As an analyst with a background in finance and experience in covering the healthcare industry, I view Semler Scientific’s decision to adopt Bitcoin as its primary reserve asset as an intriguing development. The company’s focus on combating chronic diseases through innovative solutions is commendable, and their flagship product, QuantaFlo, has shown great potential in diagnosing cardiovascular diseases.

Semler Scientific, Inc. (NASDAQ: SMLR), recognized for pioneering approaches to combating persistent health conditions, unveiled a new direction in their treasury management on May 28, 2024. This change involves the adoption of Bitcoin as their principal reserve asset, representing a notable shift in the company’s financial planning.

As a researcher focusing on Semler Scientific, I can tell you that this company is renowned for its innovation in medical technology, particularly in the development and commercialization of their flagship product, QuantaFlo. This FDA-approved rapid point-of-care test measures arterial blood flow in the extremities, contributing significantly to the diagnosis of cardiovascular conditions such as peripheral arterial disease (PAD). Currently, Semler Scientific is pursuing additional 510(k) clearances for QuantaFlo, expanding its applications. Healthcare professionals utilize this test not only to diagnose these conditions but also to assess a patient’s risk of mortality and major adverse cardiovascular events (MACE), providing valuable insights into their patients’ health.

In a statement released from Santa Clara, California, Semler Scientific announced the purchase of 581 bitcoins for a total cost of $40 million. This investment underlines the company’s conviction in Bitcoin’s role as a dependable store of value and lucrative investment opportunity. Eric Semler, Semler Scientific’s chairman, underscored Bitcoin’s standing as a significant asset class, with a market worth over $1 trillion. He stressed Bitcoin’s unique traits as a scarce and finite resource, making it an effective hedge against inflation and a secure refuge during economic uncertainty. Moreover, Semler contended that Bitcoin’s digital and architectural robustness sets it apart from gold, whose market value is roughly ten times larger than Bitcoin’s. With this substantial difference, Semler proposed that Bitcoin could generate substantial returns as it continues to be recognized as the digital equivalent of gold.

As a researcher studying the evolution of Bitcoin, I’ve observed the increasing global recognition and formalization of this digital currency. Notably, the U.S. Securities and Exchange Commission (SEC) approved 11 Bitcoin exchange-traded funds (ETFs) in January 2024. These ETFs have seen impressive net inflows exceeding $13 billion, drawing investments from approximately 1,000 institutions – ranging from global banks to pensions, endowments, and registered investment advisors. The estimation is that institutions collectively hold over 10% of all existing Bitcoins.

After careful consideration, Eric Semler and the leadership team at Semler Scientific weighed different options for utilizing their surplus funds, including potential acquisitions. Ultimately, they determined that investing in Bitcoin offered the greatest value for the company’s cash reserves.

In spite of the latest financial approach adopted by the treasury, Semler Scientific stays true to its primary mission in the field of medical products and healthcare services. CEO Doug Murphy-Chutorian has reiterated the organization’s pledge to its clientele and ambition to manage a thriving and prosperous healthcare business. The company intends to sustain sales for QuantaFlo®, utilized in PAD testing, while pursuing broader FDA authorization for its application in diagnosing various other cardiovascular disorders.

As Semler Scientific keeps earning revenue and creating surplus cash from QuantaFlo sales, the company intends to carefully consider how to utilize this extra money. Bitcoin will likely be used as the main asset for storing this excess cash, with the decision depending on market fluctuations and the business’s projected financial requirements.

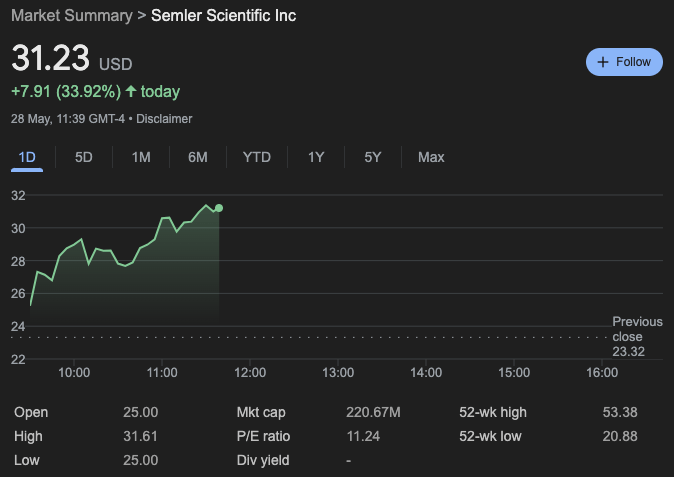

I’ve observed that as of 11:39 a.m. Eastern Daylight Time, Semler Scientific shares are being exchanged at approximately $31.23, representing a significant gain of almost 34% for the day.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- USD ILS PREDICTION

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- 9 Kings Early Access review: Blood for the Blood King

- Every Minecraft update ranked from worst to best

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- 10 Shows Like ‘MobLand’ You Have to Binge

2024-05-28 18:56