As a seasoned researcher with over a decade of experience in the cryptocurrency market, I have seen my fair share of price fluctuations and trends. The current situation with Shiba Inu (SHIB) intrigues me due to its unique dynamics.

The RSI remaining neutral since December 20 suggests a consolidation phase, which is not unusual in the volatile world of crypto. However, the stability of whale activity indicates that large investors are neither aggressively accumulating nor significantly reducing their positions – a sign of neutral sentiment among major players.

In my experience, this balance between buying and selling pressures can often lead to unexpected market movements, especially when external factors or shifts in market sentiment come into play. If history repeats itself, we might see SHIB price break out of its current range soon.

Now, let’s not forget that the crypto market is known for its unpredictability – it could turn a bull into a bear in no time! So, keep your eyes on those key resistance and support levels. If the uptrend strengthens, we might just see SHIB reach new heights. But if the downtrend takes over, well, let’s just say I’ll be ready with my popcorn for another exciting ride in this rollercoaster market!

Oh, and remember: In crypto, the only certainty is uncertainty!

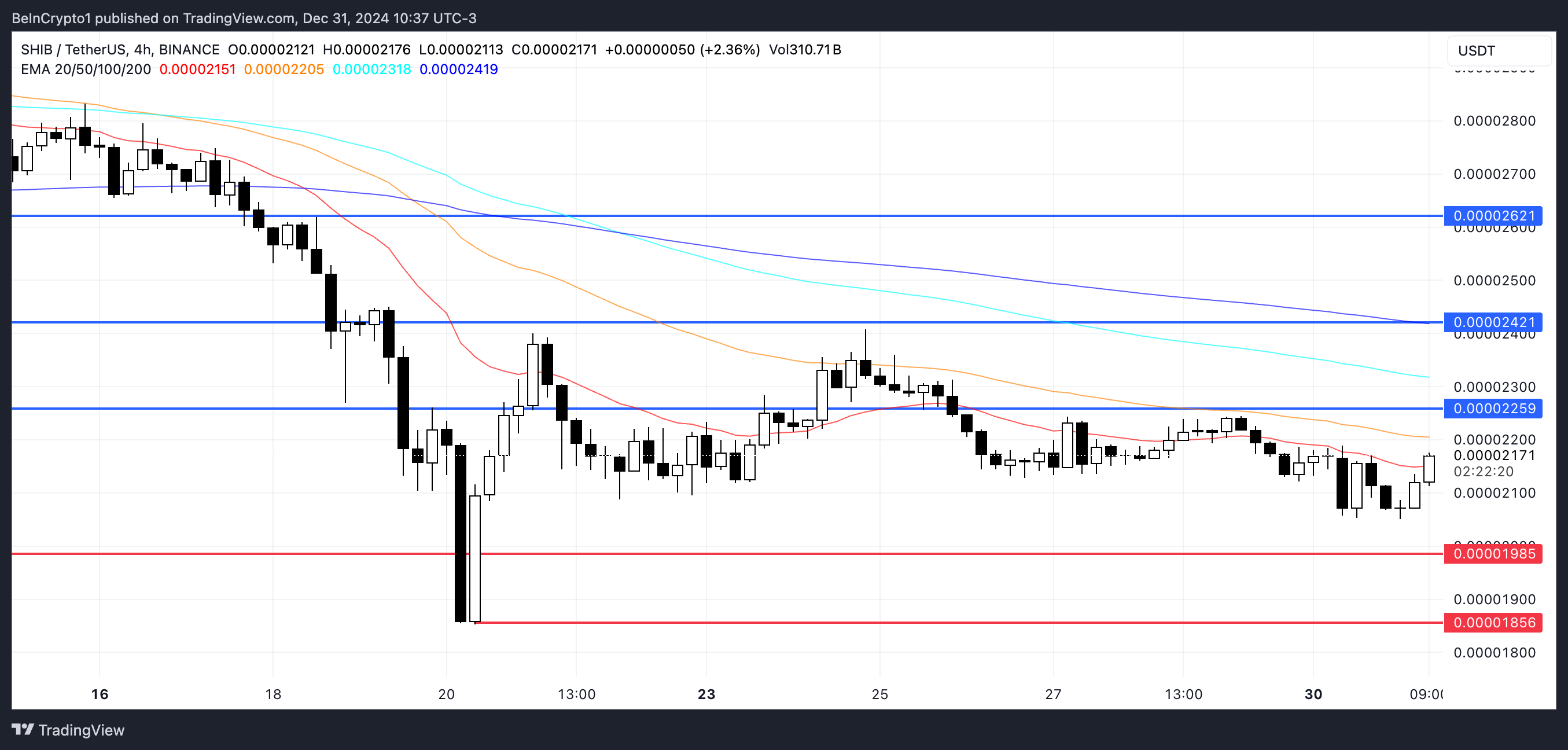

Shiba Inu’s (SHIB) price dropped by approximately 5.6% over the last week, but it managed to bounce back by 3% in the last day, aiming to regain its pace. The Relative Strength Index (RSI), currently at 50.9, indicates a balanced situation where both buying and selling forces are roughly equal. Notably, whale activity has leveled off following a period of decline.

As a researcher, I’m observing Shib’s current trading position hovering around crucial points. If the upward trend gains momentum, it might challenge significant resistance levels. Conversely, should selling pressure intensify, it could encounter key support zones.

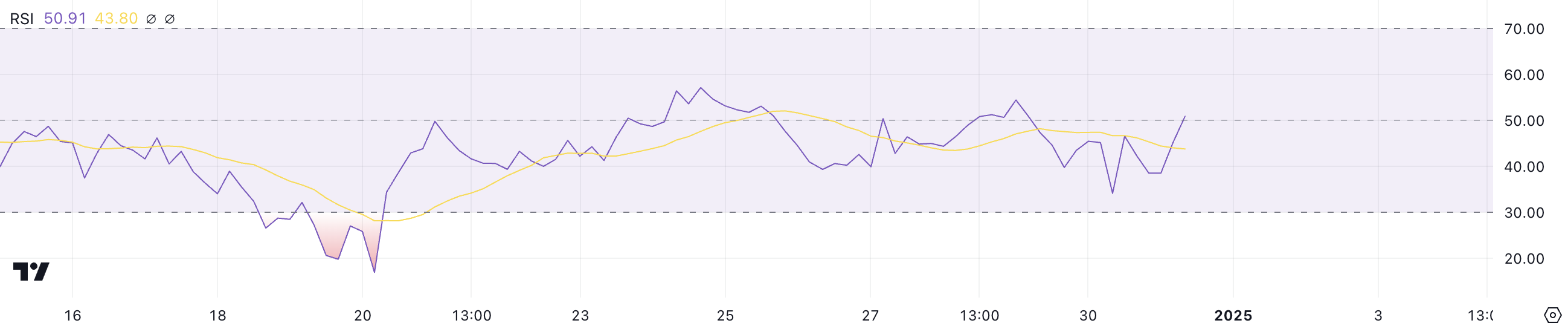

Shiba Inu RSI Has Been Neutral Since December 20

