing prices to approach the area where the market is considered oversold, but it hasn’t quite reached that point yet.

The Relative Strength Index (RSI) is a tool that measures how quickly and intensely prices are changing, ranging from 0 to 100. When the RSI exceeds 70, it signals overbought conditions, which might be followed by a price adjustment or correction. Conversely, an RSI below 30 indicates oversold conditions, possibly leading to a price increase or rebound.

As an analyst, I find myself observing Shiba Inu (SHIB) with a Relative Strength Index (RSI) of 40.4. This places it within a bearish-neutral zone, suggesting that there’s some selling pressure at play, but not to the point where it’s oversold. Over the short term, this could mean one of two things: either the price might dip further or find a temporary equilibrium near its current levels. However, if robust buying interest resurfaces soon, it could potentially reverse the trend and shift the momentum back in SHIB’s favor.

Shiba Inu Current Downtrend Is Not That Strong

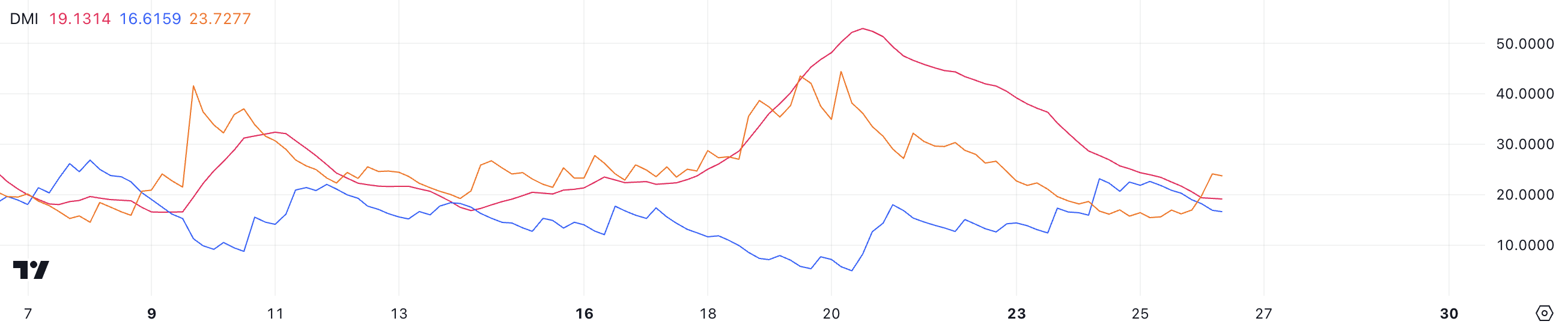

The Shiba Inu’s Directional Movement Index (DMI) chart shows a decrease in its Average Directional Index (ADX), which was previously higher three days ago. This drop in ADX suggests that the intensity of Shiba Inu’s current downward trend is diminishing, even though the overall trend continues.

The strength of buyers has weakened as the Positive Directional Indicator (D+) has decreased from 23 two days ago to 16.6 now. On the other hand, the Negative Directional Indicator (D-) has increased from 18.6 to 23.7, indicating a rise in selling pressure. This pattern indicates that sellers are currently more active than buyers in the market, with buying interest gradually diminishing.

The ADX (Average Directional Movement Index) is a tool used to gauge the strength of a trend, ranging from 0 to 100, without specifying whether it’s upward or downward. A value below 20 indicates weak trends, whereas values exceeding 25 signify strong trends. With Shiba Inu (SHIB) ADX currently at 19.13, the decline doesn’t show a substantial intensity, even though sellers are in control, as suggested by the higher D-.

For a while, SHIB’s price might face more downward pressure, but since the overall trend is weakening, it could also indicate potential stability or a pause in the decline if there’s a resurgence of buying interest.

SHIB Price Prediction: Back to $0.000015 Soon?

