Ah, September, that sultry siren of stock markets, whispers sweet nothings that send shivers down the spines of investors enveloped in an aura of trepidation. Over the arc of time-a mere seven and a half decades show us, mind you-this month has cautiously donned the most unfortunate mantle, emerging as the ungracious harbinger of decline for the infamous S&P 500 (^GSPC). With the index, as per the paragon of financial wisdom, Bloomberg, showcasing an average dip of 0.7%, one might consider it practically an act of folly to restock one’s portfolio before the fall. Indeed, the narrative of folly becomes riveting, for in four of the last five years, the S&P 500 has descended from its heights, much like Icarus who dared to court the sun.

Yet, lo and behold! This September, the index exhibits a rather improbable vitality; it has crested by 1.9% as of late. But, dear reader, let us not indulge in premature exultation; over two weeks yet remain, and with them lie the potent specters of wild fluctuations, either soaring higher on angel wings or plummeting earthward with a tragic grace. Hence, we are beckoned to ponder: Is it truly prudent to acquire stocks in this month of warm breezes and waning sun? Let us embark on this intellectual voyage.

Five-Year Performance of the S&P 500: A Dance of Variability

To commence our exploration, let us scrutinize the reluctant ballet of the S&P 500 over the last five years-a tableau rife with both elegant advances and disheartening retreats. Last year, the index contrived to rise amidst September’s embrace of autumn, yet it had fallen from grace between 3% and 9% in the preceding four years; it’s almost as if the stock market, like a fickle lover, has grown capriciously enamored with instability.

| Year | S&P 500 September Performance |

|---|---|

| 2020 | down 3.9% |

| 2021 | down 4.7% |

| 2022 | down 9.3% |

| 2023 | down 4.8% |

| 2024 | up 2% |

Ah, but we mustn’t let these dismal historical tidings cast such a long shadow over our investment decisions. Is there not magic in the air? Yes, indeed, as myriad factors conspire in asymmetrical patterns to allure us away from the path of predictable peril. Chief among these oscillating variables are corporate revelations and economic happenings, both of which have already unveiled their controversial sleeves this month, momentarily lighting the path ahead.

Consider, for instance, the tech titans, Broadcom and Oracle, whose latest fiscal escapades exhibit a luminous prosperity in their AI-driven operations this quarter, suffusing their stock prices with a vigor most remarkable. In the grand mosaic that constitutes the S&P 500, tech stocks-those modern-day muses-wield disproportionate influence; a mere whisper of their triumphs provokes seismic shifts.

On the fourth day of September, Broadcom incisively reported a resplendent 63% surge in AI revenue, elevating to a staggering $5.2 billion, with anticipations of even loftier heights to follow. In what one might call a belle époque of clarity, Oracle enthralled and stunned with predictions of cloud infrastructure revenues thriving in copious abundance, foretold to soar to unimaginable heights driven by AI clientele. A thrilling 55% increase in this quarter catapults their figures to $3.3 billion, with prospects promising to burgeon to $144 billion in just four years-an empire burgeoning in real-time.

Nvidia’s Vision: A Futuristic Foretelling

Following in a tale that oscillates between the plausible and the fantastical, Nvidia dangles its visionary predictions, heralding not less than $4 trillion in AI infrastructure spending before this glorious decade slips through our fingers. This clamor of expectation around technological stocks-and it is nothing less-has effectively energized the S&P 500, propelling it skyward as though on the crest of a wave.

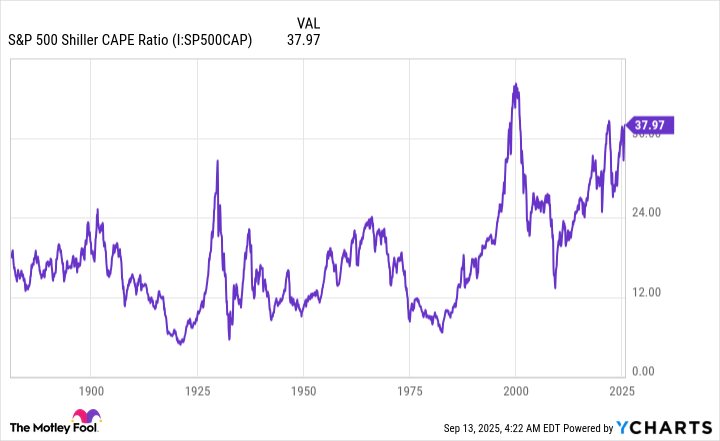

However, with this burgeoning interest in equities comes a prodigious concern: are stocks not inching towards a perilously inflated status? One gaze upon the S&P 500’s Shiller CAPE ratio-a fiendishly clever metric gauging earnings against inflating prices-confirms an unsettling reality: a soaring 37, a level only surpassed on two previous occasions in all the vast annals of market history. Such reflections suggest that the hunt for euphoria-laden bargains may well elude us in this atmosphere.

As we drift into yet another week, a tantalizing jolt emanates on the horizon, compelling us to ponder the Federal Reserve’s decision on impending interest rates. Anguish lingers in anticipation; for if, as economists speculate, a reduction in rates materializes, it may very well incite a cascade of optimism, lower costs for weary consumers, and an invigorated appetite for corporate liabilities.

Now returning to our pressing inquiry: Should one delve headlong into the arms of stocks this September, amidst the turbulence of so many unknown currents? Indeed, as the prospects shimmer like a distant mirage-valuations perched precariously high, the historical specter of decline looming-dare we acknowledge that the entirety of corporate grandeur and nascent optimism may yet buoy the equities? Perhaps the elusive decision of the Federal Reserve could act as the enlightening torch guiding investor dreams.

Forsooth! A Long-Term Perspective

What shall our journeying investor do, then? The answer, inevitably, remains deceptively simple. Adopt the long-sighted gaze, akin to an eagle surveying its domain from lofty heights. Shun distractions spurred by ephemeral valuations and the whims of the immediate market; rather, consider the essence of individual stocks-unravel their intricacies, assess the strength of their financial sinews, and contemplate their future prospects. Should one find a share worth its weight in gold, reprised with a reasonable valuation, let us toast to a profitable encounter.

A final note, dear reader: the S&P 500, in its mysterious, cyclical choreography of gains and losses, has always risen from the ashes, delivering an average annual return of 10%. To gaze upon the long-term allows you the comfort to transcend seasonal worries and embrace investment with confidence, ushering the peace of mind that unencumbered slumber beckons.

😊

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Why Nio Stock Skyrocketed Today

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

2025-09-15 12:19