The curious lineage of Serve Robotics—spun from the Uber behemoth’s Postmates acquisition, a digital mitosis of sorts—presents a fascinating, if slightly precarious, case study. One observes the company, not as a mere assembler of wheeled automatons, but as a gambler attempting to orchestrate a ballet upon the unforgiving asphalt of last-mile delivery. The notion, of course, is to supplant the pedestrian inefficiency of human couriers with these diminutive, electrically propelled emissaries. A charming ambition, wouldn’t you agree? Cathie Wood, that prophet of disruptive technologies, whispers of a $450 billion market by 2030, a sum so vast it threatens to induce vertigo. Serve, naturally, inclines its metallic ear to the promise.

The stock, a volatile sprite, dipped 23% last year, a momentary stumble for a company attempting to redefine convenience. Yet, in the nascent weeks of 2026, it has ascended a respectable 40%, a flutter of wings suggesting a potential lift-off. Trading 8% above its 2025 starting point, the question, as always, is whether this is a genuine ascent or merely a temporary updraft, a phantom limb of optimism twitching in the market’s capricious breeze. Is it, in short, a prudent allocation of capital, or a whimsical indulgence?

The Uber Pact: A Symphony of Sidewalks

Serve’s core proposition—that the current system of vehicular delivery for short-range orders is a grotesque inefficiency—is undeniably sound. The median food delivery, a mere 2.5 miles, is akin to dispatching a battleship to retrieve a postage stamp. These robots, these miniature automatons, are intended as a more elegant, less wasteful solution. One pictures a fleet of them, gliding silently along sidewalks, a chrome-plated choreography of commerce.

Since 2022, some 3,600 restaurants across five American cities have entrusted Serve’s creations with the delivery of over 100,000 meals. Powered by Nvidia’s Jetson Orin—a rather grand name for a small computer, don’t you think?—these robots have achieved Level 4 autonomy. They navigate sidewalks, at a stately 11 miles per hour, without human intervention. A rather impressive feat, considering the unpredictable nature of pedestrians and rogue shopping carts. The company dreams of reducing delivery costs to a mere dollar, a figure that would render existing human-driven solutions positively archaic.

The deal with Uber Eats, a strategic alliance of considerable import, requires the deployment of 2,000 robots across major metropolitan areas—Los Angeles, Atlanta, Dallas, Miami, and Chicago. Serve recently announced the completion of its 2,000th robot, a milestone suggesting a capacity to meet demand. Adding to this momentum, a new agreement with DoorDash promises even further expansion. The company, it seems, is poised for a scaling spree, a mechanical blossoming upon the urban landscape.

Revenue & Ruin: The Arithmetic of Ambition

Despite the fanfare, Serve’s revenue remains, shall we say, modest. $1.77 million in the first three quarters of 2025, a sum that barely registers against a $1.1 billion market capitalization. Management anticipates total revenue of $2.5 million for the year, a figure that, while an improvement, still feels… diminutive. However, the forecast for 2026 is far more ambitious: a tenfold increase, propelled by the 2,000-robot fleet. A bold prediction, to be sure, and one that hinges on a multitude of factors.

Scaling a robotics enterprise, alas, is not a cost-free endeavor. Even a tenfold increase in revenue may prove insufficient to offset the ballooning expenses. Operating costs soared to $63.7 million in the first three quarters of 2025, more than double the previous year’s figure. This has resulted in a $67 million loss, and a full-year loss that is almost certain to exceed the $39.2 million deficit of 2024. The company possesses $210 million in cash, providing a temporary cushion. However, without a path to profitability, further capital raises—and the inevitable dilution of existing shareholders—may become necessary.

A Sidewalk Serenade, or a Stock Market Lament?

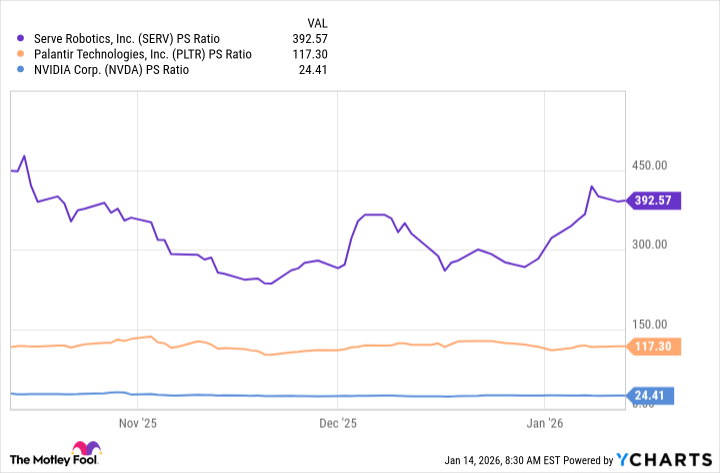

Currently, Serve trades at a price-to-sales ratio of 392, a figure that borders on the preposterous. Nvidia, a company of considerably more substance, sports a P/S ratio of a mere 24. Even Palantir, a company known for its own extravagant valuation, appears almost reasonable in comparison.

Assuming Serve’s revenue does indeed soar tenfold in 2026, reaching approximately $25 million, its forward P/S ratio would fall to 44—still elevated, but less outlandish. If, as some predict, robotic and drone delivery does become a $450 billion market by 2030, then Serve stock may, in retrospect, prove to be a bargain. However, this is a nascent industry, fraught with uncertainty. If the company’s business model encounters unforeseen obstacles, or if revenue growth falls short of expectations, the stock could experience a sharp decline.

For investors considering a position in Serve, a cautious approach is warranted. A small allocation, perhaps, to savor the potential upside without exposing oneself to undue risk. The company, after all, is attempting to orchestrate a rather ambitious ballet upon the unforgiving asphalt of reality. And as any seasoned investor knows, not all performances end with a standing ovation.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Top 15 Insanely Popular Android Games

- Games That Faced Bans in Countries Over Political Themes

- ‘Zootopia 2’ Wins Over Critics with Strong Reviews and High Rotten Tomatoes Score

- The Best Actors Who Have Played Hamlet, Ranked

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

2026-01-16 14:13