The year 2025, when its curtain finally falls, will not be remembered for its cruelty. By December’s fifth, the S&P 500 had bloomed like a stubborn wildflower in a desert of uncertainty, rising 17% amid the wreckage of global economies. The Nasdaq, that restless child of innovation, and the Dow, its weathered elder, had each found their way to green pastures. Yet beneath the sheen of profit, a deeper truth gnawed at the edges of the market’s joy-a truth written in numbers older than the stock tickers themselves.

There is a rhythm to the market, a pulse that beats in cycles of greed and fear. This year, the Federal Reserve’s whispered promises of rate cuts and the birth of technologies like artificial intelligence had stirred hope. But hope, like the rain in a drought, can be a cruel illusion. For the S&P 500, now teetering near 6,900, history casts a long shadow. A single number-a ghost of past excesses-whispers of a reckoning in 2026.

A Sentinel of Time

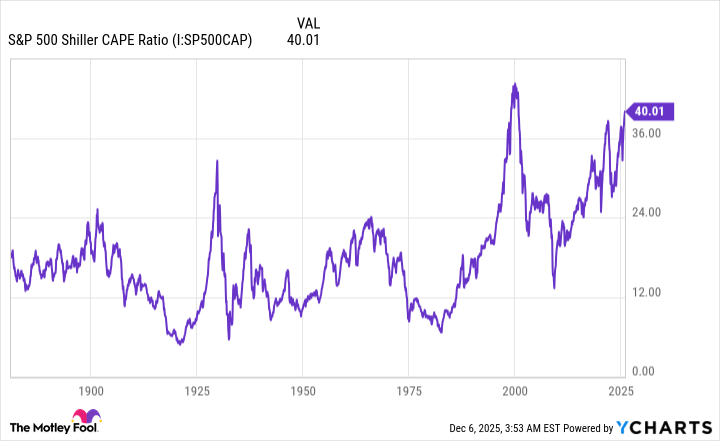

Wall Street, for all its glitter, is a theater of illusions. No oracle can predict the market’s next move with certainty. But there exists a silent watcher, a relic of 155 years of human folly: the Shiller P/E Ratio. It does not shout. It does not weep. It merely tallies the arithmetic of despair and hubris, averaging the earnings of a decade, stripped of inflation’s mask.

This ratio, now swollen to 40.46, is a warning carved into stone. It mirrors the feverish days before the dot-com crash, when the CAPE Ratio peaked at 44.19. The market, like a farmer who over-plows his field, has exhausted its soil. And yet, the sowers still plant, blind to the dryness beneath their feet.

The Shiller P/E is not a prophet, but a mirror. When it rises above 30, it has never failed to foreshadow a collapse. Six times in history, this threshold has been crossed. Five times, the S&P 500 has crumbled by 20% or more. The last fall-from 2000 to 2002-was a winter that lasted four years, a drop of nearly half its value.

If the cycle repeats, the S&P 500 may find itself in the dust by 2026, its value reduced to 4,600. That is not a prophecy. It is an echo, a shadow cast by the mistakes of those who came before.

But here lies the irony: the market is not a machine. It is a living thing, shaped by the hands of those who trade in it. The Shiller P/E does not dictate the future. It merely reveals the weight of the present. And in that weight, there is both danger and opportunity.

The Long Road Home

To speak of a 2026 sell-off is to speak of a storm. Few welcome the wind that tears at their roofs. But for the patient, the storm is not the end-it is the pruning. In 2023, when the S&P 500 clawed its way out of the October 2022 bear market, Bespoke Investment Group reminded us that bear markets, though brutal, are brief. They average 9.5 months. Bull markets, by contrast, stretch for years-3.5 times longer, like a river carving through stone.

Crestmont Research, with its 20-year rolling returns, offers another truth: the S&P 500 has never failed to reward patience. Every 20-year period since 1900 has ended in profit. Even the worst downturns, the darkest winters, have been followed by springs. The market, in its cruelty, is also kind.

For the growth investor, then, the Shiller P/E is not a death knell. It is a map-a guide to the valleys where opportunity lies hidden. The small investor, the one who toils without the luxury of algorithms or insider whispers, must learn to read these signs. The land may be barren now, but the seed, if planted with care, will find its way to the sun.

In the end, the market is a story. One of hubris and humility, of storms and harvests. And like all stories, it belongs to those who dare to write the next chapter. 🌾

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-12-09 13:39