Currently, the Relative Strength Index (RSI) for Shiba Inu stands at approximately 50.9, keeping it in a neutral zone it has occupied since December 20. This level signifies an equilibrium between buying and selling forces, with neither side clearly having the upper hand. The RSI’s consistency suggests that the Shib price is experiencing consolidation, as traders are finding it difficult to make a definitive call on its future direction.

Based on my years of trading experience, I have noticed that a neutral reading in the market often signifies a lack of strong direction, making the price susceptible to external events or changes in market sentiment. This can be challenging as it requires constant vigilance and adaptability to stay ahead of potential triggers that could impact the market’s trajectory.

As an analyst, I utilize the Relative Strength Index (RSI) as a tool to gauge the momentum in price movements, ranging from 0 to 100. When the RSI surpasses 70, it signals overbought conditions, potentially hinting at an upcoming price correction. Conversely, values below 30 indicate oversold conditions, which might imply a forthcoming recovery.

As someone who has been following the cryptocurrency market for several years now, I find myself constantly analyzing various indicators to predict trends and make informed investment decisions. One such indicator that I have come to rely on is the Relative Strength Index (RSI). When I see SHIB’s RSI at 50.9, it reminds me of a scale teetering precariously in the middle, neither tipped too far towards overbought nor oversold conditions. This neutral RSI suggests that the price of SHIB may continue to fluctuate within a range for the short term, unless there is a significant increase in buying or selling activity to tip the momentum one way or the other. My personal experience has taught me that such periods of indecision can be challenging, as it’s difficult to predict which direction the market will break in. However, I always remind myself to stay patient and wait for a clear signal before making any moves in my portfolio.

