As we tumble into the final quarter of the year, a certain shift is palpable in the air-a movement of minds, as investors scurry to reassess their portfolios. Naturally, they are pondering the eternal question: “What now?” Well, let’s not be hasty in abandoning ship, for there are still delightful bargains tucked away in the stock market, just waiting to be plucked. If you’re in a position to do so, let’s make sure you’re not leaving potential profits to the whims of lesser minds.

In my ever-so-humble opinion, I have singled out four companies that stand to deliver a jolly good return as we shuffle through the remaining months of 2025 and into 2026. They’re worth your attention, darling-take notes.

Nvidia

Nvidia (NVDA) has long been the darling of the investment world. A true frontrunner in the field of artificial intelligence (AI), the company’s graphics processing units (GPUs) are the unsung heroes behind the very fabric of AI development. If you haven’t yet heard, AI is having its moment-again. And while the future, like a good soufflé, is prone to collapse, Nvidia’s prospects remain quite robust. As its CEO, Jensen Huang, so bluntly put it, we’re looking at an infrastructure spend of $600 billion in AI by 2025, with trillions more to follow. Quite heady, wouldn’t you agree?

Even if this projection turns out to be slightly more optimistic than the average accountant’s mid-year forecast, Nvidia stands to benefit. The company is solid, darling, and remains an absolute must-buy as we race into the AI arms race.

Taiwan Semiconductor Manufacturing

Then, of course, there’s Taiwan Semiconductor Manufacturing (TSM)-or TSMC for those of us who like to sound a bit more familiar. Now, unlike Nvidia, TSMC isn’t exactly setting the world on fire. It’s not the loudest at the party. However, for those who prefer steady and reliable investments with a touch of class, TSMC fits the bill rather splendidly. The company is the undisputed leader in third-party chip manufacturing, producing semiconductors for everyone from Apple to Nvidia.

Even if another competitor emerges with a more dazzling offering, you can bet your bottom dollar that TSMC will still be the one doing the manufacturing. At 23.7 times forward earnings, it’s a little cheaper than the S&P 500-an unusual but fortuitous situation, wouldn’t you agree?

For a company growing at a 44% rate, with those figures looking rather lovely, it’s a safe bet to hold on to for the foreseeable future.

Alphabet

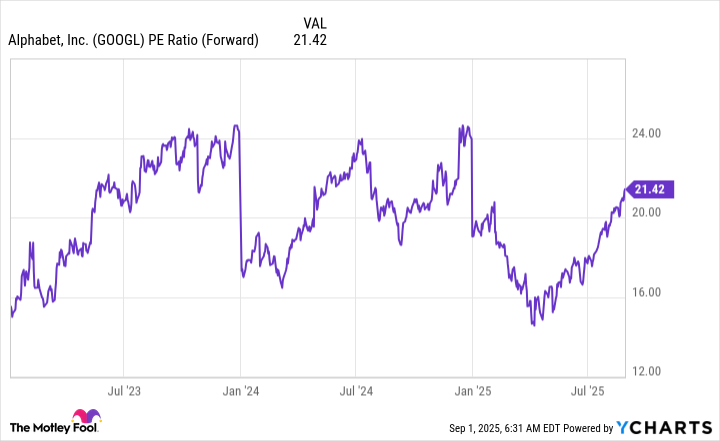

If TSMC strikes you as reasonable, then let me introduce you to Alphabet (GOOG)-or perhaps its more formal counterpart, GOOGL. Now, Alphabet may not have the razzle-dazzle of an AI startup, but it’s been around long enough to know how to keep the wheels turning. At 21.4 times forward earnings, it’s practically a bargain, considering it’s riding the wave of AI’s advance while maintaining its stronghold on Google Search.

It’s a curious thing, this stock, which has proved itself time and time again, even while the doomsayers were declaring that generative AI would completely undermine Google’s relevance. It turns out that, much like a good brandy, Alphabet has only improved with age. In Q2, the company saw a 14% rise in revenue, with a 22% increase in earnings per share. Not bad at all.

The Trade Desk

And lastly, The Trade Desk (TTD)-an advertising technology platform. One could say that the company is in the midst of a bit of a transition. It’s moving clients onto its new AI-powered platform, Kokai, and the process has not been entirely smooth. The company reported a 19% growth in Q2, which, while respectable, is a bit of a step down from its usual performances. Growth is projected to slow even further in Q3, to a mere 14%. Naturally, this led to a sell-off, with the stock tumbling about 60% from its peak.

But let’s not be too hasty in our judgments. The ad tech space is rife with opportunities, and The Trade Desk remains a leader. If you’ve got a bit of patience, purchasing this stock at its current price is, in my estimation, an excellent play for the long term.

There we have it-four stocks that, in the grand scheme of things, are worth adding to your portfolio. No promises, of course-life is never quite so simple. But with a bit of luck and some careful attention, your returns could be positively divine. ☕

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Why Nio Stock Skyrocketed Today

- Games That Faced Bans in Countries Over Political Themes

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Best Ways to Farm Prestige in Kingdom Come: Deliverance 2

2025-09-06 13:59