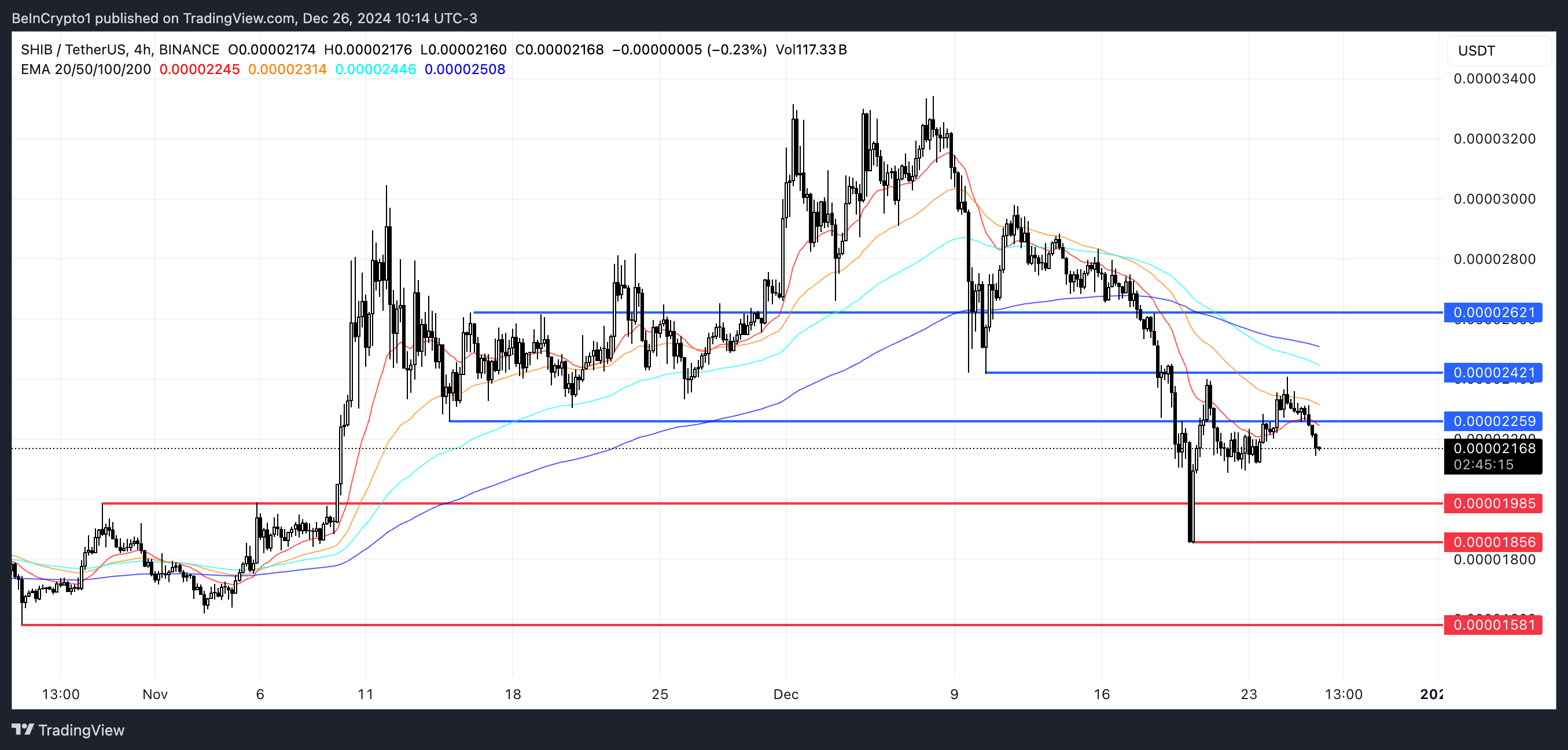

If SHIB current downtrend persists, the price could soon test the support level at $0.0000198.

If the downward trend grows stronger, the Shiba Inu (SHIB) price might keep falling. It could encounter resistance at approximately $0.000018 and $0.0000158 in the near future.

If the price of SHIB can bounce back and surge past its current resistance at $0.000022, I believe it has the potential to reach new heights. The token might aim for levels as high as $0.000024, with an optimistic projection of potentially even reaching $0.000026.

The given levels underscore the significance of both $0.000022 as a crucial resistance level and $0.0000198 as an important support level, which play vital roles in deciding whether Shiba Inu (SHIB) can reverse its downward trend and show a more optimistic perspective in the near future.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2024-12-26 21:23