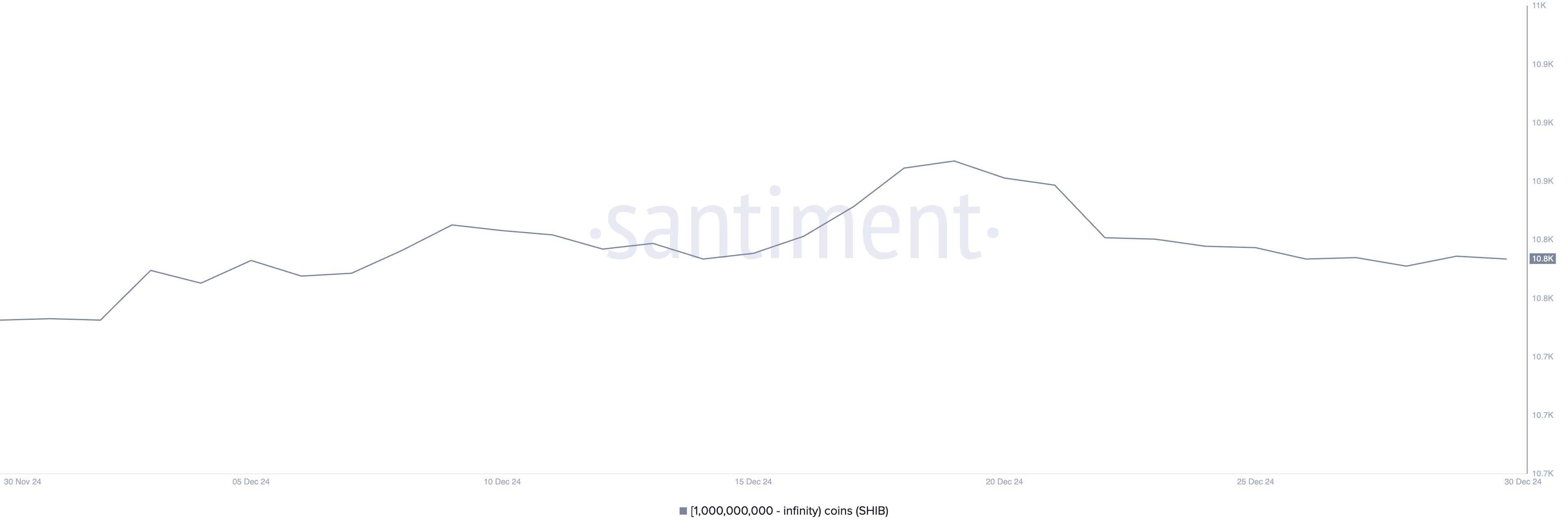

SHIB Whale Activity Stabilizes

On December 19th, a record number (10,930) of significant Shiba Inu investors, identified as wallets holding a billion SHIB or more, hit their peak for the month. However, since then, these whale numbers have been gradually decreasing.

Approximately 10,861 Shiba Inu (SHIB) wallets holding large amounts of the cryptocurrency have remained steady around this number since December 20, not showing signs of significant increase or decrease in holdings. This stability indicates that major investors are currently neither actively buying more nor significantly selling their positions.

Monitoring the behavior of whales in the financial market is important as these big players frequently influence market movements thanks to their ability to make substantial transactions. When they amass or accumulate assets, it can create a positive trend, but when they distribute or sell, it can cause a wave of selling pressure.

The current stability in SHIB whale numbers indicates a neutral sentiment among major investors.

SHIB Price Prediction: Will the Recover Continue?

If the ongoing upward trend continues strongly, the price of Shiba Inu might challenge the resistance level around $0.0000225. Overcoming this barrier could potentially open up opportunities for additional growth, with potential resistance levels at $0.000024 and $0.000026 following.

An upward trend that is getting stronger could indicate increasing optimism among investors, possibly drawing in more buyers and causing Shib to reach greater heights.

Should the upward momentum weaken and a dominant downward trend emerges, Shiba Inu (SHIB) could potentially test its initial support at approximately $0.0000198. If this level proves insufficient to halt the decline, further drops might occur, reaching the support level of around $0.0000185, indicating intensifying selling pressure.

In simpler terms, these crucial resistance and support points are expected to shape Shiba Inu coin’s immediate path, as traders keep a close eye on which side – bullish or bearish – holds the upper hand.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2024-12-31 19:02